Wyoming Charitable Remainder Inter Vivos Annuity Trust

Description

How to fill out Charitable Remainder Inter Vivos Annuity Trust?

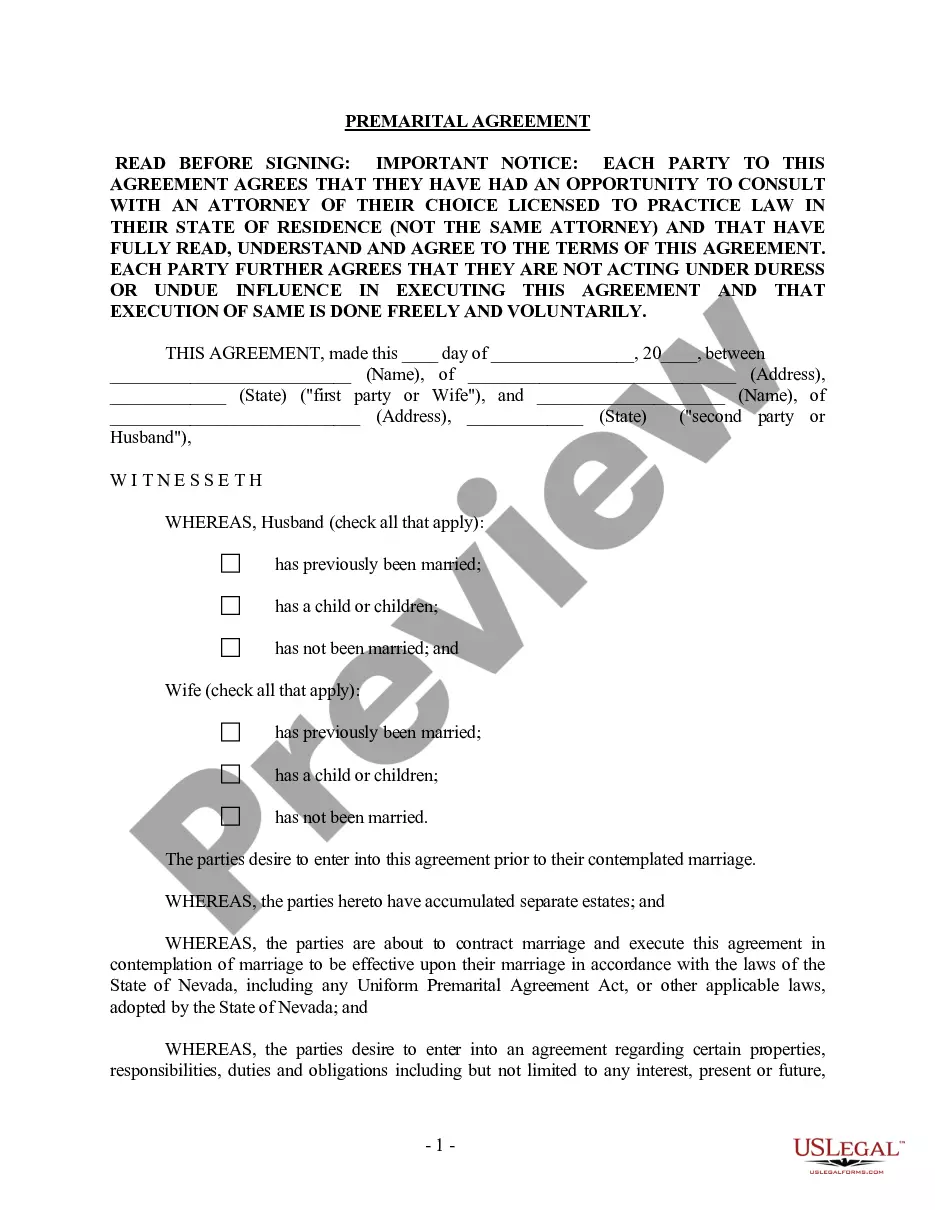

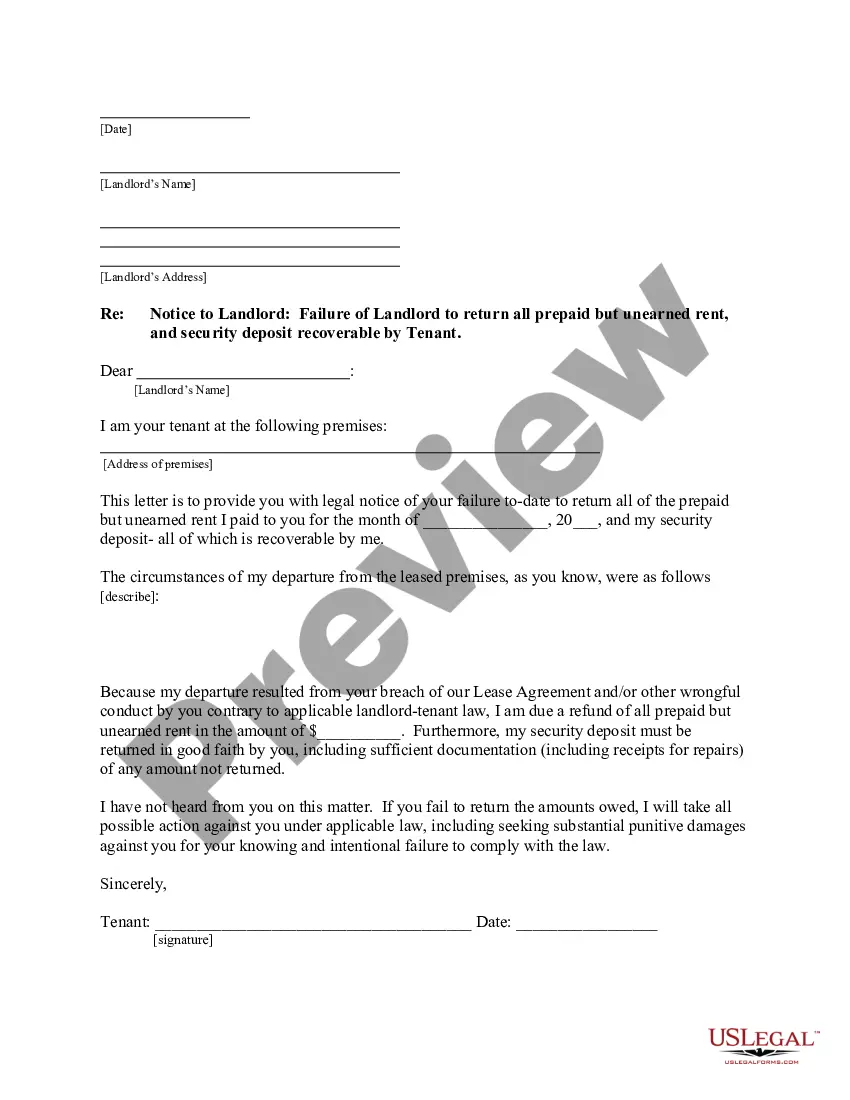

Locating the appropriate legal document template can be a challenge. Naturally, there are numerous formats accessible online, but how can you locate the legal template you need? Utilize the US Legal Forms website.

The service offers a vast array of templates, including the Wyoming Charitable Remainder Inter Vivos Annuity Trust, which you can utilize for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download option to obtain the Wyoming Charitable Remainder Inter Vivos Annuity Trust. Leverage your account to browse the legal forms you have previously purchased. Navigate to the My documents tab of your account to retrieve another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Wyoming Charitable Remainder Inter Vivos Annuity Trust. US Legal Forms is the largest collection of legal forms where you can find various document templates. Take advantage of the service to obtain well-crafted documents that comply with state requirements.

- First, ensure that you have selected the correct form for your area/region.

- You can view the form using the Preview option and read the form description to confirm that it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are confident that the form is right, click the Get now option to acquire the form.

- Choose the pricing plan you desire and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Many individuals choose to set up trusts in Wyoming for several reasons, including favorable tax laws and a strong privacy framework. Establishing a Wyoming Charitable Remainder Inter Vivos Annuity Trust allows beneficiaries to receive income while supporting charitable causes. Additionally, Wyoming's flexible trust laws make it an attractive option for asset protection and estate planning. This flexibility offers peace of mind when managing your legacy.

Starting a trust in Wyoming begins with defining your goals and the assets you wish to include. You will then create a trust document that meets state regulations, which may require the assistance of professionals like attorneys or financial advisors. It is crucial to consider creating a Wyoming Charitable Remainder Inter Vivos Annuity Trust if you wish to benefit a charity while also receiving income from the trust. Finally, fund the trust appropriately to ensure it aligns with your financial and philanthropic objectives.

Opening a Wyoming trust, including a Wyoming Charitable Remainder Inter Vivos Annuity Trust, involves selecting a trustee who will manage the trust assets. You will need to complete a trust document that sets forth how the trust will operate. After completing this document, you must fund the trust with your chosen assets. Your next step is to record any necessary paperwork with the appropriate county office in Wyoming to ensure compliance with state laws.

To create a Wyoming Charitable Remainder Inter Vivos Annuity Trust, you should first decide on the assets you want to place in the trust. Next, you must draft a trust agreement, which outlines the terms and conditions of the trust. It is often beneficial to consult with an attorney or a financial advisor who understands Wyoming trust laws. Finally, ensure that the trust is properly funded to activate your charitable goals.

A charitable remainder trust typically files Form 5227 with the IRS. This form reports the trust's income, expenses, and distributions. For the Wyoming Charitable Remainder Inter Vivos Annuity Trust, it is vital to ensure correct and timely filings to avoid penalties. Utilizing platforms like uslegalforms can simplify the process, providing you with necessary documents and guidance.

Yes, you can place an annuity within a charitable remainder trust. This approach allows for a steady stream of income while also providing planned charitable gifts. By implementing a Wyoming Charitable Remainder Inter Vivos Annuity Trust, you can achieve both financial security and philanthropic goals. Engaging with experts will ensure you structure the trust effectively to meet your needs.

One common misconception is that a charitable remainder trust offers immediate income tax deductions for all contributions made. In reality, only the present value of the charitable interest is deductible. Understanding the specifics of your Wyoming Charitable Remainder Inter Vivos Annuity Trust helps uncover all real benefits and clarifies what to expect. Consulting professionals can provide tailored insights into this topic.

To file a trust in Wyoming, you must first prepare your trust document according to state laws. You will then need to appoint a trustee, who will manage the trust's assets. After preparing the document, you should consider having it notarized to ensure its validity. It is important to consult with professionals who specialize in the Wyoming Charitable Remainder Inter Vivos Annuity Trust to navigate specific requirements effectively.

Yes, you can transfer an annuity to a charity, often allowing you to claim a charitable deduction. This action can be part of your strategy when considering a Wyoming Charitable Remainder Inter Vivos Annuity Trust, where the transfer can help fund your charitable legacy while providing financial support during your life. Consulting with legal or tax professionals can assist you in making the right choices.

A charitable gift annuity is a simple contract between a donor and a charity, providing fixed payments for life, whereas a charitable remainder annuity trust is a more formal trust structure that allows for the distribution of income to a beneficiary over time. A Wyoming Charitable Remainder Inter Vivos Annuity Trust offers added flexibility in terms of asset management and can cater to both beneficiary needs and charitable interests. Understanding these differences can help you make an informed decision.