The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

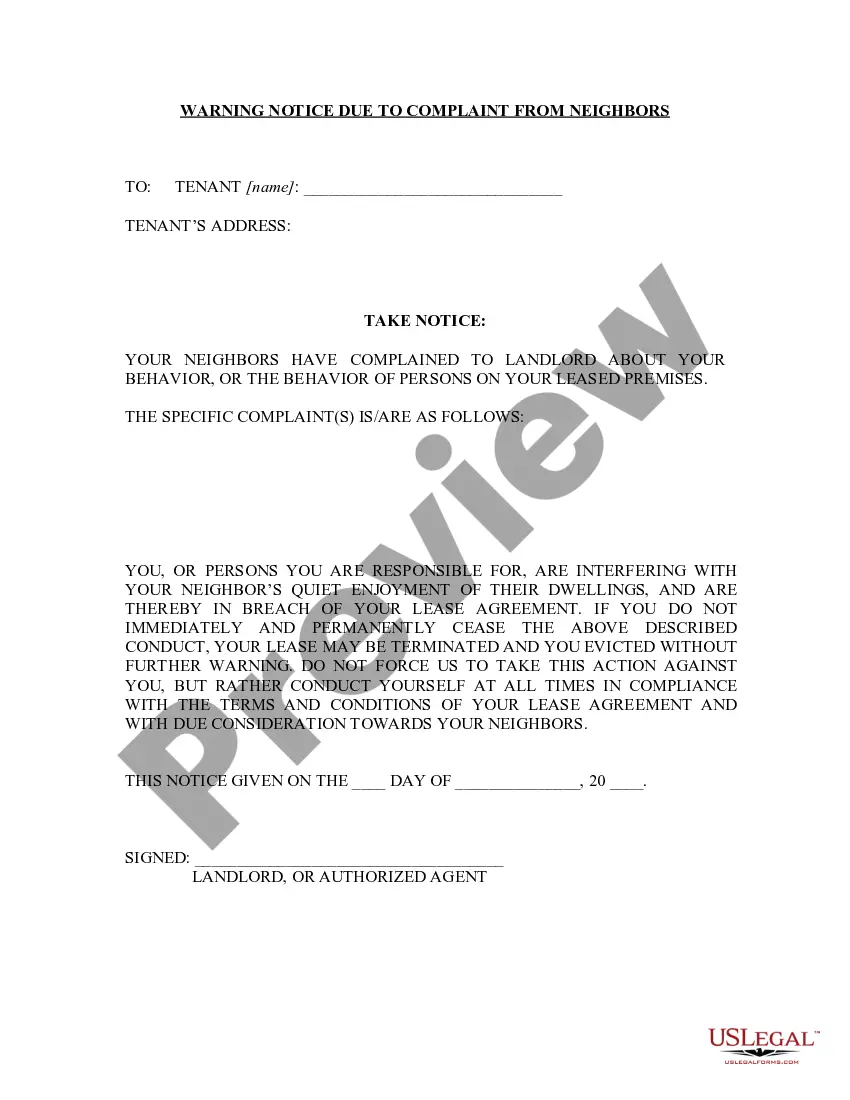

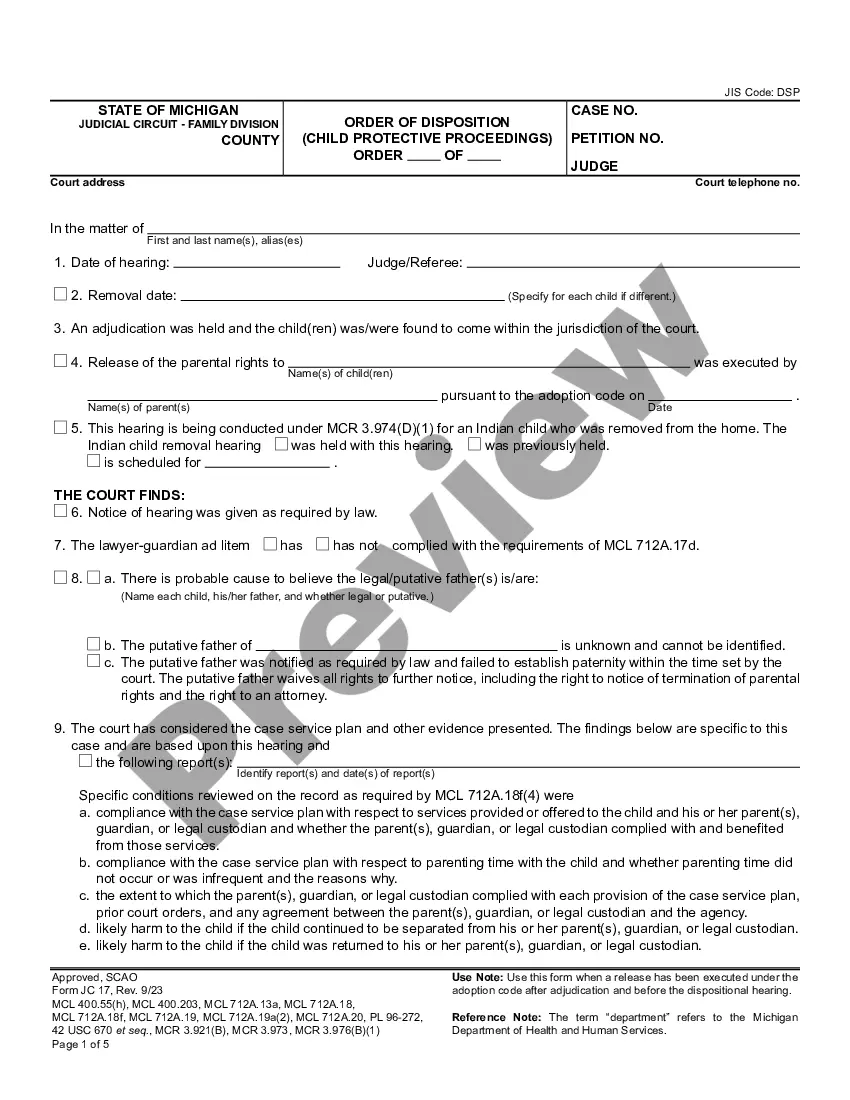

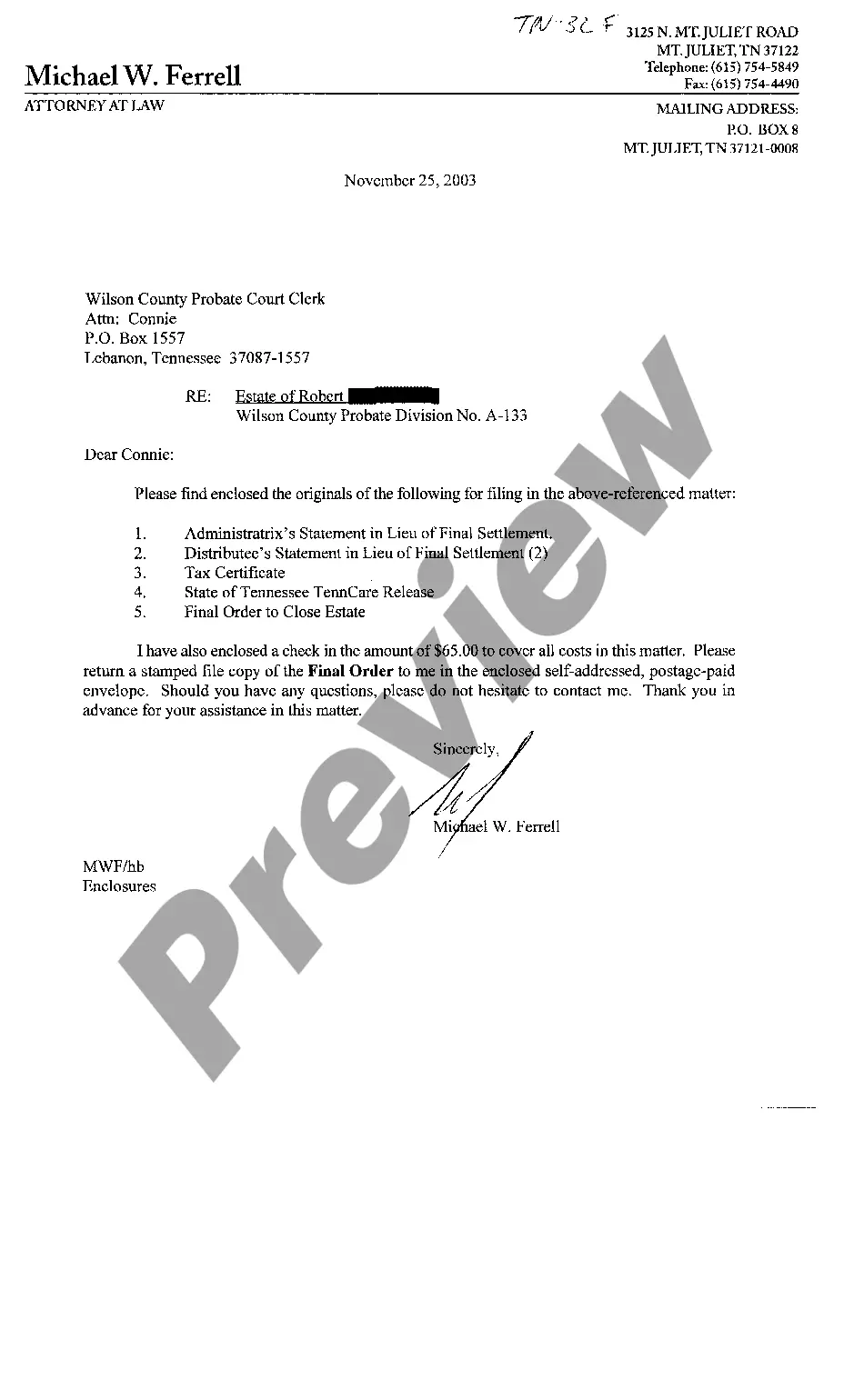

This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Wyoming Agreement Between Chiropractic Physician as Self-Employed Independent Contractor and Professional Corporation Introduction: A Wyoming Agreement Between Chiropractic Physician as Self-Employed Independent Contractor and Professional Corporation is a legally binding document that outlines the terms and conditions agreed upon by a chiropractic physician who decides to work as a self-employed independent contractor for a professional corporation in the state of Wyoming. This agreement sets clear expectations, rights, and responsibilities for both parties, ensuring a mutually beneficial working relationship. Keywords: Wyoming, agreement, chiropractic physician, self-employed, independent contractor, professional corporation Types of Wyoming Agreement Between Chiropractic Physician as Self-Employed Independent Contractor and Professional Corporation: 1. General Wyoming Agreement: This type of agreement covers the standard terms and conditions applicable to a chiropractic physician working as a self-employed independent contractor for a professional corporation in Wyoming. It covers various areas such as compensation, working hours, liability, and termination provisions. 2. Non-Compete Wyoming Agreement: This agreement includes additional clauses that restrict the chiropractic physician from engaging in competing activities during and after the agreement's duration. It protects the interests of the professional corporation and ensures that the chiropractic physician does not enter into direct competition with the corporation. 3. Confidentiality Wyoming Agreement: This type of agreement focuses on maintaining the confidentiality of sensitive information and trade secrets belonging to the professional corporation. It includes provisions to prevent the chiropractic physician from disclosing or misusing any confidential company information during or after the agreement. Keywords: non-compete, confidentiality, professional corporation, trade secrets, sensitive information Important Elements of a Wyoming Agreement Between Chiropractic Physician as Self-Employed Independent Contractor and Professional Corporation: 1. Parties Involved: Clearly identify the professional corporation and the chiropractic physician as the parties entering into the agreement. 2. Term and Termination: Specify the duration of the agreement and the conditions under which either party can terminate the agreement. 3. Duties and Responsibilities: Clearly outline the chiropractic physician's obligations, such as scheduling patient appointments, providing chiropractic care, maintaining proper documentation, and adhering to the corporation's policies and procedures. 4. Compensation and Benefits: Detail the payment structure, including any base salary, incentives, bonuses, or benefits that the chiropractic physician is entitled to receive. 5. Indemnification: Define the extent to which the professional corporation will indemnify the chiropractic physician against any legal claims arising from their work, within the limits of applicable laws and regulations. 6. Non-Disclosure and Non-Compete: Include clauses to protect the professional corporation's trade secrets, confidential information, and the chiropractic physician's commitment not to compete with the corporation during and after the agreement. 7. Dispute Resolution: Establish a mechanism for resolving any disputes or disagreements that may arise between the parties, such as through mediation or arbitration. Keywords: parties involved, term and termination, duties and responsibilities, compensation and benefits, indemnification, non-disclosure, non-compete, dispute resolution By understanding the different types and elements of a Wyoming Agreement Between Chiropractic Physician as Self-Employed Independent Contractor and Professional Corporation, both parties can ensure a fair and transparent working relationship that complies with Wyoming state laws and regulations.