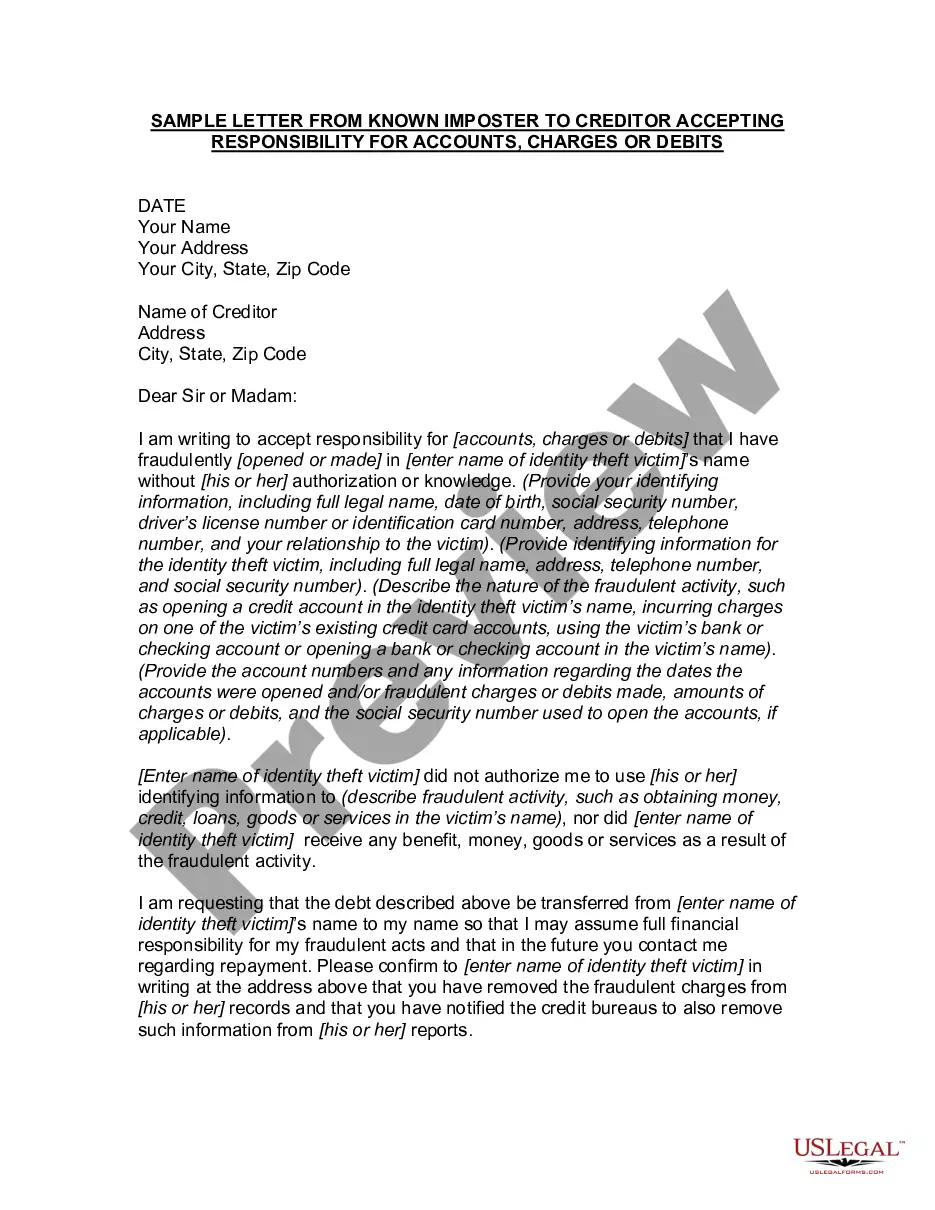

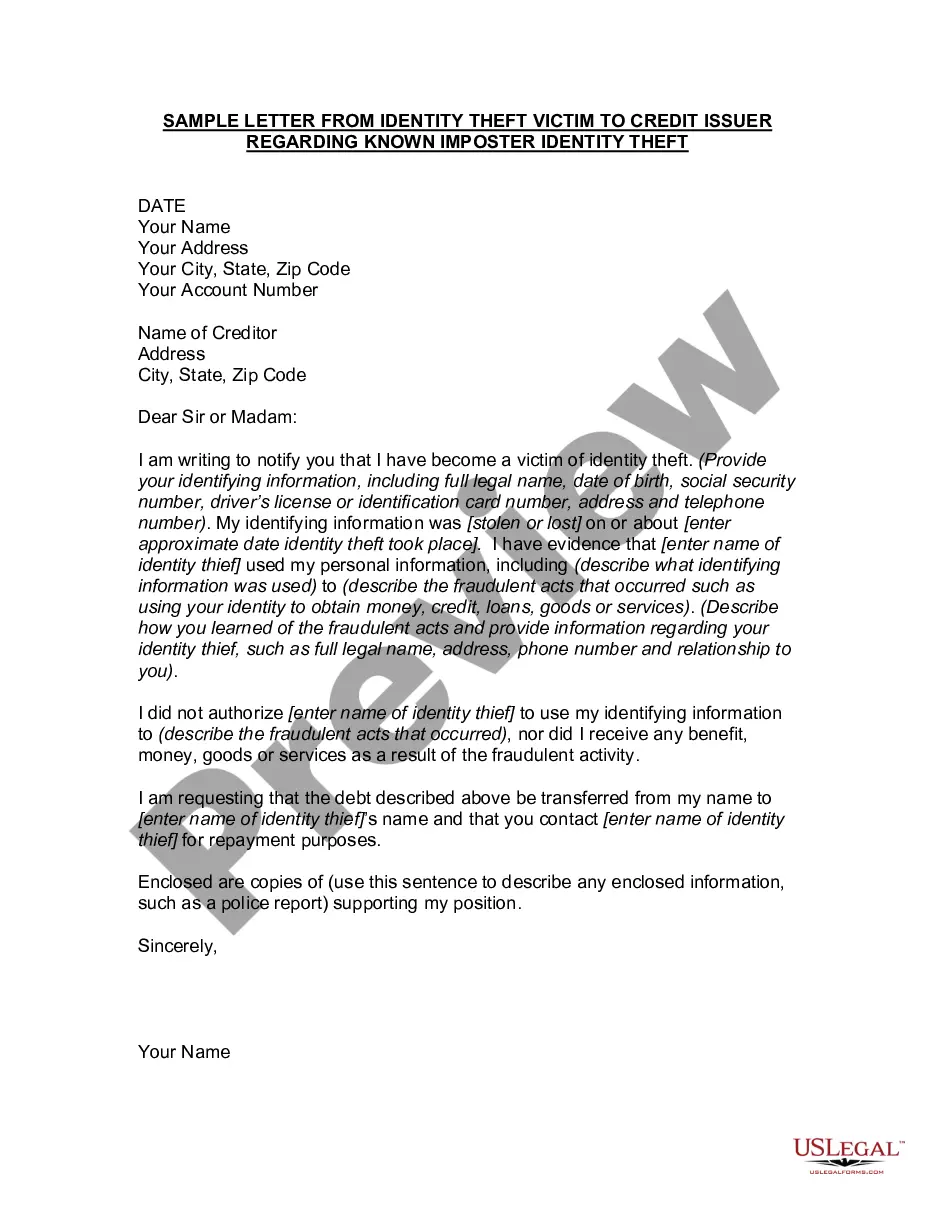

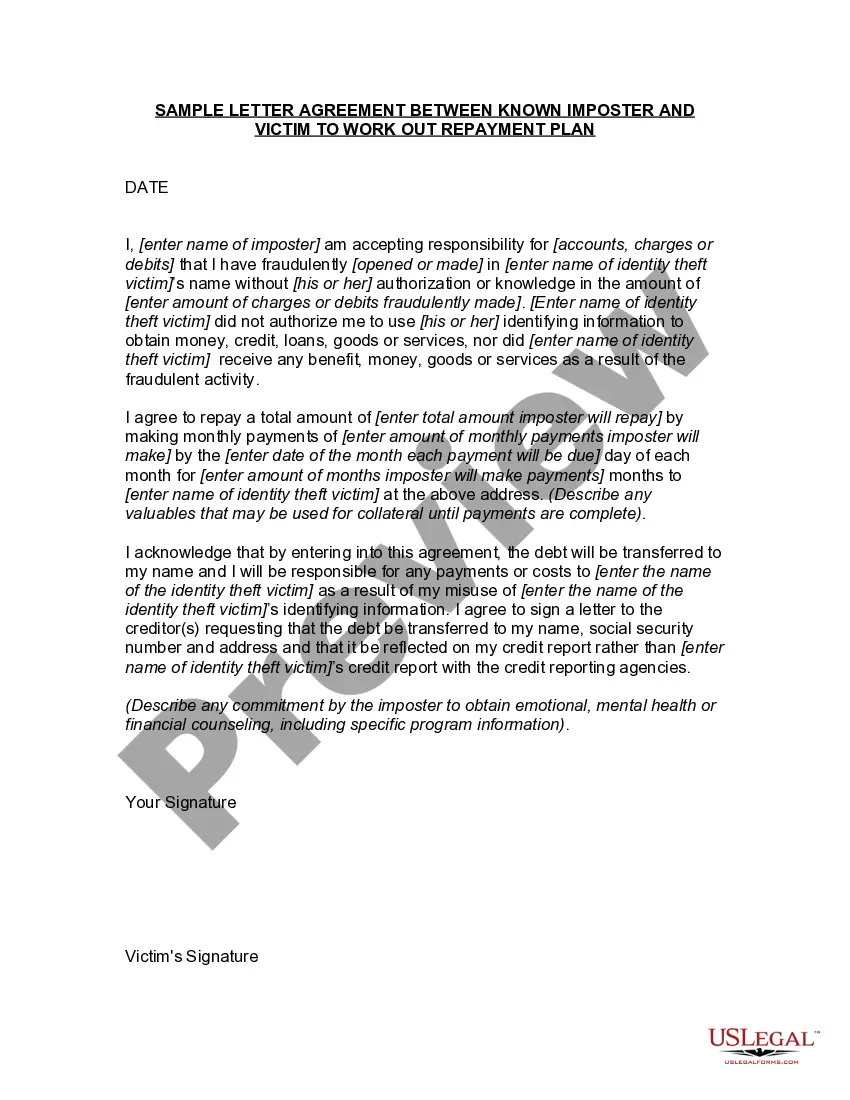

Wyoming Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

How to fill out Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

You might spend hours online trying to find the authentic document template that meets the state and federal requirements you need.

US Legal Forms offers a multitude of legal templates that are reviewed by professionals.

You can download or print the Wyoming Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits from their service.

If available, use the Review button to browse through the document template as well. To find another version of the form, use the Lookup field to locate the template that suits your needs.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- Then, you can complete, edit, print, or sign the Wyoming Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits.

- Each legal document template you acquire is yours permanently.

- To get another copy of any obtained form, go to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Until the debt is either paid or forgiven, you still owe the money. This is true even if it's a credit card debt that is sold to a collection agency and even if you think it's unfair.

Can you dispute a debt if it was sold to a collection agency? Your rights are the same as if you were dealing with the original creditor. If you do not believe you should pay the debt, for example, if a debt is stature barred or prescribed, then you can dispute the debt.

I am requesting that you accept payments of $______________paid on the__________. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible. I regret that I have to ask for this consideration and hope that you will understand.

Until the debt is either paid or forgiven, you still owe the money. This is true even if it's a credit card debt that is sold to a collection agency and even if you think it's unfair.

If you stop making payments to a creditor or collection agency, they can sue you for the money you owe. The court will look at factors like the size and age of your debt, how much you make and what assets you own.

If there are negative items on your credit report but the information is accurately reported, you can write a goodwill letter to ask the creditor or collection agency to remove the collections account from your report. This isn't guaranteed to work, but it won't hurt to ask.

This means sending a written letter explaining how you wish to settle your debt, how much you are offering to pay and when this can be paid by. Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors.