Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

How to fill out Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

Locating the appropriate legitimate document template can be challenging. Clearly, there are numerous templates accessible online, but how can you find the authentic form you require.

Utilize the US Legal Forms platform. This service offers thousands of templates, including the Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, which you can use for both business and personal purposes. All of the forms are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download option to access the Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. Use your account to browse the legitimate forms you have previously acquired. Navigate to the My documents section of your account to obtain another copy of the document you need.

Complete, edit, print, and sign the received Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. US Legal Forms is the largest library of legitimate forms where you can find various document templates. Utilize this service to access professionally created paperwork that adheres to state regulations.

- If you are a new user of US Legal Forms, here are straightforward instructions you can follow.

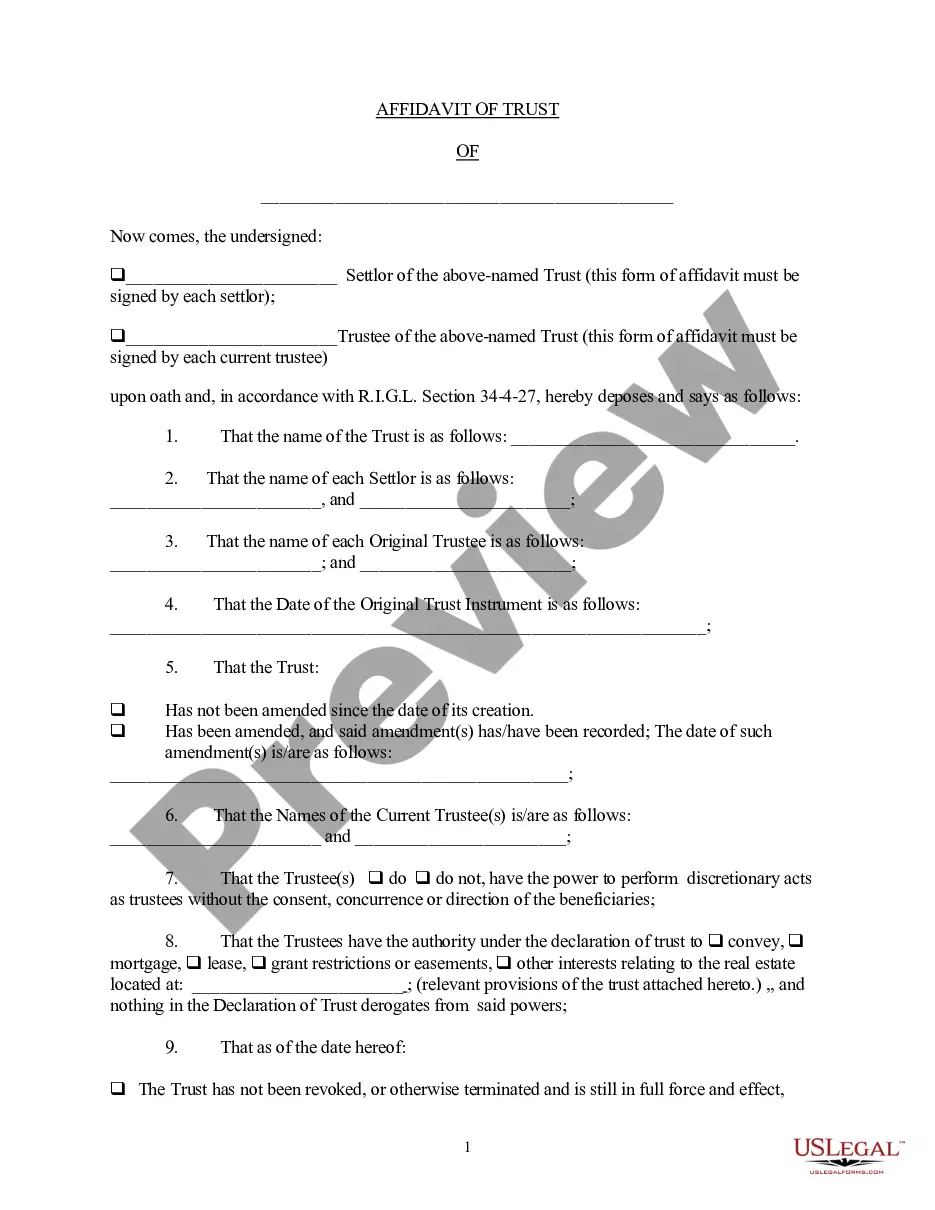

- First, ensure you have selected the correct form for your locality/region. You can review the document using the Preview feature and read the document description to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident that the form is right, click the Get now button to acquire the document.

- Choose the pricing plan you desire and provide the required information. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legitimate document template to your system.

Form popularity

FAQ

In Virginia, a non-physician cannot directly own a medical practice, as state laws require practices to be owned by licensed medical professionals. However, a non-physician can invest in a medical practice under certain conditions. It's essential to structure these arrangements properly, especially when considering agreements such as a Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, to ensure compliance with state regulations.

In Pennsylvania, whether independent contractors need a business license often depends on local regulations and the type of business they operate. Generally, it’s a good idea to check with your local municipality to make sure you comply with any licensing requirements. Having the proper licenses not only legitimizes your work but can also enhance your credibility when forming agreements, such as a Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

A Physician Assistant (PA) can be classified as an independent contractor based on the nature of their work arrangement. If the PA offers services without being an employee of a medical practice, they operate as an independent contractor. This flexibility benefits both the PA and the practice, as they can negotiate terms based on a Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. Always review state regulations for specific requirements.

Writing an independent contractor agreement starts with defining the parties involved clearly. Then, outline the scope of work, payment terms, and the duration of the agreement. Don't forget to include clauses that discuss confidentiality and termination. By including these elements, you create a solid foundation that reflects a Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

The agreement between a contractor and a company outlines the specific terms under which services will be provided. It usually includes payment details, service expectations, and legal responsibilities. A Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can facilitate this by providing a clear structure for the arrangement and ensuring compliance with relevant laws.

To write an independent contractor agreement, start by defining the scope of work, payment terms, and duration of the contract. Ensure that both parties acknowledge and agree to the terms by signing the document. Using a Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can guide you through this process and provide legal reassurance.

An example of an independent contractor is a freelance graphic designer who works for multiple clients without being tied to a single employer. They may create designs, produce logos, or develop marketing materials based on individual contracts. This arrangement aligns with the Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, which helps clarify the relationship and responsibilities.

To write a simple contract agreement, start by identifying the parties involved and clearly defining the services to be provided. Include payment terms, deadlines, and any specific responsibilities. Incorporating a Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can simplify this process and ensure all legal aspects are covered.

As an independent contractor, you typically fill out various forms, including a W-9 form for tax purposes. Additionally, you may need to submit invoices detailing your services and payments received. It’s crucial to have a Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation to outline the terms of your work and protect your rights.

While both freelancers and independent contractors operate independently, the key difference lies in the job type. Freelancers often work on a project basis for multiple clients, whereas independent contractors may engage in longer-term contracts, such as the Wyoming Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation. Understanding this distinction can help dictate how you approach your business strategy.