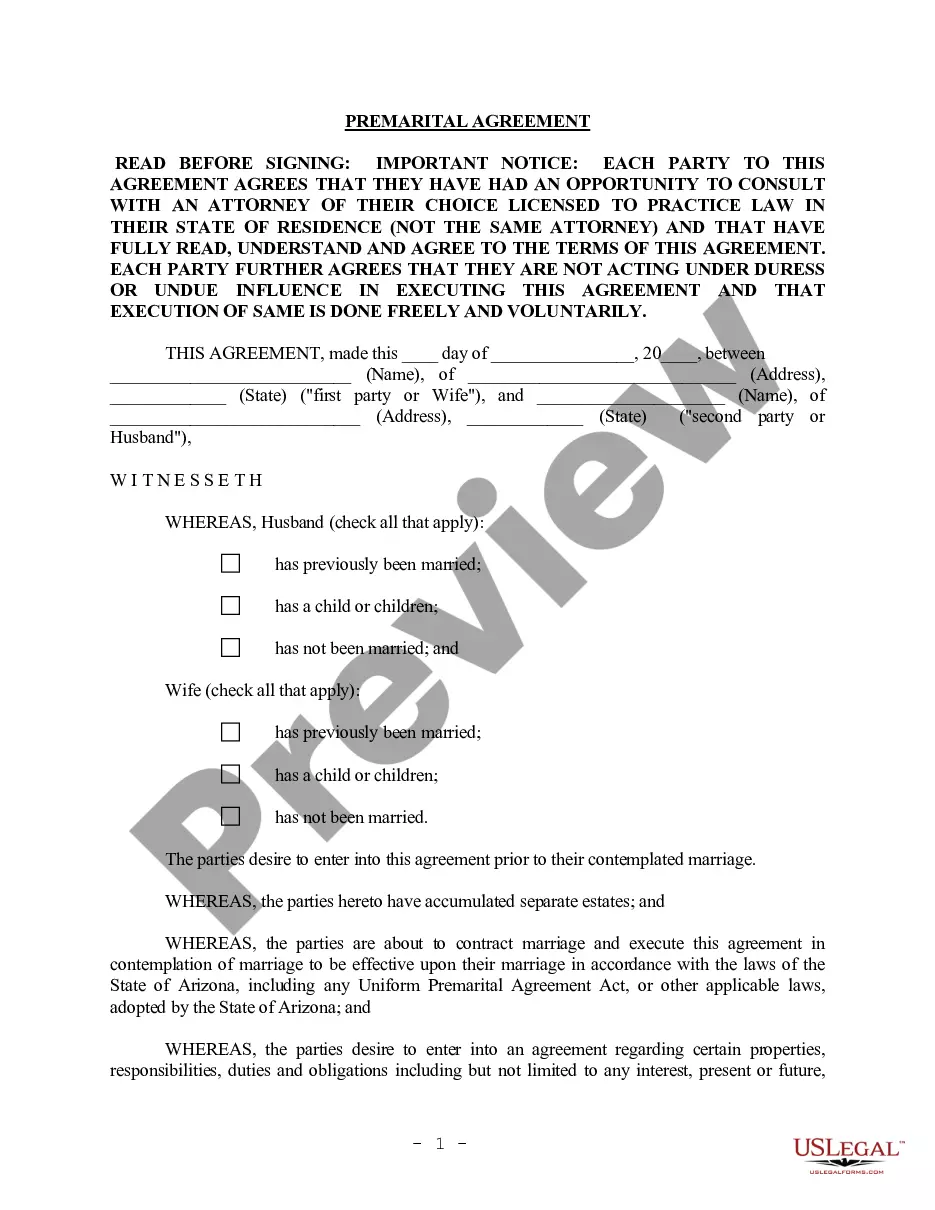

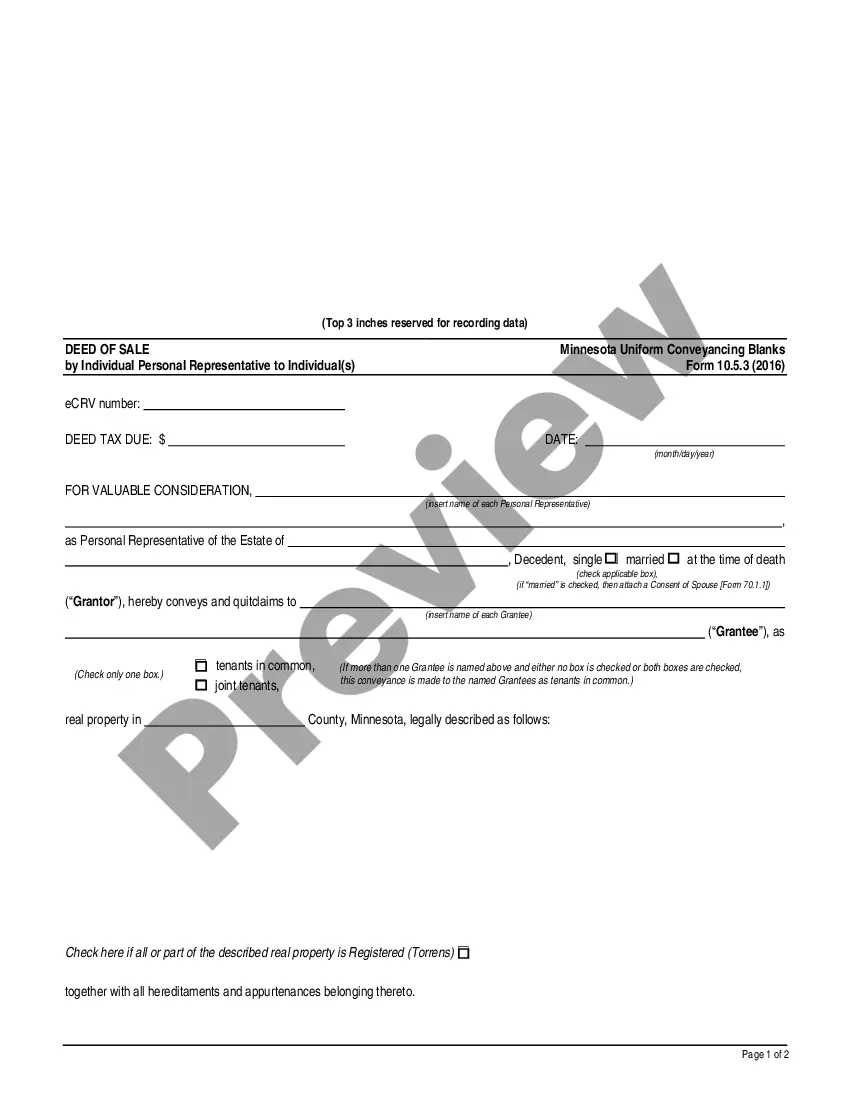

The Wyoming Bill of Sale for a Coin Collection is a legal document that serves as proof of ownership and transfer of a coin collection in the state of Wyoming. It outlines the details of the transaction and provides a record of the buyer and seller's agreement. This document is essential for both parties involved in buying or selling a coin collection, as it ensures a smooth and secure transfer of ownership. The Wyoming Bill of Sale for a Coin Collection typically includes key information such as the date of the transaction, the names and contact details of the buyer and seller, a detailed description of the coin collection being sold, and the agreed-upon purchase price. It may also include any additional terms or conditions agreed upon by both parties. Different types of Wyoming Bill of Sale for a Coin Collection may include specific clauses or provisions that cater to unique circumstances or preferences. These variations may include: 1. Simple Wyoming Bill of Sale for a Coin Collection: This type of bill of sale is a basic document that includes only the essential information such as parties involved, description of the coin collection, and the purchase price. 2. Notarized Wyoming Bill of Sale for a Coin Collection: In some cases, parties may choose to have their bill of sale notarized. This adds an extra level of authentication to the document and can be useful if the buyer or seller intends to use it as evidence in a legal dispute. 3. Conditional Wyoming Bill of Sale for a Coin Collection: This type of bill of sale includes specific conditions or contingencies that must be met before the transfer of ownership is finalized. For example, the buyer might require a third-party appraisal of the coin collection's value, and the sale will only proceed if both parties agree on the appraised value. 4. Installment Wyoming Bill of Sale for a Coin Collection: If the buyer and seller agree to a payment plan where the purchase price is paid in installments, this type of bill of sale outlines the agreed-upon payment schedule and any additional terms related to the installment payments. Regardless of the specific type, the Wyoming Bill of Sale for a Coin Collection is an essential document that ensures a legal and transparent transfer of ownership between the buyer and seller. It's important for both parties to carefully read and understand the contents of the bill of sale before signing, as it becomes a legally binding contract once executed. Additionally, it is advisable to consult with a legal professional for assistance in drafting or reviewing the Wyoming Bill of Sale for a Coin Collection to ensure compliance with state laws and to protect the interests of both parties.

Wyoming Bill of Sale for a Coin Collection

Description

How to fill out Wyoming Bill Of Sale For A Coin Collection?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of documents for business and personal purposes, organized by type, state, or keywords.

You can find the latest versions of documents like the Wyoming Bill of Sale for a Coin Collection in seconds.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Purchase now button, then choose the pricing plan you prefer and enter your details to register for an account.

- If you already have a monthly subscription, Log In and obtain the Wyoming Bill of Sale for a Coin Collection from the US Legal Forms library.

- The Acquire button will appear on every document you view.

- You can access all previously saved documents in the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are basic steps to help you get started.

- Ensure you have selected the appropriate document for your location.

- Review the form’s content by clicking the Review button.

Form popularity

FAQ

If purchased from an individual, you will need a notarized bill of sale. If purchased from an individual or not provided with a Wyoming Dealer`s Reassignment Form, at least one of the buyer`s must sign the purchaser`s application and have their signature notarized.

Car title transfer in WyomingYour out of state title and a completed application for Certificate of Title and VIN/HIN Inspection form (MV-300A)If you haven't undergone a VIN inspection, law enforcement or the county clerk can do one for $10.

How do you write a bill of sale? When you write a bill of sale, you include both the seller and buyer's name and address, a complete description of the sold item, the vehicle's identification number, conditions, date, amount paid, previous owner, method of payment and any other agreements between the buyer and seller.

If purchased from an individual, you will need a notarized bill of sale. If purchased from an individual or not provided with a Wyoming Dealer`s Reassignment Form, at least one of the buyer`s must sign the purchaser`s application and have their signature notarized.

The following information should appear on the Wyoming Bill of Sale Form: Name and address of the seller. Name and address of the buyer. Complete vehicle description, including Vehicle Identification Number (VIN), make, model, year.

Wyoming requires a notarized bill of sale for private car sales....The bill of sale requires the following:Year, Make and Model of the Vehicle.Vehicle Identification Number (VIN)Sale Price.Date of Sale.Legal full name, address and signature of the buyer(s)Legal full name, address and signature of the seller(s)More items...

In Wyoming, a vehicle ownership transfer must include a bill of sale....A Wyoming motor vehicle bill of sale must have the following information:Buyer and seller's names and addresses.Date of sale.Make.Model.Year of production.Title number.Purchase price.VIN.

Yes, a bill of sale is required for private car sales in Wyoming. The buyer and seller must sign the bill of sale in the presence of a notary.

If purchased from an individual, you will need a notarized bill of sale. If purchased from an individual or not provided with a Wyoming Dealer`s Reassignment Form, at least one of the buyer`s must sign the purchaser`s application and have their signature notarized.

In the State of Wyoming a Bill of Sale Form is required in any private vehicle transaction. Since Wyoming's vehicle services are handled by each county separately, check with your county treasurer's office to see if they provide a Bill of Sale Form and if they require the Bill of Sale you use to be notarized.