Wyoming Revocable Living Trust for Married Couple

Description

How to fill out Revocable Living Trust For Married Couple?

It is feasible to spend numerous hours online attempting to locate the legal document template that complies with the state and federal guidelines you require.

US Legal Forms offers an extensive selection of legal forms that can be assessed by experts.

It is easy to download or print the Wyoming Revocable Living Trust for Married Couple from your account.

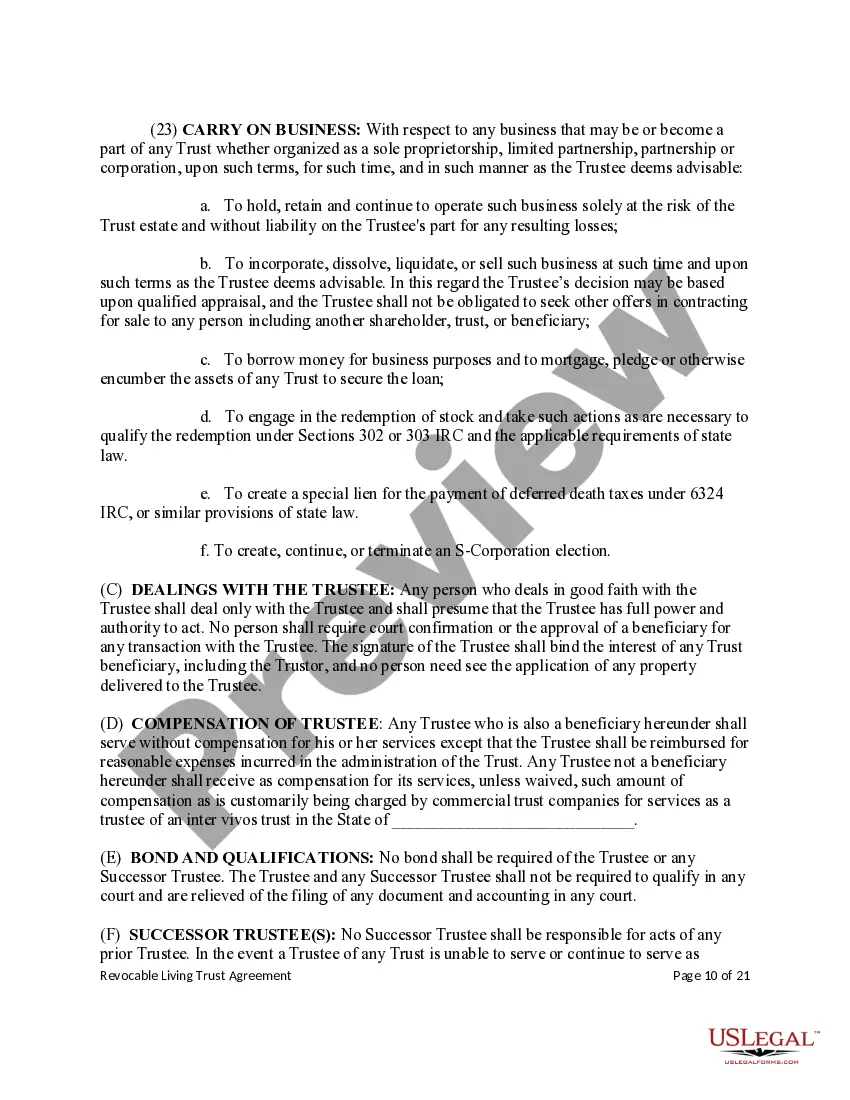

If available, utilize the Preview button to look through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Wyoming Revocable Living Trust for Married Couple.

- Every legal document template you obtain is yours permanently.

- To retrieve another copy of a purchased form, go to the My documents section and click the corresponding button.

- If you’re using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Yes, a revocable trust can be changed even if one spouse has passed away. The surviving spouse generally has the authority to modify the trust as needed, reflecting their current wishes and circumstances. This adaptability is one of the key benefits of establishing a Wyoming Revocable Living Trust for Married Couple. It’s important to consult with legal experts to ensure that any changes comply with relevant laws and intentions.

Certain assets typically cannot be placed in a trust, such as life insurance policies that do not name the trust as a beneficiary, or individual retirement accounts (IRAs) if they are not properly structured. Additionally, interests in a business can present complexities when incorporating them into a trust. Understanding these limitations is crucial when setting up your Wyoming Revocable Living Trust for Married Couple. Consulting with a professional can help identify what works best for your situation.

A joint trust does not automatically become irrevocable when one spouse dies. Instead, the trust typically becomes a sharing trust, which allows the surviving spouse to manage and access the assets. This flexibility helps ensure that the surviving partner retains control over their Wyoming Revocable Living Trust for Married Couple, meeting their future needs. To maintain clarity, couples should review the trust's terms after a change in circumstances.

Filling out a Wyoming Revocable Living Trust for Married Couples requires a clear understanding of your needs. You will need to list your assets, name your trustee, and decide on beneficiaries. Using a platform like UsLegalForms can guide you through the entire process and ensure you complete your trust correctly.

While creating a Wyoming Revocable Living Trust for Married Couples, avoid placing retirement accounts and life insurance policies directly in the trust. Instead, designate the trust as a beneficiary for these assets. This strategy helps maintain favorable tax treatment while ensuring that your assets are managed effectively.

Yes, a married couple can absolutely establish a Wyoming Revocable Living Trust for Married Couples. This type of trust allows both partners to collaboratively manage their assets and simplify the transfer process upon passing. It can also provide beneficial tax and estate planning advantages.

To fill out a Wyoming Revocable Living Trust for Married Couples, you need to provide essential information such as your full names, address, and details of your assets. Next, you identify your beneficiaries and the trustee, who will manage the trust. This process ensures that your assets are distributed according to your wishes.

One downside of a Wyoming Revocable Living Trust for Married Couples is that it does not protect assets from creditors. Additionally, if you want to maintain privacy, your trust may still go through the probate process, which could expose your affairs to public record. It's important to consider these aspects when setting up your trust.

When one spouse passes away, a joint revocable trust typically remains in effect and continues to manage the surviving spouse's share of the assets. The trust becomes a single revocable trust, allowing the surviving spouse to maintain control. This streamlines the process and can facilitate the distribution of assets to heirs without going through probate.

No trust entirely avoids all taxes, but certain strategies can minimize tax burdens. A Wyoming Revocable Living Trust for Married Couple might help in estate planning and reducing probate fees, but it's essential to discuss tax strategies with a professional. Different trusts serve varying purposes, so tailored advice is key.