Wyoming Bill of Sale of Mobile Home with or without Existing Lien

Description

How to fill out Bill Of Sale Of Mobile Home With Or Without Existing Lien?

If you wish to obtain, download, or print authentic document templates, utilize US Legal Forms, the most extensive repository of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to locate the documents you require.

Numerous templates for business and personal use are organized by categories and titles, or keywords.

Step 5. Process the payment. You can use your Мisa or Ьastercard or PayPal account to complete the transaction.

Step 6. Retrieve the format of the legal form and download it to your device.

- Use US Legal Forms to acquire the Wyoming Bill of Sale for Mobile Home with or without Existing Lien in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Acquire button to obtain the Wyoming Bill of Sale for Mobile Home with or without Existing Lien.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

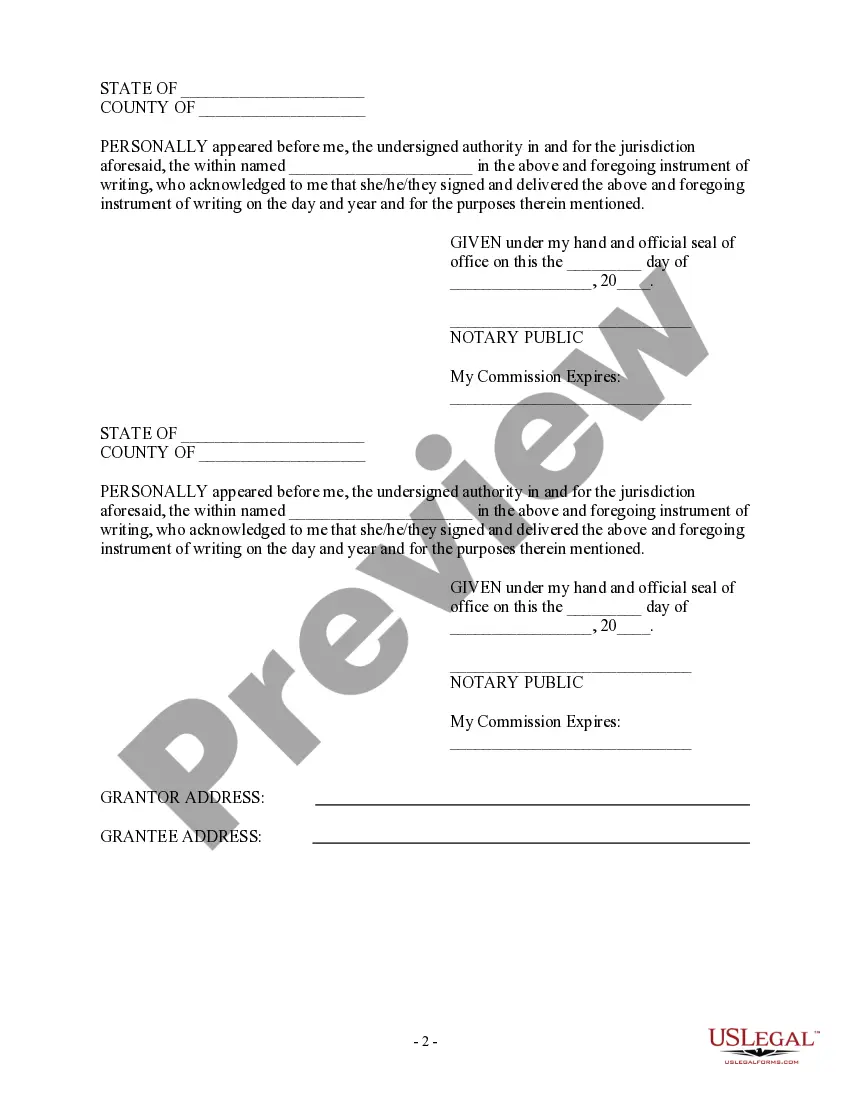

- Step 2. Utilize the Preview option to review the form's details. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search bar at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Buy now button. Select the pricing plan you prefer and enter your credentials to sign up for an account.

Form popularity

FAQ

In most cases, once a bill of sale is signed, the buyer cannot simply back out. However, if the buyer discovers significant issues, such as misrepresentations or fraud related to the Wyoming Bill of Sale of Mobile Home with or without Existing Lien, they may have grounds to cancel the sale legally. It is crucial to understand your rights and obligations before signing any bill of sale.

A properly executed bill of sale can hold up in court as long as it meets legal requirements. It serves as a vital piece of evidence during legal disputes regarding ownership and transaction terms. When using the Wyoming Bill of Sale of Mobile Home with or without Existing Lien, ensure all relevant details are accurately captured to enhance its enforceability.

Yes, in Wyoming, a bill of sale is generally required to transfer the title of a mobile home. This legal document provides proof of the transaction and outlines the terms of sale, ensuring clarity for both parties. Having a well-drafted Wyoming Bill of Sale of Mobile Home with or without Existing Lien simplifies the title transfer process and fulfills legal requirements.

A bill of sale can be voided for various reasons, including misrepresentation or fraud. If either party does not fulfill their obligations outlined in the Wyoming Bill of Sale of Mobile Home with or without Existing Lien, or if the item sold was stolen, the bill may be void. It is important to understand these factors to protect yourself during transactions.

Yes, you can void a bill of sale under certain conditions. For example, if both the buyer and seller agree that the contract is no longer valid, it can be canceled. Additionally, if there are any fraudulent practices involved in the creation of the Wyoming Bill of Sale of Mobile Home with or without Existing Lien, it may also be voided. Make sure to document any agreements to avoid future disputes.

While it’s common to have a bill of sale on paper for legal purposes, digital versions can also be valid if state laws permit. A written document, however, serves as a clear record of the transaction. By utilizing uslegalforms, you can easily create a Wyoming Bill of Sale of Mobile Home with or without Existing Lien, whether you need it on paper or prefer an electronic format.

No, notarization is not a requirement for a bill of sale in Wyoming under standard conditions. However, notarization could be beneficial in certain cases, like when dealing with an existing lien. Using the uslegalforms platform can guide you in generating a Wyoming Bill of Sale of Mobile Home with or without Existing Lien, ensuring you meet all necessary requirements.

Generally, a bill of sale does not always require notarization unless state laws dictate otherwise. However, notarizing the document can help prevent disputes in the future and offer peace of mind. If you’re looking for assistance, consider creating a Wyoming Bill of Sale of Mobile Home with or without Existing Lien using uslegalforms, which provides straightforward solutions for your needs.

In Wyoming, a vehicle bill of sale does not necessarily need to be notarized unless required by specific circumstances, such as the presence of an existing lien. However, notarization can add an extra layer of security for both parties involved in the sale. To create a reliable Wyoming Bill of Sale of Mobile Home with or without Existing Lien, using platforms like uslegalforms can simplify the process.

To write a bill of sale without a title, start by gathering essential details about the sale. Include the buyer's and seller's names, addresses, and the mobile home's vehicle identification number (VIN). Clearly state the sale terms, especially if there is an existing lien. You can use a platform like uslegalforms to generate a Wyoming Bill of Sale of Mobile Home with or without Existing Lien.