A Wyoming Promissory Note — Payable on Demand is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of Wyoming. This type of promissory note is specifically designed to be payable on demand, meaning that the lender can request full repayment of the loan at any time. Keywords: Wyoming, Promissory Note, Payable on Demand, legal document, loan agreement, borrower, lender, repayment. Different Types of Wyoming Promissory Note — Payable on Demand: 1. Unsecured Promissory Note: This type of promissory note does not require any collateral from the borrower. It is solely based on the borrower's promise to repay the loan. 2. Secured Promissory Note: A secured promissory note requires the borrower to provide collateral, such as real estate or valuable assets, to secure the loan. If the borrower fails to repay the loan, the lender has the right to seize and sell the collateral to recover the outstanding debt. 3. Installment Promissory Note: An installment promissory note allows the borrower to repay the loan in multiple installments over a specified period. The note includes details such as the amount of each installment, interest rate, and payment schedule. 4. Demand Promissory Note: A demand promissory note does not have a specific maturity date. Instead, the lender can request repayment in full at any time by providing the borrower with a written demand. 5. Revolving Promissory Note: A revolving promissory note is similar to a line of credit. It allows the borrower to borrow funds up to a specified limit, repay them, and borrow again without the need to create a new promissory note. This type of note is commonly used in business financing. It is crucial to note that the above information is provided for general understanding and should not substitute professional legal advice. Consulting with an attorney is recommended to ensure compliance with Wyoming state laws and to address specific requirements or circumstances.

Wyoming Promissory Note - Payable on Demand

Description

How to fill out Wyoming Promissory Note - Payable On Demand?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates you can download or print.

By using the site, you can discover thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of documents like the Wyoming Promissory Note - Payable on Demand in moments.

Review the document description to ensure you have selected the correct form.

If the document does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have a monthly subscription, Log In and download the Wyoming Promissory Note - Payable on Demand from the US Legal Forms library.

- The Download button will appear on every template you view.

- You can access all previously downloaded documents in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct document for your city/region.

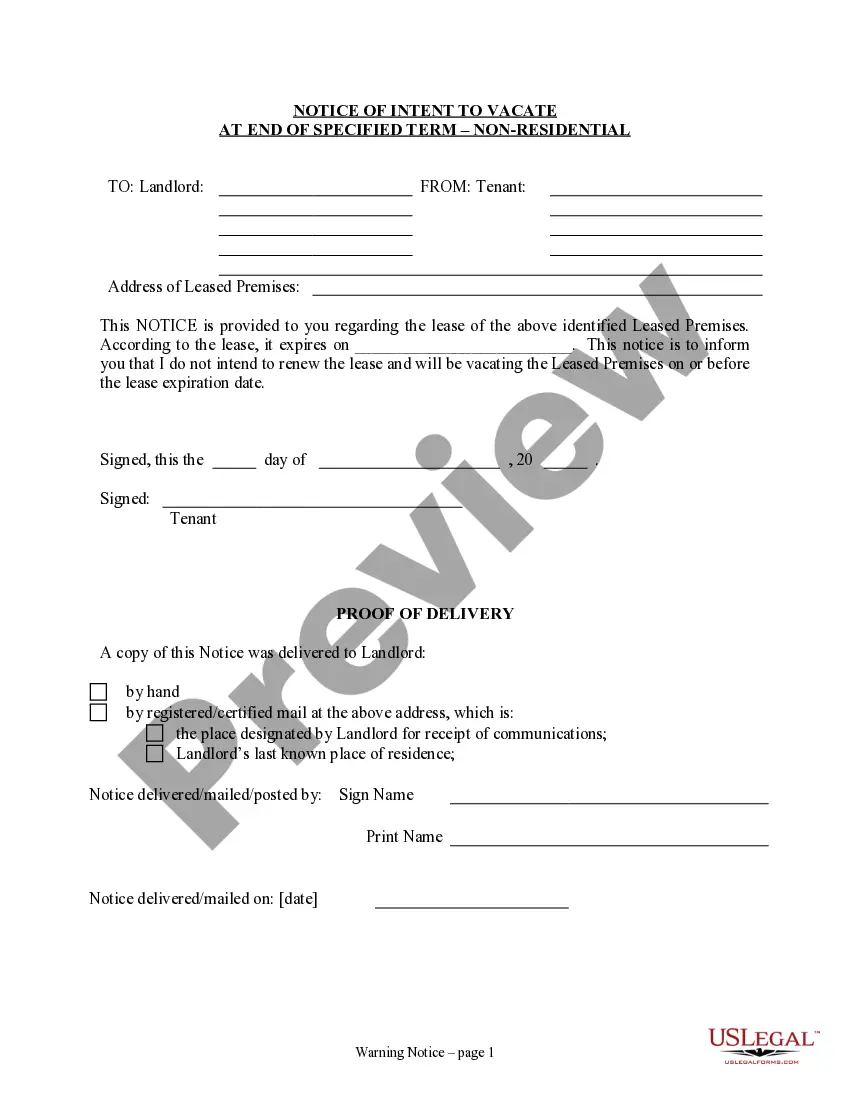

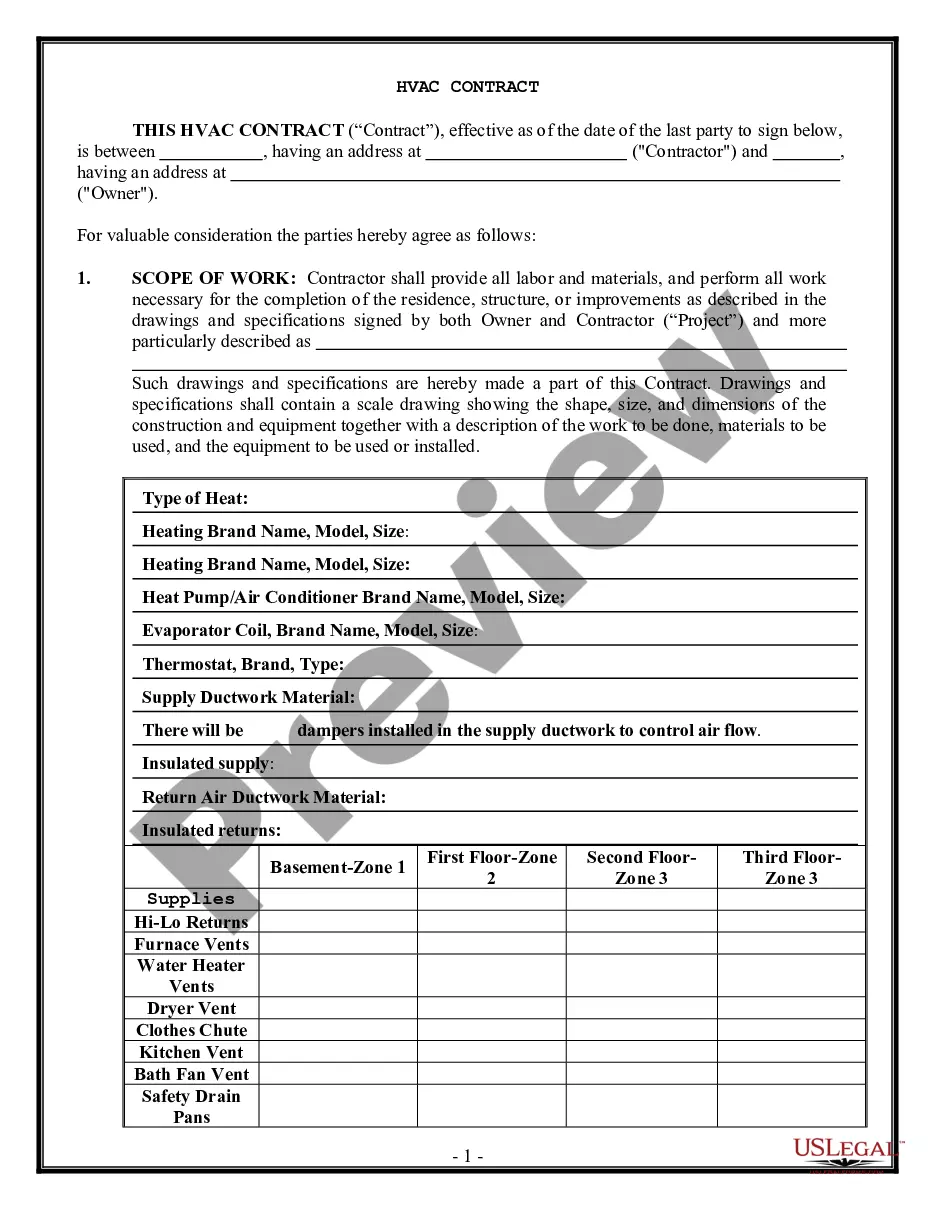

- Click the Preview button to examine the document's content.

Form popularity

FAQ

Yes, a bill of exchange can be made payable on demand if it states that it is due upon request. This means that the holder can present it for payment at any time. Similar to a Wyoming Promissory Note - Payable on Demand, the specifics of the terms must be clear to avoid ambiguity. It is always wise to understand the obligations involved before entering any agreement.

To obtain your Wyoming Promissory Note - Payable on Demand, you can use platforms like USLegalForms. These platforms offer customizable templates specifically designed for your needs. Simply choose the appropriate form, fill in your details, and you can download it instantly. This process is convenient and helps ensure your note meets all legal requirements.

To write a simple Wyoming Promissory Note - Payable on Demand, start by identifying the parties involved and the date. Next, state the amount being borrowed, outline the repayment terms clearly, and specify that it is payable on demand. Conclude with spaces for both parties to sign and date the document. For accurate documentation, consider using helpful resources like the uslegalforms platform.

Yes, a promissory note can be structured to be payable on demand. A Wyoming Promissory Note - Payable on Demand specifically allows the lender to request repayment at their discretion. This type of note provides flexibility for the lender and can be advantageous in certain lending situations. Ensure the terms clearly state this condition to avoid misunderstandings.

Yes, a promissory note can definitely be on demand. A Wyoming Promissory Note - Payable on Demand allows the holder to request payment whenever necessary. This type of note adds flexibility to financial transactions. Utilizing platforms like uslegalforms can help you create a customized note that meets your needs.

Absolutely, a Wyoming Promissory Note - Payable on Demand can be created to specify repayment terms. Such notes can include various provisions to suit the needs of both parties. The key is to ensure all terms are clearly laid out in the document. This clarity helps in preventing potential disputes.

A demand payment of a promissory note refers to the request for payment at any time. With a Wyoming Promissory Note - Payable on Demand, the lender can ask for payment without prior notice. This feature provides a layer of security for the lender. Make sure to draft your note carefully to outline how this demand should be communicated.

A promissory note is indeed made payable, and it specifies the amount due. In the case of a Wyoming Promissory Note - Payable on Demand, the payment is expected when requested. This payment structure offers flexibility to the lender. It’s crucial to clearly outline the payment terms to avoid confusion.

Yes, a Wyoming Promissory Note - Payable on Demand can be made payable to the bearer. This means that the person holding the note has the right to demand payment. This feature can simplify the transfer of the note. Always ensure that the language in your note clearly indicates this.

Yes, both a promissory note and a bill of exchange can be made payable on demand. This flexibility allows lenders to request payment at their discretion, making it advantageous in certain financial situations. In Wyoming, ensuring that this specification is included in the document is essential for maintaining its legal integrity. A Wyoming Promissory Note - Payable on Demand clearly outlines these terms for all parties involved.

Interesting Questions

More info

We provide a range of services that include: We can help you build an online presence, and provide you with an innovative online business plan, marketing and promotional services that help you to maximize your time and resources. Furthermore, we can assist you with all aspects of your online business, from SEO strategies for your website to a comprehensive software suite to help you get started and to manage your sales and marketing campaigns. By building a sales team that is professional, accountable, and reliable, you can become a profitable online business faster than you could have imagined. For more information, please contact our sales team at infosnotheel.com. Snot heel.