Wyoming Demand Bond

Description

How to fill out Demand Bond?

Selecting the correct authorized document format can be a challenge. Naturally, there are numerous templates accessible online, but how can you acquire the legitimate form you require? Utilize the US Legal Forms website.

The platform offers thousands of templates, including the Wyoming Demand Bond, which can be utilized for business and personal purposes. All documents are reviewed by experts and meet federal and state regulations.

If you are currently authorized, Log In to your account and click on the Download button to obtain the Wyoming Demand Bond. Use your account to view the authorized documents you have purchased previously. Navigate to the My documents section of your account and retrieve another copy of the document you require.

US Legal Forms is the largest collection of authorized documents where you can discover various record templates. Use the service to download properly-crafted papers that comply with state regulations.

- First, ensure you have selected the correct form for your city/state.

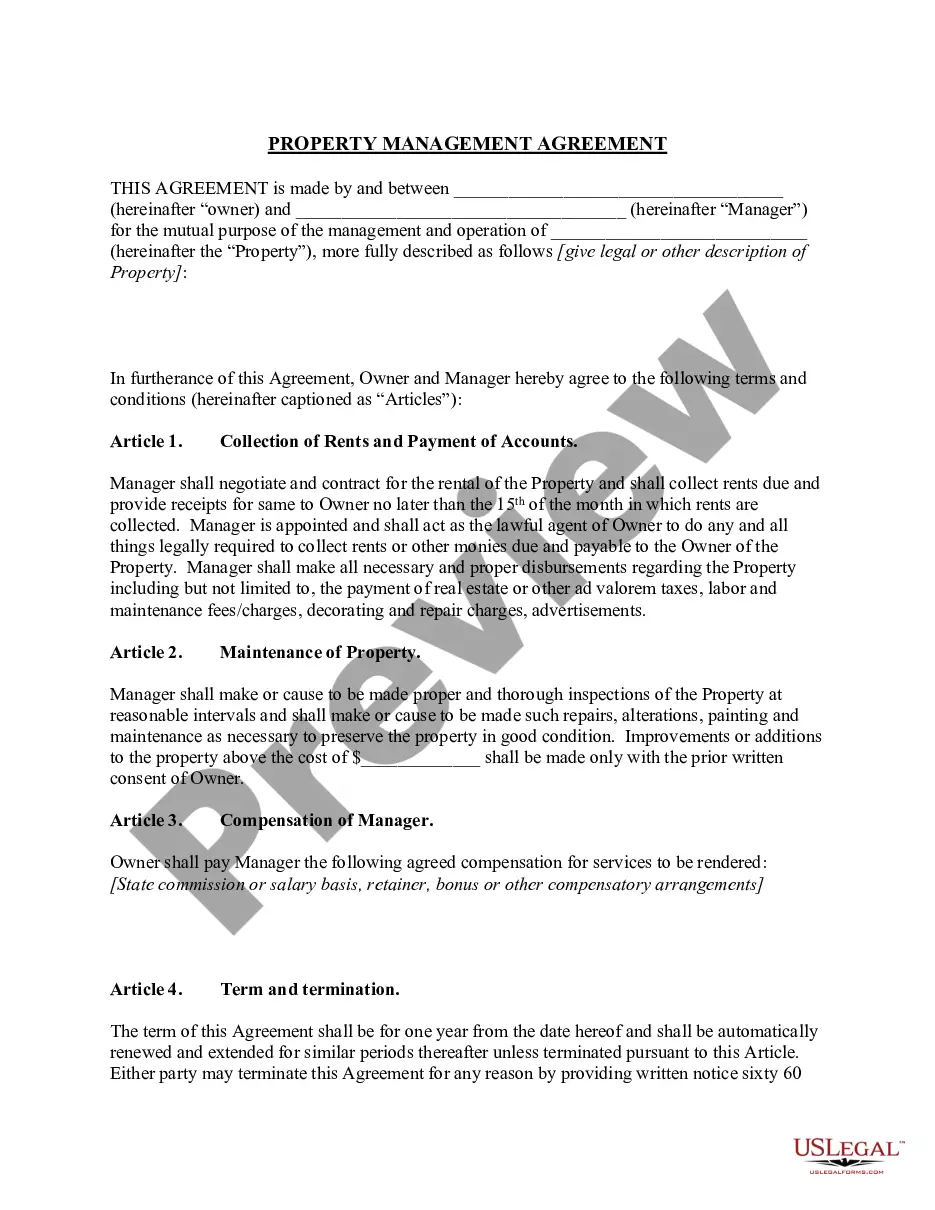

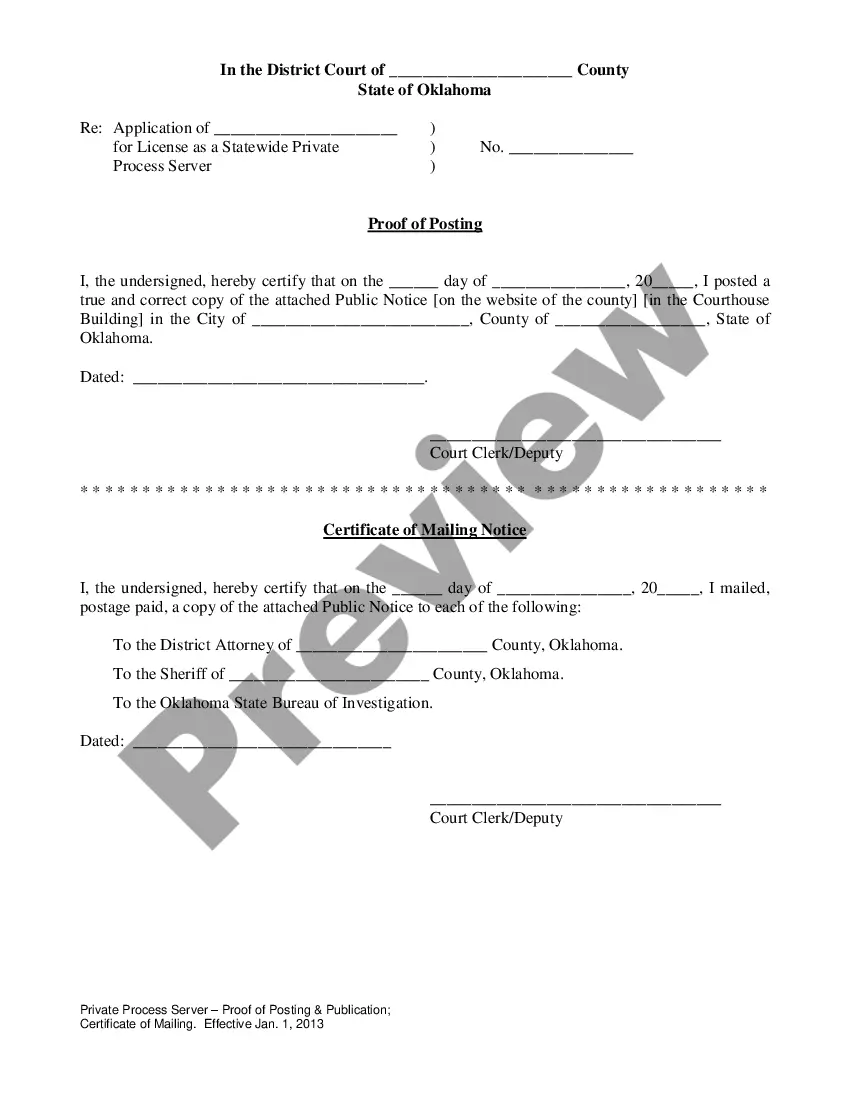

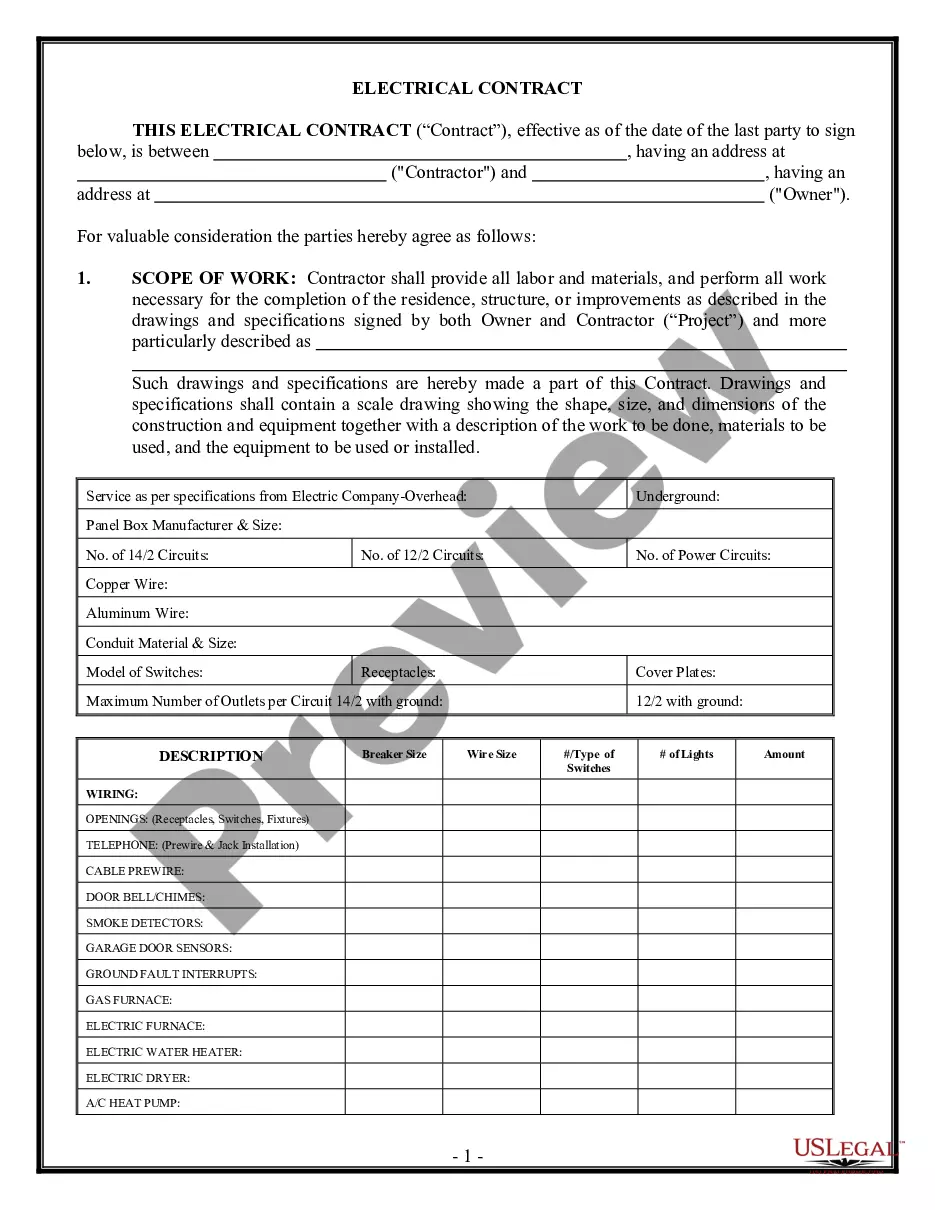

- You can preview the document using the Preview option and read the form description to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are certain that the document is suitable, click the Buy Now button to acquire the form.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and complete your purchase using your PayPal account or credit card.

- Select the file format and download the authorized document format to your device.

- Complete, modify, print, and sign the acquired Wyoming Demand Bond.

Form popularity

FAQ

The risks associated with a bonded title include the possibility of discovering claims against the title after it has been issued. If a claim arises, the surety bond must cover the costs, which could lead to financial liability for the title holder. Additionally, a Wyoming Demand Bond may not resolve all ownership disputes, leaving the holder vulnerable. It's crucial to understand these risks before proceeding with a bonded title and consider using USLegalForms for expert advice and support.

A surety bond in Wyoming is a legally binding agreement among three parties: the principal, the obligee, and the surety. Essentially, it ensures that the principal fulfills their obligations to the obligee, such as complying with laws or regulations. In the context of a Wyoming Demand Bond, this type of bond provides assurance that any claims against the title will be covered. This protects both the title holder and the state from potential disputes.

Filling out a bond form requires careful attention to detail. Begin by entering your personal information, followed by the specifics of the bond, including the amount and purpose. Always double-check your entries to ensure all information is accurate. For ease, uslegalforms provides user-friendly templates that guide you through the process step by step.

To complete a bond form effectively, start by gathering all necessary information, such as the bond amount and relevant dates. Carefully enter the information in the designated fields, ensuring accuracy to avoid delays. After filling out the form, review it for any missing details or errors. For additional support, consider uslegalforms, which offers comprehensive resources for bond completion.

Filling a bond form in Wyoming involves entering specific details about the bond and the parties involved. Start with your name, the bond amount, and the purpose of the bond. Ensure that you read the instructions carefully to avoid mistakes. Using uslegalforms can simplify this task, providing you with clear templates and instructions.

To fill out the back of a Wyoming title, you need to provide the necessary information about the new owner. This includes the name and address of the buyer, along with their signature. It is essential to complete this step accurately to ensure a smooth transfer of ownership. If you need assistance, uslegalforms offers templates and guidance to help you navigate this process.

Filling out a performance bond in Wyoming requires specific information about the project and the parties involved. Start by providing details such as the project name, bond amount, and the parties’ names. Make sure to include any required signatures and dates. For a straightforward process, consider using the resources available at uslegalforms, which guide you through the steps.

In Wyoming, a bond acts as a financial guarantee ensuring that obligations are met. When you secure a Wyoming Demand Bond, you promise to fulfill a contractual duty, such as completing a project. If you fail to meet this obligation, the bond provides compensation to the other party. This process helps build trust and fosters smoother business transactions.

Yes, a bonded title can eventually be converted into a regular title in Wyoming. To do this, you need to hold the bonded title for a designated period, usually three years, during which no claims are made against the bond. Once this period elapses, you can apply to the state for a regular title, demonstrating that you have fulfilled all requirements. This process provides peace of mind and solidifies your ownership.

Getting an assurance bond begins with determining the type of bond you need for your specific situation. You can obtain a Wyoming Demand Bond through a bonding company or a financial institution that offers these services. The next steps involve completing the application and providing any necessary documentation to prove your eligibility. This bond will protect against potential claims, making your financial transactions more secure.