Subject: Urgent Request to Credit Reporting Bureau to Safeguard Personal Information against Identity Theft — Wyoming Sample Letter [Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Credit Reporting Bureau/Agency Name] [Address] [City, State, Zip Code] Subject: Request to Implement Additional Security Measures to Prevent Identity Theft Dear Sir/Madam, I hope this letter finds you well. I am writing to request your assistance in protecting my valuable personal information from the rising threats of identity theft. Given the increasing prevalence of fraudulent activities targeting innocent individuals, it is essential for credit reporting bureaus to take proactive measures to safeguard sensitive consumer data across all platforms. As a responsible citizen residing in the beautiful state of Wyoming, I understand the importance of monitoring and controlling my credit information to prevent undue harm caused by identity theft. While I appreciate the efforts credit reporting agencies like yours have put into securing personal data, I believe that it is crucial to constantly reassess and reinforce measures to stay one step ahead of cybercriminals. In light of the significant impact identity theft can have on an individual's financial well-being and personal life, I kindly request the following enhancements to your existing security protocols: 1. Multi-Factor Authentication (MFA): Implementing MFA as an additional layer of protection would ensure that only authorized individuals can access or modify credit information. This can include the use of unique one-time passwords, security questions, or biometric authentication methods. 2. Continuous Credit Monitoring: Provide customers with real-time alerts, preferably through both email and SMS notifications, regarding any new accounts, changes in credit limits, or suspicious activities detected on their credit reports. 3. Enhanced Fraud Detection: Employ advanced algorithms and machine learning techniques to proactively identify fraudulent patterns, anomalous behaviors, and unauthorized inquiries. Regularly review and upgrade your fraud detection algorithms to match the evolving tactics of identity thieves. 4. Secure Mobile Application: Offer a secure mobile application that allows users to conveniently monitor their credit reports, freeze or unfreeze their credit, and receive instant alerts on potential threats or unauthorized access attempts. 5. Comprehensive Education and Awareness: Launch regular public awareness campaigns, workshops, or webinars to educate consumers about the latest identity theft risks, prevention techniques, and how to respond effectively in case of compromise. 6. Collaborative Industry Initiatives: Participate actively in industry-wide discussions and initiatives aimed at creating a unified front against identity theft. Collaborate with other credit reporting bureaus, financial institutions, and law enforcement agencies to share best practices and knowledge in combating this pervasive issue. I am confident that implementing these additional security measures will not only enhance the protection of sensitive personal information but also set an excellent example for the entire credit reporting industry to follow. Together, we can make a significant impact in mitigating the risks associated with identity theft and preserving the trust of consumers. I appreciate your attention to this matter and kindly request a written response outlining the steps your agency will take to address these concerns. I anxiously await your prompt action in securing our credit information. Thank you for your dedication to consumer safety and for taking the necessary steps to prevent identity theft. Sincerely, [Your Name]

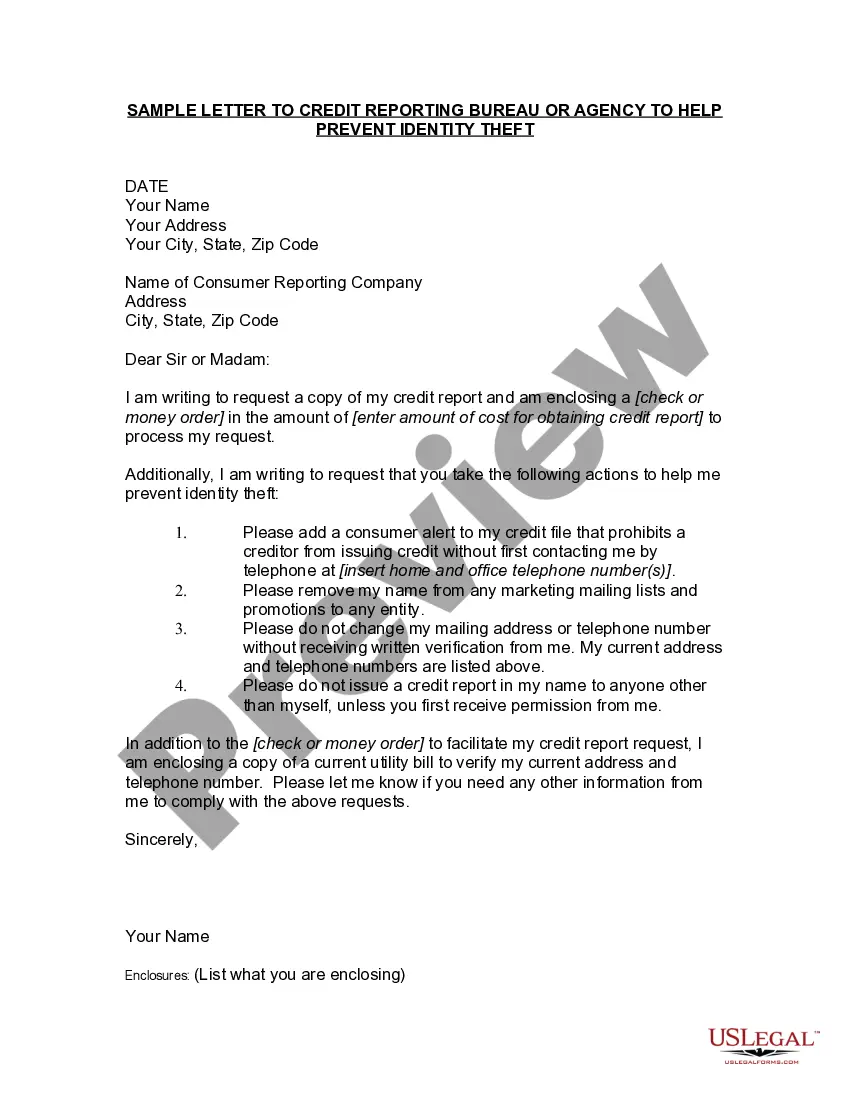

Wyoming Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft

Description

How to fill out Wyoming Sample Letter To Credit Reporting Bureau Or Agency To Help Prevent Identity Theft?

Have you been inside a place where you need paperwork for possibly business or person reasons almost every day? There are a variety of lawful file templates available on the Internet, but finding versions you can trust is not effortless. US Legal Forms delivers thousands of form templates, such as the Wyoming Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft, which can be created in order to meet federal and state demands.

If you are already acquainted with US Legal Forms internet site and get an account, simply log in. Following that, you may obtain the Wyoming Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft web template.

Unless you provide an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Find the form you need and ensure it is for that appropriate area/region.

- Use the Review switch to check the shape.

- Read the explanation to actually have chosen the correct form.

- If the form is not what you are searching for, make use of the Look for area to discover the form that fits your needs and demands.

- Whenever you find the appropriate form, click Get now.

- Select the prices plan you want, submit the necessary details to make your account, and pay money for the order with your PayPal or Visa or Mastercard.

- Decide on a hassle-free data file file format and obtain your backup.

Get all the file templates you might have bought in the My Forms menu. You may get a more backup of Wyoming Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft any time, if necessary. Just go through the needed form to obtain or produce the file web template.

Use US Legal Forms, probably the most extensive selection of lawful forms, to save lots of time and steer clear of mistakes. The service delivers professionally made lawful file templates which can be used for an array of reasons. Make an account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

File a report with your local police department. Place a fraud alert on your credit report. ... Consumer Reporting Agencies (CRA's) Close the accounts that you know or believe have been tampered with or opened fraudulently. ... Report the theft to the Federal Trade Commission. ... File a police report.

If you've been a victim of identity theft, you can also get credit reporting companies to remove fraudulent information and debts from your credit report, which is called blocking. To do this, you must send the credit reporting companies: An identity theft report, which can be done through IdentityTheft.gov.

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation. - Request these companies to place a fraud alert in your file as well as a credit freeze.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.