Wyoming Privacy and Confidentiality of Credit Card Purchases

Description

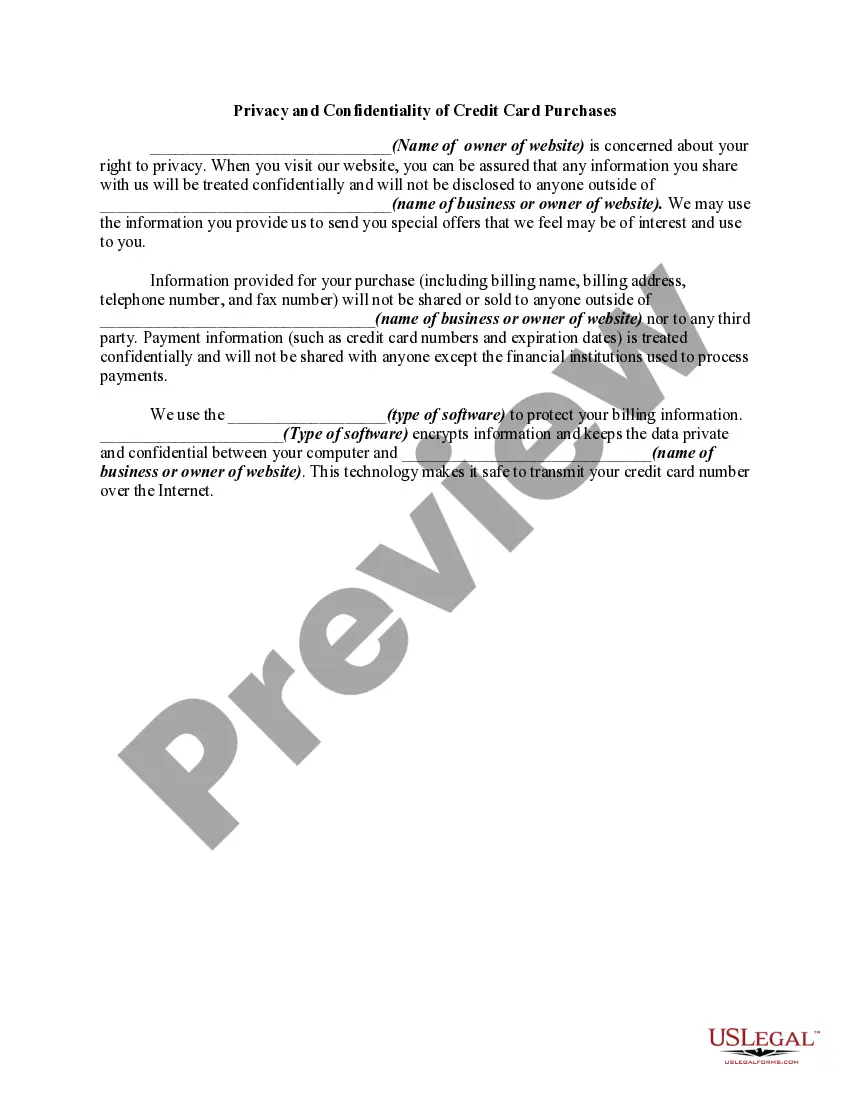

The following form seeks to give such assurance.

How to fill out Privacy And Confidentiality Of Credit Card Purchases?

It is feasible to spend hours online attempting to locate the suitable legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal documents that are reviewed by professionals.

You can either download or print the Wyoming Privacy and Confidentiality of Credit Card Purchases from the platform.

Should you wish to obtain another version of your form, utilize the Search section to find the template that fulfills your needs and requirements.

- If you possess a US Legal Forms account, you may Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Wyoming Privacy and Confidentiality of Credit Card Purchases.

- Each legal document template you acquire is yours permanently.

- To obtain an additional copy of the purchased document, go to the My documents tab and click on the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/region of choice.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

It is safe to provide your credit card details if you take necessary precautions. Ensure that the platform you are using complies with the Wyoming Privacy and Confidentiality of Credit Card Purchases. Always look for security features, like secure connections and privacy policies, to help protect your personal information.

Yes, if someone gains access to your credit card details, they could potentially steal your identity. This is why understanding the Wyoming Privacy and Confidentiality of Credit Card Purchases is so important. Taking proactive measures, such as monitoring your accounts and using secure payment methods, can help protect your identity.

Sharing your credit card information should be done with caution. You can share it safely if you are dealing with a trustworthy company that adheres to the Wyoming Privacy and Confidentiality of Credit Card Purchases standards. Always verify the site’s security and privacy protocols before sharing your information.

Yes, the information associated with your credit card is generally confidential. Companies and merchants are required to protect your data through various regulations, including the Wyoming Privacy and Confidentiality of Credit Card Purchases law. It is essential to always choose reputable businesses that prioritize your privacy.

The Wyoming Attorney General serves as the chief legal advisor to the state and protects consumer rights regarding various issues, including credit card fraud. This office also oversees enforcement of consumer protection laws to ensure fair practices. Understanding their role is essential when navigating matters related to the privacy and confidentiality of credit card purchases in Wyoming.

To file a complaint against the Attorney General of Wyoming, you can write a letter or submit an online report detailing your concerns. Make sure to include specific incidents and relevant documentation. Addressing issues regarding officials is vital for upholding principles tied to Wyoming privacy and confidentiality of credit card purchases.

A general power of attorney in Wyoming grants someone the authority to make financial and legal decisions on your behalf. This can include managing credit card transactions or handling your financial affairs. Understanding this tool is crucial for ensuring proper management of your credit-related matters, aligning with Wyoming’s privacy and confidentiality of credit card purchases.

The Wyoming Consumer Privacy Act aims to protect individuals' personal data and ensure their privacy rights are respected. This act establishes guidelines for businesses regarding the handling of consumer information, especially related to credit card purchases. Being informed about this act enhances your understanding of your rights in Wyoming’s privacy landscape.

Filing a complaint against a judge in Wyoming involves submitting a detailed report to the Wyoming Commission on Judicial Conduct and Ethics. Include your contact information and a clear account of the incident. By addressing concerns about judicial conduct, you contribute to maintaining integrity in the Wyoming privacy and confidentiality of credit card purchases.

To report a credit card company in Wyoming, you can contact the Wyoming Division of Banking or the Consumer Financial Protection Bureau. Providing detailed information about your experiences will help the authorities take action. Remember, reporting helps uphold the Wyoming standards of privacy and confidentiality of credit card purchases.