Wyoming Donation or Gift to Charity of Personal Property

Description

How to fill out Donation Or Gift To Charity Of Personal Property?

Are you currently in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast collection of form templates, such as the Wyoming Donation or Gift to Charity of Personal Property, that are crafted to comply with state and federal regulations.

Once you find the correct form, click Get now.

Select the pricing plan you want, complete the required information to create your account, and purchase the order with PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Wyoming Donation or Gift to Charity of Personal Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct state/region.

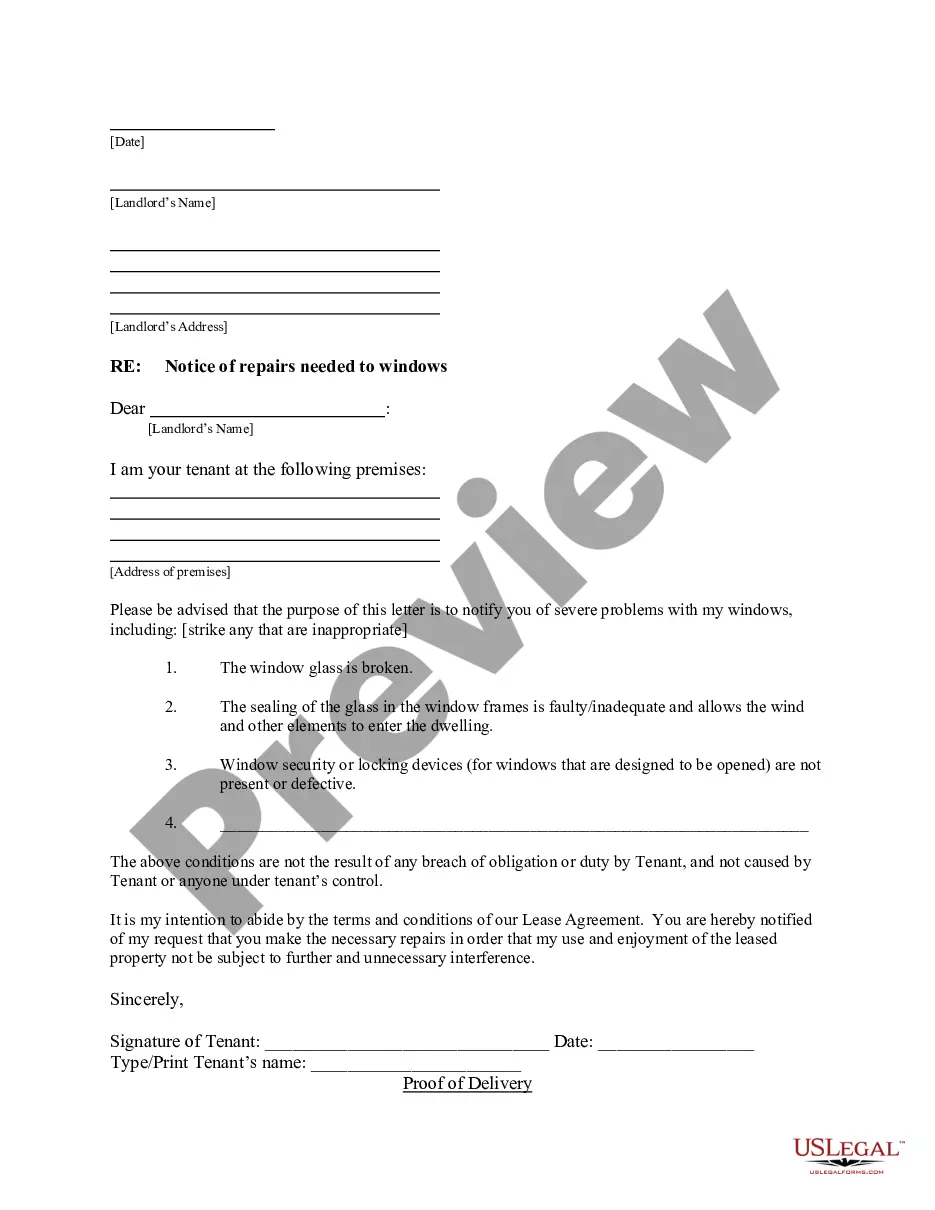

- Use the Preview button to view the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

The IRS requires specific proof of charitable donations for tax deductions, including written acknowledgment from the charity for contributions exceeding $250. Keep receipts, photos, and appraisals related to your Wyoming Donation or Gift to Charity of Personal Property. This documentation is essential for substantiating your claims during future tax filings.

To give property to charity, start by choosing a reputable organization that resonates with you. You will need to complete a property transfer deed, ensuring all documentation is thorough and filed. For a successful Wyoming Donation or Gift to Charity of Personal Property, keep your paperwork organized for tax records and possible future inquiries.

The IRS outlines specific rules for property donations to ensure they qualify for tax deductions. Typically, the property must be in good condition and used for charitable purposes. It is essential to accurately assess the fair market value of your property when making a Wyoming Donation or Gift to Charity of Personal Property, as this value affects your tax deduction.

To donate property to a nonprofit, start by selecting a recognized organization aligned with your values. After confirming the nonprofit's eligibility to receive donations, you can execute a deed transfer. Document your Wyoming Donation or Gift to Charity of Personal Property properly to ensure it adheres to legal requirements and tax regulations.

The best way to gift property is by transferring ownership through a formal deed. You should ensure that the paperwork is correctly filed with your local authorities. Additionally, consider the tax implications regarding your Wyoming Donation or Gift to Charity of Personal Property. Consulting with a legal or financial advisor can provide tailored advice.

An act of donation for property is a formal transfer of ownership from you to a charitable organization or individual without expecting anything in return. This act is often documented through a written agreement or receipt, especially in the context of the Wyoming Donation or Gift to Charity of Personal Property. This helps both parties keep accurate records and ensures that the donation is recognized for tax purposes.

Yes, you can donate property to a church, as churches qualify as charitable organizations under IRS guidelines. When you make the donation, ensure that the church provides you with a written acknowledgment for your records and your tax deductions. Participating in a Wyoming Donation or Gift to Charity of Personal Property can help fund important programs your church may offer.

To take a deduction for property donated to a charity, ensure that the charity is a qualified 501(c)(3) organization. The property must also qualify under IRS rules for the Wyoming Donation or Gift to Charity of Personal Property. Be aware that there are limits on the amount you can deduct, based on the fair market value, and specific rules regarding items like vehicles or appreciated assets.

Accounting for donated property requires you to record the fair market value of the item at the time of donation. Use this value when documenting your charitable contribution on your tax returns as part of the Wyoming Donation or Gift to Charity of Personal Property. It's best to keep all relevant documents, like the donation receipt and any appraisals if necessary, for accurate reporting and potential audits.

To donate property to a nonprofit, first identify a legitimate organization that aligns with your values. Then, communicate your intent to donate and clarify the type of property you wish to contribute. Once agreed, you may need to complete a donation receipt or form for the Wyoming Donation or Gift to Charity of Personal Property to ensure proper documentation for tax purposes. Finally, arrange for the transfer of the property or its value to the nonprofit.