A Wyoming Contract of Sale and Leaseback of an Apartment Building with the Purchaser Assuming an Outstanding Note Secured by a Mortgage or Deed of Trust is a legal agreement that involves the sale and leaseback of an apartment building in Wyoming, where the purchaser assumes the responsibility of the outstanding note secured by a mortgage or deed of trust. This type of contract is commonly used in real estate transactions where the seller of the apartment building wants to continue occupying the property while also receiving the benefits of selling it. The contract allows the seller to sell the property to the purchaser and then lease it back for a specified period, typically on a long-term basis. The key aspect of this contract is that the purchaser agrees to assume the outstanding note, which means they take over the responsibility for the mortgage or deed of trust on the property. By assuming this obligation, the purchaser gets control of the property while receiving the benefit of the seller's monthly payments on the note. This arrangement can be advantageous for both parties involved. There are different types of Wyoming Contracts of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust, based on various factors. These may include the length of the leaseback period, the terms of the assumption of the outstanding note, and any additional clauses or conditions agreed upon by both parties. One type of variation is a short-term leaseback, where the seller leases back the apartment building for a shorter duration, typically a few months or up to a year. This type of contract is usually preferred when the seller needs more time to find an alternative property or relocate. Another type is a long-term leaseback, which typically extends for several years or even decades. This option is often chosen when the seller wants to continue operating their business in the building or needs a stable source of income while searching for another property investment. Additionally, there can be variations regarding the assumption of the outstanding note. The purchaser may take over the note as-is, assuming the remaining balance and payment terms. Alternatively, they may negotiate to modify the terms of the note, such as adjusting the interest rate or extending the repayment period. In conclusion, a Wyoming Contract of Sale and Leaseback of an Apartment Building with the Purchaser Assuming an Outstanding Note Secured by a Mortgage or Deed of Trust is a legally binding agreement that allows a seller to sell their apartment building while leasing it back. The purchaser assumes the responsibility of the outstanding note secured by a mortgage or deed of trust, enabling the seller to continue occupying the property while providing financial benefits to both parties. Different variations of this contract can occur, depending on factors such as leaseback period and terms of the assumption of the outstanding note.

Wyoming Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust

Description

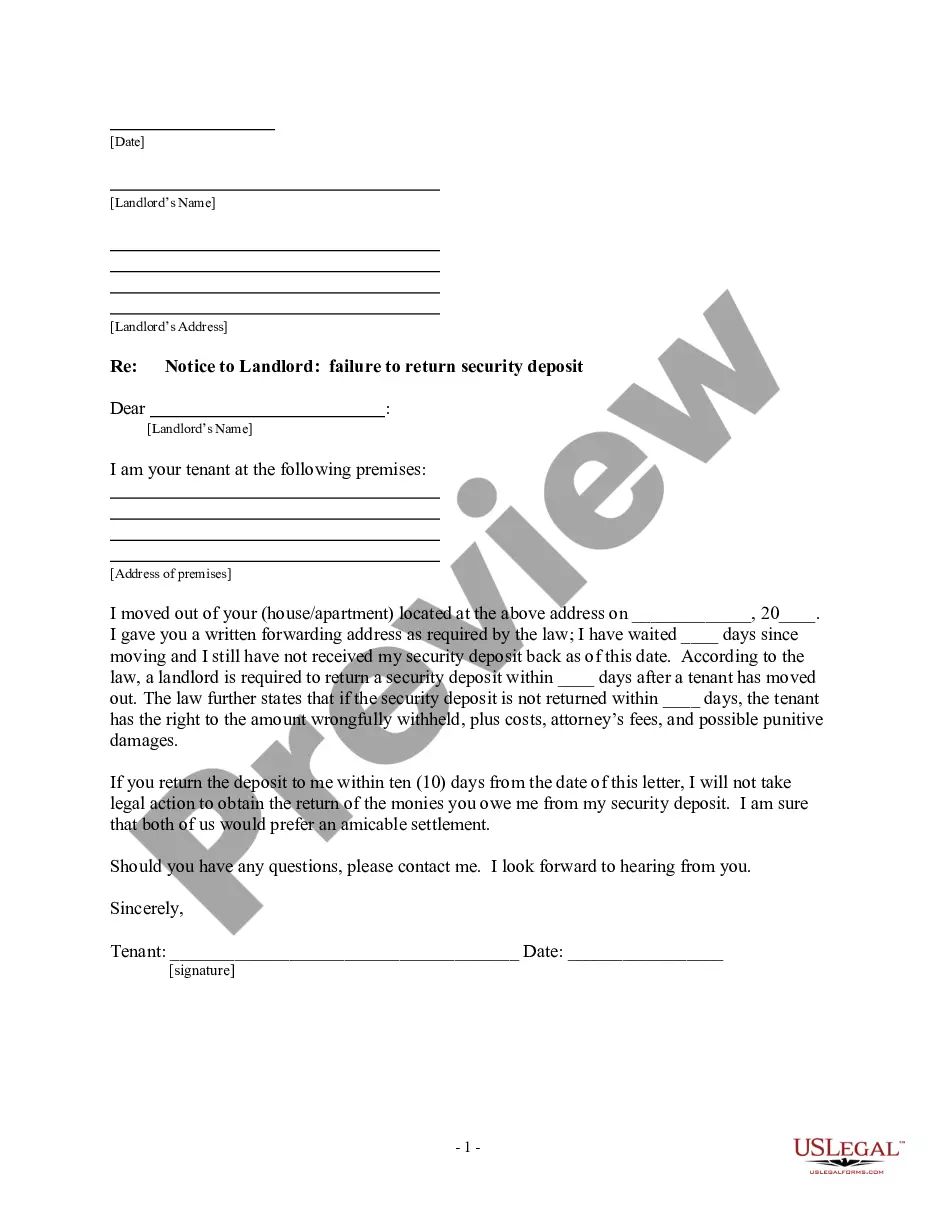

How to fill out Wyoming Contract Of Sale And Leaseback Of Apartment Building With Purchaser Assuming Outstanding Note Secured By A Mortgage Or Deed Of Trust?

You can devote time online trying to find the lawful papers format that meets the state and federal demands you want. US Legal Forms gives 1000s of lawful forms which are evaluated by pros. You can actually down load or print out the Wyoming Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust from the assistance.

If you already possess a US Legal Forms profile, you can log in and click on the Acquire option. Following that, you can complete, modify, print out, or indication the Wyoming Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust. Every lawful papers format you purchase is your own property eternally. To acquire an additional copy for any bought form, proceed to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms website the very first time, stick to the simple recommendations listed below:

- Very first, be sure that you have selected the right papers format for the region/metropolis of your liking. See the form description to ensure you have selected the correct form. If readily available, take advantage of the Preview option to look through the papers format as well.

- If you would like discover an additional variation of the form, take advantage of the Lookup field to discover the format that fits your needs and demands.

- After you have identified the format you need, click Acquire now to carry on.

- Find the pricing plan you need, key in your qualifications, and register for an account on US Legal Forms.

- Complete the transaction. You may use your bank card or PayPal profile to purchase the lawful form.

- Find the format of the papers and down load it to the device.

- Make modifications to the papers if required. You can complete, modify and indication and print out Wyoming Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust.

Acquire and print out 1000s of papers templates utilizing the US Legal Forms Internet site, that provides the greatest selection of lawful forms. Use skilled and state-distinct templates to deal with your small business or person requirements.

Form popularity

FAQ

Risks of a Contract for Deed If disputes arise between the buyer and seller of a contract for deed property, legal recourse is limited for the party living in the home. The purchaser has few options and may not be able to take full advantage of rights provided by law under a traditional mortgage.

A major drawback of a contract for deed for buyers is that the seller retains the legal title to the property until the payment plan is completed. On one hand, this means that they're responsible for things like property taxes. On the other hand, the buyer lacks security and rights to their home.

Is a contract for deed a good idea? While it is acknowledged that a contract for deed can help those who currently have poor credit or an otherwise tough lending situation, it isn't a good idea in most cases. There are several reasons why: The seller retains the title.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

In a contract for deed, the purchase of property is financed by the seller rather than a third-party lender such as a commercial bank or credit union. The arrangement can benefit buyers and sellers by extending credit to homebuyers who would not otherwise qualify for a loan.