The Wyoming Earnest Money Promissory Note is a legal document that serves as a written promise from a borrower to repay a loan amount that is used as earnest money in a real estate transaction. This type of promissory note is specific to the state of Wyoming and is commonly used in real estate transactions when a buyer wants to demonstrate their sincere intention to purchase a property. The document outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional fees or penalties. It also defines the rights and obligations of both the borrower and the lender, ensuring that both parties are legally protected. There may be different types of Earnest Money Promissory Notes in Wyoming based on specific circumstances or preferences. Some common variations include: 1. Traditional Earnest Money Promissory Note: This is a standard promissory note used in most real estate transactions. It includes details such as the loan amount, interest rate, and repayment terms. 2. Seller Financing Earnest Money Promissory Note: In certain cases, the seller may agree to provide financing to the buyer instead of going through a traditional lender. This type of promissory note outlines the terms and conditions of the loan provided by the seller. 3. Balloon Payment Earnest Money Promissory Note: This type of promissory note allows the borrower to make smaller monthly payments for a specific period, with a larger lump sum payment (balloon payment) due at the end of the term. 4. Interest-Only Earnest Money Promissory Note: As the name suggests, this type of promissory note requires the borrower to only pay the interest on the loan amount for a certain period, with the principal being due at a designated time. 5. Fixed-Rate Earnest Money Promissory Note: This variation ensures that the interest rate agreed upon at the beginning of the loan remains fixed throughout the loan term, providing certainty for both the borrower and lender. It is important for all parties involved in a Wyoming Earnest Money Promissory Note to carefully review and understand the terms before signing the document. Seeking legal advice or consulting with a real estate professional can help ensure that all aspects of the transaction are accurately represented and legally binding.

Wyoming Earnest Money Promissory Note

Description

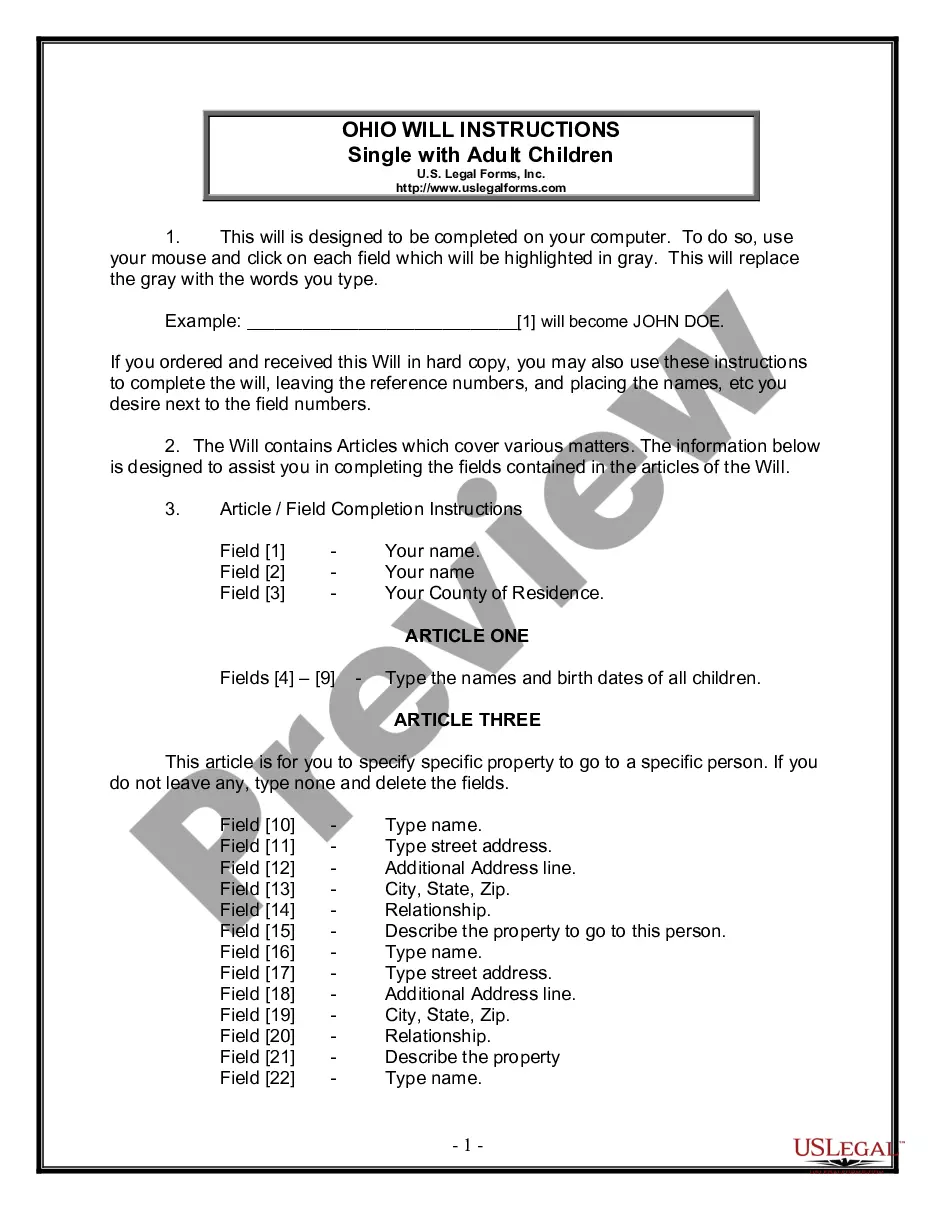

How to fill out Wyoming Earnest Money Promissory Note?

If you seek to be thorough, obtain, or generate official document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Employ the site's straightforward and efficient search to locate the forms you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find alternative versions of the legal form template.

Step 4. Once you have identified the form you desire, select the Purchase now button. Choose the pricing plan you prefer and provide your details to create an account.

- Use US Legal Forms to find the Wyoming Earnest Money Promissory Note in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Wyoming Earnest Money Promissory Note.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the template for the correct city/state.

- Step 2. Use the Review option to navigate through the form’s details. Remember to read the information carefully.

Form popularity

FAQ

Paying earnest money deposit Typically, you pay earnest money to an escrow account or trust under a third-party like a legal firm, real estate broker or title company. Acceptable payment methods include personal check, certified check and wire transfer. The funds remain in the trust or escrow account until closing.

The parties should sign only one original note, and the seller or escrow agent should keep that document. If you are the buyer, you will want to keep the note in the hands of an escrow agent or company.

An earnest money deposit is money is put up by a potential buyer of real estate to show that it is seriously interested in making the purchase. The money is usually paid within 24-48 hours after the offer is accepted, and is held by a third party or escrow company until the deal is completed.

The use of an earnest money promissory note usually contemplates the existence of a purchase agreement for real property. The enclosed document assumes that a purchase agreement will be created and signed by the parties, but that agreement is not provided as part of this form.

Updated April 12, 2022. An earnest money deposit receipt is given to a buyer of real estate after entering into a purchase agreement with a seller. The deposit slip is given to the buyer after funds have been received which binds the parties into the agreement.

Settlement Sheet The earnest money deposit will be listed as a credit to the buyer, while any other funds owed will be listed as debits. The closing agent will add up all of the debits and credits for the buyer to get a final amount of funds required at closing.

An earnest promissory note shows good faith commitment to purchase an asset and outlines the aspects of the purchase agreement between a buyer and seller.

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.

As promissory notes are legal and enforceable, banks will often accept them as they know they can get their money back if you fail to repay the loan. For your promissory note to be legal, you can print off a promissory note template online, fill in your details and sign it.

The owner must be aware that the earnest money deposit will be made in the form of a promissory note (i.e., not in cash) before it accepts the purchase offer. This fact must also be stated clearly in the purchase agreement itself.

Interesting Questions

More info

If you are a buyer or mortgage lender, your answer is “only you.” Any individual or corporation can use this form for their own use; for example, you can use it if you are a buyer for a property listed on the form to determine the earnest money amount and the amount that the property will receive. This document may NOT be used for any other purpose except to verify the amount the buyer or lender paid.