Wyoming Tax-Free Exchange Agreement Section 1031: Exploring the Ins and Outs of this Lucrative Tax Strategy Wyoming tax-free exchange agreement Section 1031 is a powerful tool that allows individuals and businesses to defer capital gains taxes on the sale of certain real estate or investment properties by reinvesting the proceeds into like-kind properties. This provision is found in the Internal Revenue Code (IRC) Section 1031 and has gained popularity among savvy investors seeking to maximize their wealth-building opportunities. What makes Wyoming tax-free exchange agreements under Section 1031 particularly attractive is the absence of state-level income tax. Wyoming is one of the few states in the United States that does not levy individual or corporate income taxes, making it an ideal destination for investors looking to preserve their wealth and minimize taxation. This aspect elevates the appeal of Section 1031 exchanges carried out within the state's boundaries. The basic premise of a Wyoming tax-free exchange agreement Section 1031 is straightforward: rather than recognizing capital gains on the sale of an investment property, the taxpayer can defer taxes by reinvesting the proceeds into a similar or like-kind property within a specific time frame. This allows the taxpayer to preserve their capital and continue to grow their investment portfolio without incurring an immediate tax liability. There are a few essential elements to consider when undertaking a Wyoming tax-free exchange agreement Section 1031: 1. Like-Kind Property: The property being sold and the property being acquired must be of similar nature or character. Real estate is the most common type of property involved in Section 1031 exchanges, but certain personal property may also qualify. 2. Timing: To enjoy the tax benefits of a Wyoming tax-free exchange agreement Section 1031, strict timelines must be followed. The taxpayer has to identify potential replacement properties within 45 days after the sale of the original property, and the replacement property must be acquired within 180 days. 3. Qualified Intermediary: A qualified intermediary (QI) is a crucial third party involved in the exchange process. They help facilitate the transaction by holding the proceeds from the sale of the relinquished property and then transferring them to the seller of the replacement property. It is imperative to work with an experienced and reputable QI to ensure compliance with Section 1031 regulations. While Wyoming tax-free exchange agreements under Section 1031 are known for their inherent tax advantages, it is important to highlight that there are no distinct types of Wyoming-specific tax-free exchange agreements. Instead, Section 1031 exchanges are governed by the federal tax code, and Wyoming simply serves as an advantageous jurisdiction due to its lack of state-level income taxes. In conclusion, Wyoming tax-free exchange agreement Section 1031 offers investors an unparalleled opportunity to defer capital gains taxes and preserve their wealth. By reinvesting the proceeds from the sale of an investment property into a like-kind property within the specified guidelines, individuals and businesses can unlock significant tax benefits. Taking advantage of Wyoming's tax-friendly environment further enhances the financial advantages of engaging in Section 1031 exchanges within the state.

Wyoming Tax Free Exchange Agreement Section 1031

Description

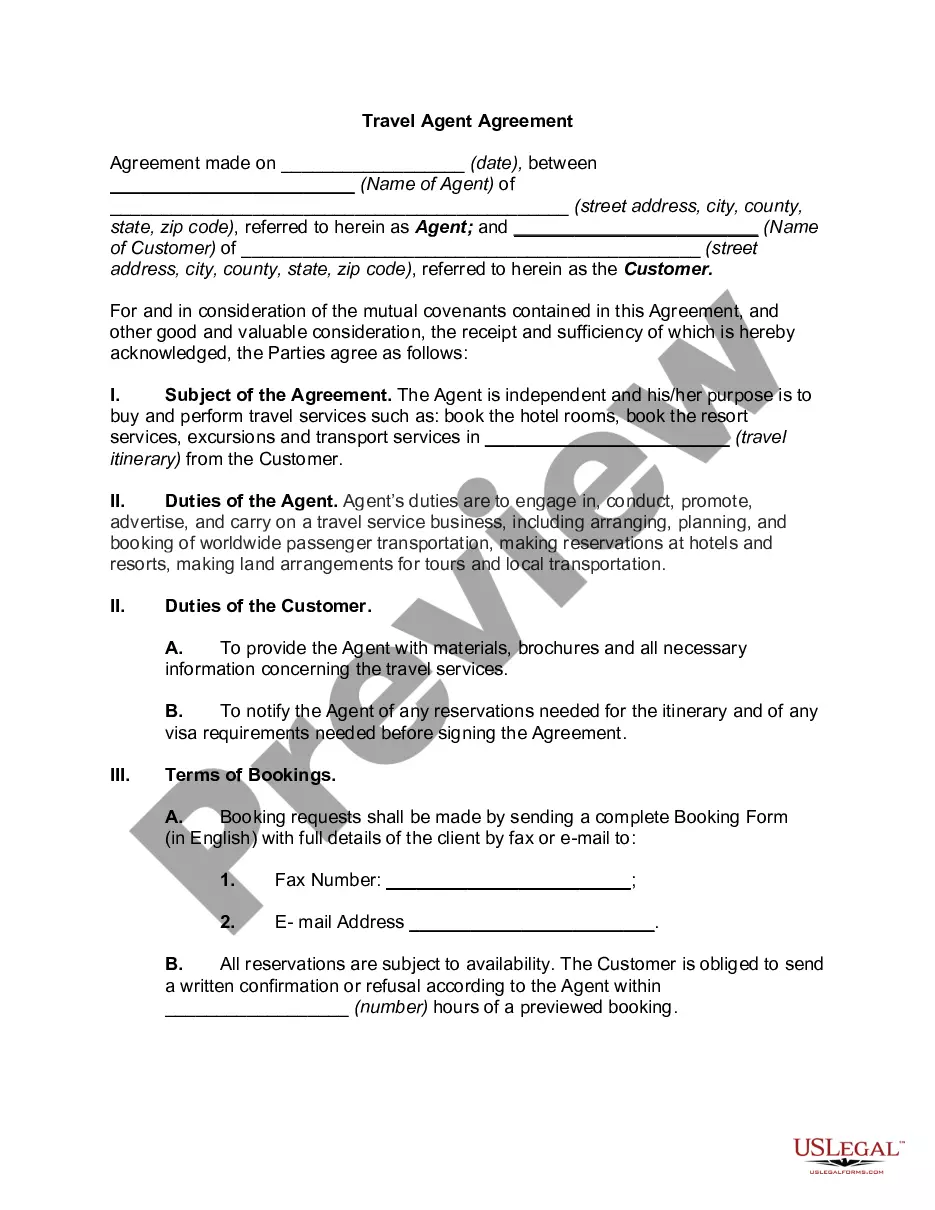

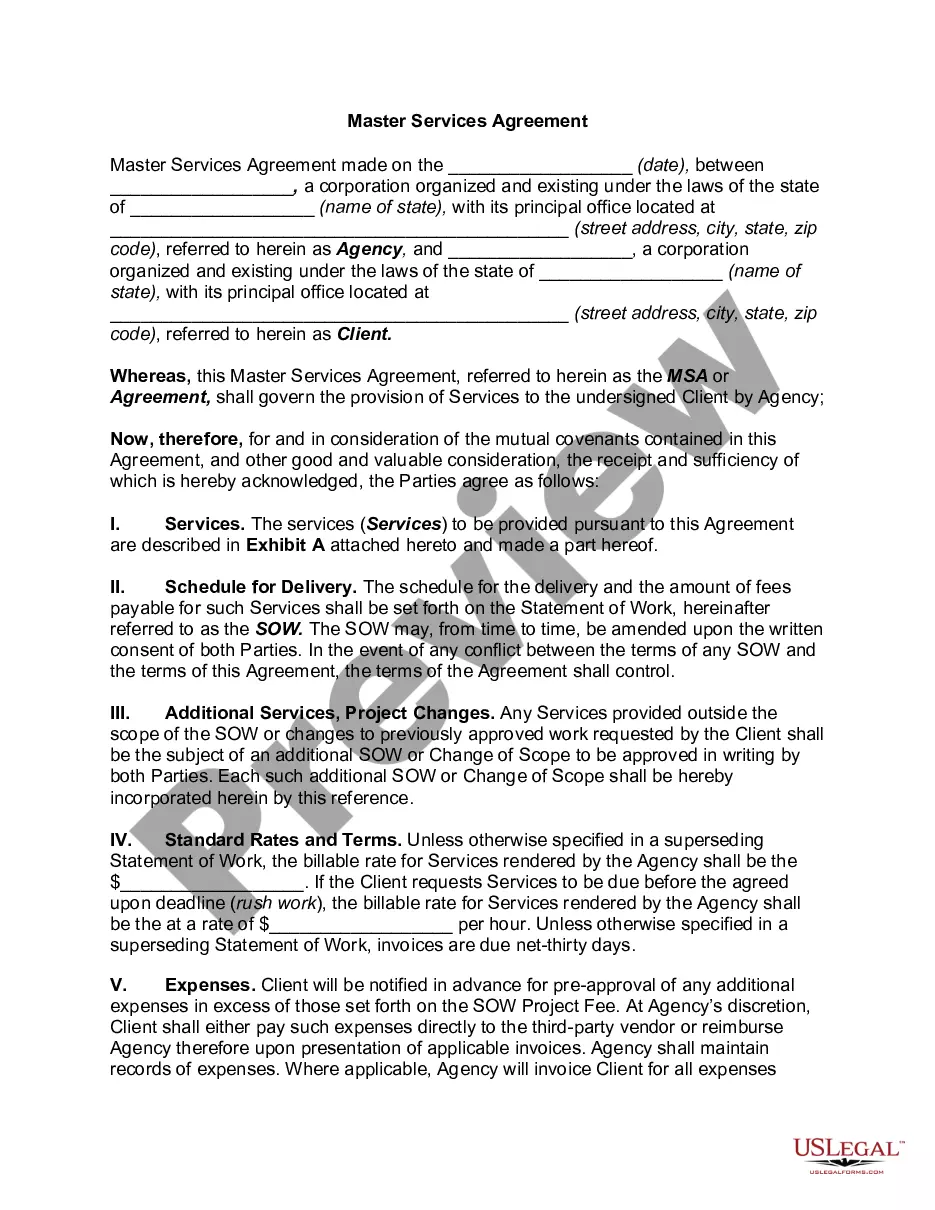

How to fill out Wyoming Tax Free Exchange Agreement Section 1031?

You are capable of dedicating time online searching for the valid document template that fulfills the state and federal regulations you need.

US Legal Forms provides thousands of valid forms that are reviewed by experts.

You can effortlessly obtain or generate the Wyoming Tax Free Exchange Agreement Section 1031 through our services.

If available, utilize the Review button to examine the document template as well. If you wish to obtain another version of the form, use the Search field to find the template that satisfies your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and press the Obtain button.

- Following that, you can complete, amend, create, or sign the Wyoming Tax Free Exchange Agreement Section 1031.

- Every valid document template you purchase is yours indefinitely.

- To download another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, adhere to the straightforward instructions below.

- First, ensure that you have selected the correct document template for the area/city of your preference.

- Check the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state. We regularly are dealing with transactions from our home state of Oregon and into California, Washington, and vice versa.

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.

California recognizes 1031 Exchanges which allows an investor to defer capital gains taxes as long as you are purchasing another like-kind property to replace the one you are selling. California does recognize it if you purchase your upleg in another state, but beware of the above Clawback rule.

Tom: The short answer is yes. Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state. We regularly are dealing with transactions from our home state of Oregon and into California, Washington, and vice versa.

Under Internal Revenue Code Section 1031, real estate located in one U.S. state is like kind to real estate located in any other state, and you can trade from one state to another. In most cases you are able to defer both federal and state tax, assuming the state has an income tax.

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

This usually implies a minimum of two years' ownership. To receive the full benefit of a 1031 exchange, your replacement property should be of equal or greater value. You must identify a replacement property for the assets sold within 45 days and then conclude the exchange within 180 days.

The gain on the sale of the property goes untaxed as long as it is reinvested. Biden said he would get rid of 1031 exchanges on the 2020 campaign trail and instead expand funding for the care economy. But that elimination has yet to happen.

Interesting Questions

More info

Aviation Falcon aircraft bearing manufacturer serial number now registered with Federal Aviation Administration equipped with Honeywell Model engines and Bearing manufacturer serial numbers collectively treated property Referred herein This is hereby established a definitive transaction whereby Exchanger agrees to pay Assault Aviation Falcon Aircraft bearing manufacturer serial number this date and that in consideration Assault Aviation Falcon aircraft bearing manufacturer serial number would be acquired by Exchanger pursuant to this Definitive transaction and for the purpose thereof.