Wyoming Trust Agreement - Family Special Needs

Description

How to fill out Trust Agreement - Family Special Needs?

US Legal Forms - one of the largest compilations of legal documents in the United States - provides a diverse selection of legal form templates that you can download or print.

Using the website, you can acquire a multitude of forms for both business and personal use, organized by categories, states, or keywords. You can locate the latest editions of forms such as the Wyoming Trust Agreement - Family Special Needs in just moments.

If you possess a subscription, Log In and retrieve the Wyoming Trust Agreement - Family Special Needs from the US Legal Forms library. The Download option will appear on every form you view.

Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the pricing plan you prefer and provide your details to create an account.

Proceed with the payment. Use a Visa or Mastercard or PayPal account to complete the transaction.

- Access all previously saved forms in the My documents tab of your account.

- If you want to utilize US Legal Forms for the first time, here are straightforward steps to get started.

- Ensure you have selected the appropriate form for your region/area.

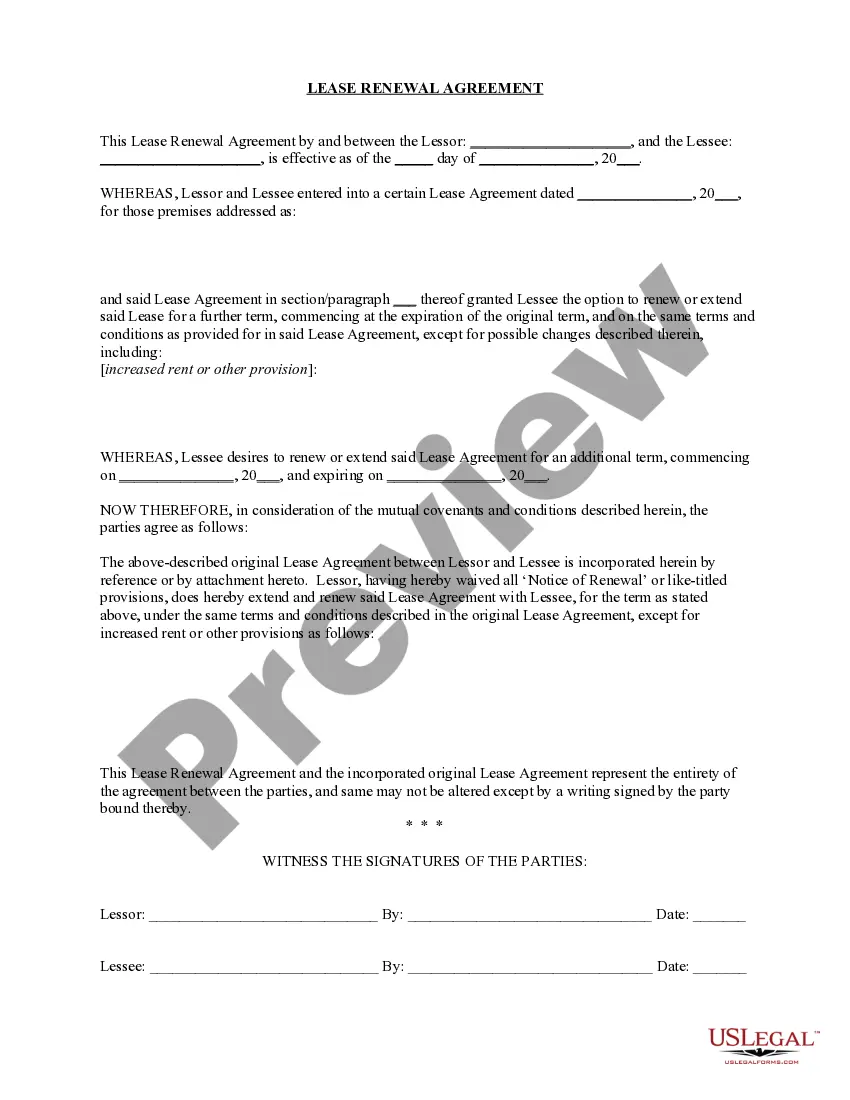

- Use the Preview option to review the document’s content.

- Check the form information to confirm that you’ve selected the correct document.

- If the form does not meet your needs, utilize the Search area at the top of the screen to find the one that fits.

Form popularity

FAQ

Determining the best state to set up a trust often depends on your specific needs and circumstances. However, many experts agree that Wyoming ranks high due to its favorable laws and lack of state income tax. When considering a Wyoming Trust Agreement - Family Special Needs, you'll find benefits in asset protection and legal advantages that can support your family's future.

Wyoming is one of the few states that does not impose a state income tax. This lack of taxation makes it an attractive option for setting up a Wyoming Trust Agreement - Family Special Needs. By establishing your trust in Wyoming, you can maximize the assets in the trust and ensure that more resources are available for your family's special needs without the burden of state taxes.

Yes, Wyoming does allow self-settled trusts, which provide individuals with a way to protect their assets while retaining some control. This feature is advantageous for those creating a Wyoming Trust Agreement - Family Special Needs, as it offers flexibility in managing the trust. By utilizing a self-settled trust, families can ensure that their loved ones benefit from the trust while also meeting specific needs.

Wyoming does not impose a state income tax on trusts, making it an attractive option for a Wyoming Trust Agreement - Family Special Needs. This feature enhances the overall benefits of managing a trust, as more funds remain available for beneficiaries. The absence of state income tax means your family can focus on ensuring the well-being of your loved one without worrying about additional tax burdens. Overall, this aspect highlights Wyoming’s favorable environment for trust management.

Establishing a trust in Wyoming, especially a Wyoming Trust Agreement - Family Special Needs, requires careful planning. Start by deciding the type of trust that best suits your family’s unique situation. Once you've made this decision, work with legal professionals who specialize in trusts to draft the necessary documents. By taking these steps, you create a reliable framework that meets your family’s needs and adheres to Wyoming's regulatory guidelines.

Creating a Wyoming Trust Agreement - Family Special Needs involves several key steps that are straightforward. First, you should clearly define your goals and the needs of your family’s special needs member. Next, consult with an attorney experienced in Wyoming trust law to draft the agreement properly. Finally, you’ll need to fund the trust with assets, ensuring your loved one can benefit from the financial resources you intend to safeguard for their future.

A Wyoming Trust Agreement - Family Special Needs offers several advantages, including strong asset protection and privacy for your family. This type of trust helps shield your assets from creditors and legal claims, ensuring your loved ones are secure. Additionally, Wyoming has favorable laws that allow for easy administration and flexibility in trust management. Overall, establishing a trust in Wyoming presents a beneficial option for families seeking security and peace of mind.

In Wyoming, trusts can last for a considerable duration, sometimes up to 1,000 years, depending on the trust's terms. This longevity is especially important for families utilizing a Wyoming Trust Agreement - Family Special Needs, ensuring support continues well into the future. By understanding these laws, you can create a trust that meets your family's needs for generations.

The maximum duration of a trust varies based on state law, but many states allow trusts to last for an extended period, sometimes even generations. With a Wyoming Trust Agreement - Family Special Needs, you can designate a timeframe that ensures the long-term care of your loved one. This feature is particularly beneficial for families looking to secure their child's future.

The best state for an irrevocable trust often depends on your specific goals and circumstances. Wyoming is known for its innovative trust laws, making it an excellent choice for establishing a Wyoming Trust Agreement - Family Special Needs. Its favorable regulations provide robust asset protection and flexible terms, which can greatly benefit families planning for special needs.