Wyoming Option to Purchase a Business is a legal agreement that grants an individual or entity the exclusive right to buy a business within a specified period of time and at a predetermined price. This arrangement provides flexibility and security to both parties involved in the transaction. The process of obtaining a Wyoming Option to Purchase a Business starts with the interested party, often referred to as the optioned, entering into negotiations with the business owner, known as the option or. Once both parties reach an agreement on the terms, conditions, and purchase price, they execute an Option Agreement. The Wyoming Option Agreement outlines essential details such as the duration of the option period, purchase price, payment terms, and any specific conditions that must be met for the option to be exercised. It is crucial to accurately document these particulars to avoid misunderstandings or disputes in the future. In Wyoming, there are various types of options to purchase a business available, each catering to different circumstances and preferences: 1. Traditional Option Agreement: This is the most common type of option agreement, giving the optioned the right, but not the obligation, to purchase the business within a specified timeframe. 2. Lease with Option to Purchase: This type of option incorporates a lease agreement alongside the option to purchase the business. It allows the optioned to occupy and operate the business while having the flexibility to eventually buy it. 3. Shotgun Option Agreement: Often used in situations involving multiple business owners, a shotgun option allows one owner to offer a predetermined price for the entire business. The other owners then have the option to buy the offering owner's share, or sell their shares at the same price. This type of option creates a mechanism to resolve disagreements or dissolve a partnership. 4. Joint Venture Option Agreement: When two or more parties intend to collaborate on buying, running, and eventually selling a business, a joint venture option agreement is utilized. This agreement outlines the roles, responsibilities, and contributions of each party involved. 5. Option to Purchase Real Property with Business: In cases where the business's real estate property is a crucial asset, this option encompasses both the purchase of the business and the underlying real estate. Wyoming Option to Purchase a Business provides a unique opportunity for potential buyers to secure the right to purchase a business while allowing them sufficient time for due diligence, business planning, and securing financing. It also grants the business owner a sense of certainty by locking in a potential buyer and preserving the company's goodwill during the option period.

Wyoming Option to Purchase a Business

Description

How to fill out Wyoming Option To Purchase A Business?

Are you presently in a location where you frequently require documents for either business or personal needs.

There is a wide array of legal document templates available online, but locating reliable versions can be challenging.

US Legal Forms offers thousands of form templates, such as the Wyoming Option to Purchase a Business, which are designed to comply with federal and state regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, enter the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Wyoming Option to Purchase a Business template.

- If you do not have an account and wish to begin utilizing US Legal Forms, follow these steps.

- Find the form you require and confirm it is for the appropriate area/state.

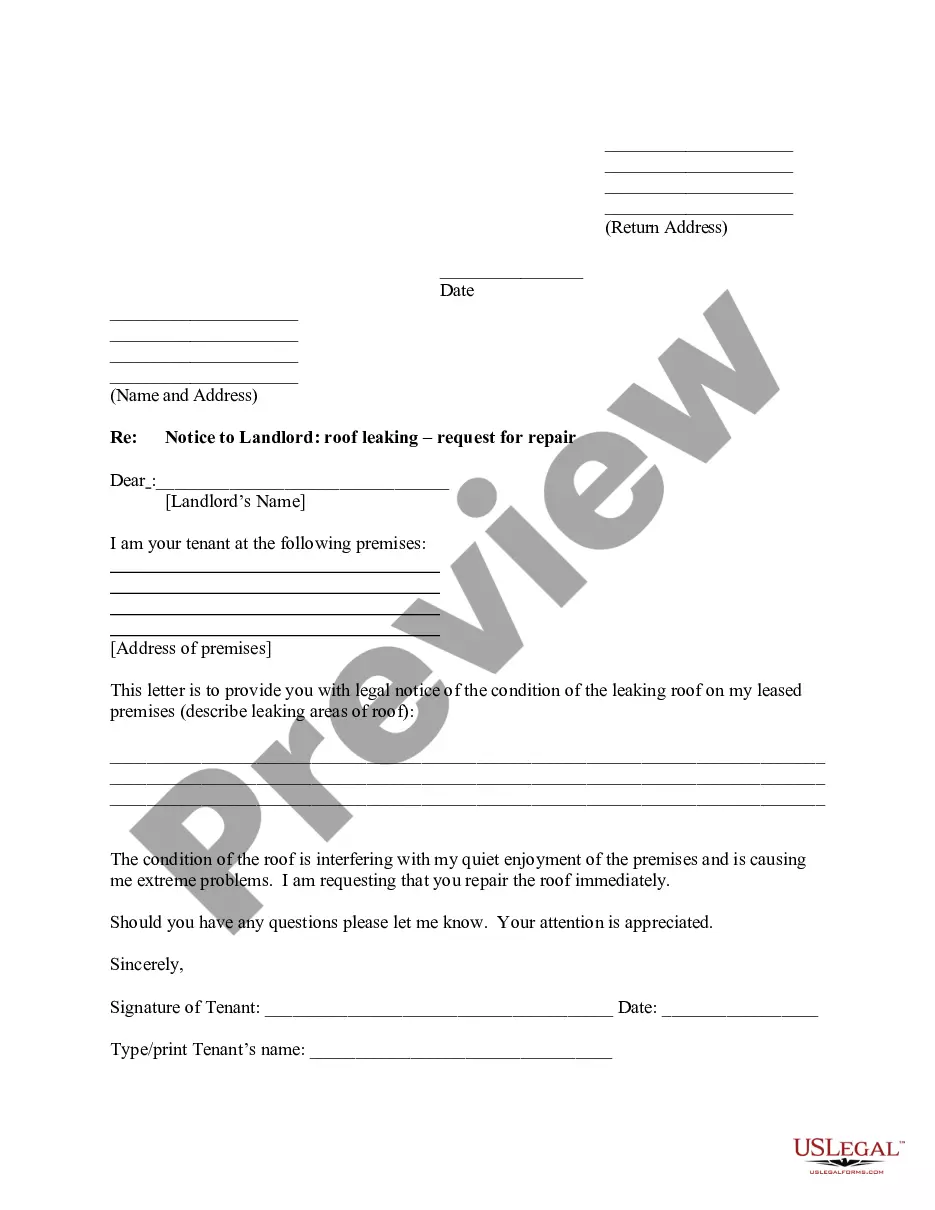

- Use the Review feature to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

Wyoming business environment There are several reasons why entrepreneurs choose to start a business in Wyoming and some of the factors driving their decision are outstanding transportation infrastructure, a well-funded public education system, a good tax climate with low tax burden.

Many companies incorporate in Wyoming because the administrative costs are generally lower than in Delaware or Nevada. Unlike many states, Wyoming does not require licensing or filing fees to be paid to complete the process of incorporation.

The main benefits of forming a LLC in Wyoming are:No state income tax on limited liability companies. Asset protection and limited liability. LLC assets are safe from personal liabilities. Charging order protection extended to single member LLC's.

Wyoming. Wyoming is the best state to start a business for a variety of reasons. For starters, Wyoming's business tax climate is conducive to starting a business. The state doesn't have a corporate income tax, individual income tax or gross receipts tax, according to the Tax Foundation.

Wyoming means business! The Wyoming Business Council looks forward to working with you. Wyoming's business-friendly benefits include: no corporate or personal state income tax, low energy costs, educated workforce, outstanding quality of life, low operating costs, safe communities and much more! Wyoming means freedom2026

Ranked as the nation's Most Business-Friendly Tax Climate since 2013, plus outstanding transportation options, top-ranked broadband connectivity, well-funded public education, safe neighborhoods, and abundant outdoor space and recreation opportunities, Wyoming businesses and people thrive.

Ranked as the nation's Most Business-Friendly Tax Climate since 2013, plus outstanding transportation options, top-ranked broadband connectivity, well-funded public education, safe neighborhoods, and abundant outdoor space and recreation opportunities, Wyoming businesses and people thrive.