Wyoming Buy Sell Agreement Between Shareholders and a Corporation

Description

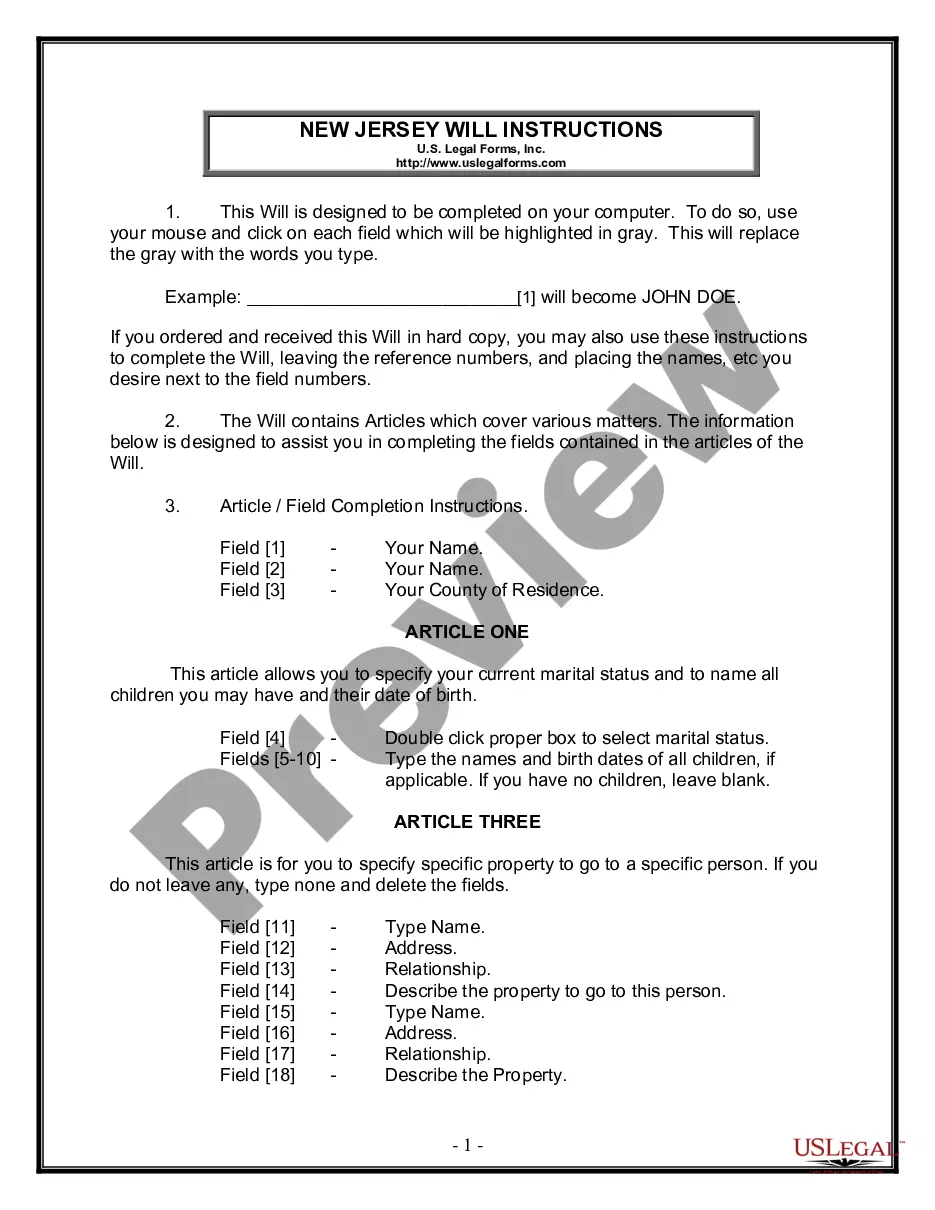

How to fill out Buy Sell Agreement Between Shareholders And A Corporation?

Are you in a location where you often require documentation for business or specific reasons nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not straightforward.

US Legal Forms offers a vast array of template designs, including the Wyoming Buy Sell Agreement Between Shareholders and a Corporation, crafted to meet federal and state standards.

Once you have the right template, click Buy now.

Select a payment plan you prefer, fill in the required details to create your account, and pay for the order with your PayPal or credit card. Choose a suitable document format and retrieve your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Wyoming Buy Sell Agreement Between Shareholders and a Corporation at any time, if necessary. Just click on the required template to download or print the document. Use US Legal Forms, the largest collection of legal documents, to save time and reduce errors. The service offers professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Wyoming Buy Sell Agreement Between Shareholders and a Corporation template.

- If you do not have an account and want to begin using US Legal Forms, take these steps.

- Find the template you need and ensure it is for the correct area/county.

- Utilize the Review feature to examine the form.

- Read the description to confirm you have chosen the appropriate template.

- If the template isn’t what you're looking for, use the Lookup section to find the form that meets your needs.

Form popularity

FAQ

Filling out a buy-sell agreement requires detailed information about the corporation and its shareholders. You'll need to include names, ownership percentages, and key terms related to triggering events and valuation methods. Ensuring accuracy in these sections is essential for a solid Wyoming Buy Sell Agreement Between Shareholders and a Corporation, and platforms like uslegalforms can guide you through the process.

The creation of a Wyoming Buy Sell Agreement Between Shareholders and a Corporation typically involves the shareholders of the company. Generally, all parties must agree on the terms to ensure the agreement reflects their wishes. It's advisable to consult with legal or financial professionals who can provide insights into the specific needs of your corporation. Using platforms like US Legal Forms can simplify this process by offering templates and guidance tailored to Wyoming regulations.

The main purpose of a buy-sell agreement is to provide a clear plan for the transfer of shares among shareholders, especially during critical events like death or disability. The Wyoming Buy Sell Agreement Between Shareholders and a Corporation ensures that there are predetermined terms, safeguarding the interests of existing shareholders. Additionally, it helps maintain stability within the company, as it prevents unwanted external parties from entering the ownership structure. Overall, this agreement is vital for the long-term success and harmony of the business.

While a shareholder agreement and a buy-sell agreement may seem similar, they serve different purposes. A shareholder agreement primarily governs the relationship among shareholders, detailing management roles and responsibilities. In contrast, a buy-sell agreement, such as the Wyoming Buy Sell Agreement Between Shareholders and a Corporation, focuses specifically on the transfer of ownership shares. Understanding these distinctions helps create a more comprehensive governance framework for your corporation.

A shareholder buy-sell agreement is a contractual arrangement among shareholders outlining how shares can be sold or transferred. This document, particularly the Wyoming Buy Sell Agreement Between Shareholders and a Corporation, helps protect both the shareholders and the business itself by setting clear terms. It typically specifies conditions under which shares must be sold or can be bought back, thereby maintaining harmony among shareholders. This agreement is crucial for ensuring the company operates smoothly during ownership changes.

Yes, a well-structured buy-sell agreement, like the Wyoming Buy Sell Agreement Between Shareholders and a Corporation, can help avoid probate. By laying out how shares are bought or sold upon a shareholder's death, these agreements facilitate a smoother transfer process. This means the shares can pass directly to designated individuals without going through the lengthy probate process. Thus, it ensures continuity and stability in your corporation's ownership.

Another name for a buy-sell agreement is a buyout agreement. This term highlights the essential function of the document, which is to outline the procedures for buying out shares from a shareholder under specific circumstances, such as death or retirement. Knowing this alternate terminology can aid in your search for relevant legal documents. If you are exploring efficient solutions, our platform provides resources for creating a robust Wyoming Buy Sell Agreement Between Shareholders and a Corporation tailored to your needs.

While buy-sell agreements provide various benefits, they also come with some disadvantages. One potential drawback is the complexity of establishing the agreement, which may require legal expertise and detailed valuation processes. Additionally, the funding for buying out shares can present financial challenges, especially if the business faces unexpected circumstances. Therefore, consulting platforms like uslegalforms can guide you through the setup, ensuring you address these potential pitfalls when drafting a Wyoming Buy Sell Agreement Between Shareholders and a Corporation.

sell agreement and a shareholder agreement are closely related but serve different purposes. While a buysell agreement specifically outlines how shares will be bought and sold among shareholders, a shareholder agreement covers broader aspects such as shareholder rights and responsibilities. Both documents complement each other and create a solid framework for governance. If you seek comprehensive legal documentation, consider the Wyoming Buy Sell Agreement Between Shareholders and a Corporation as an essential element of your corporate strategy.