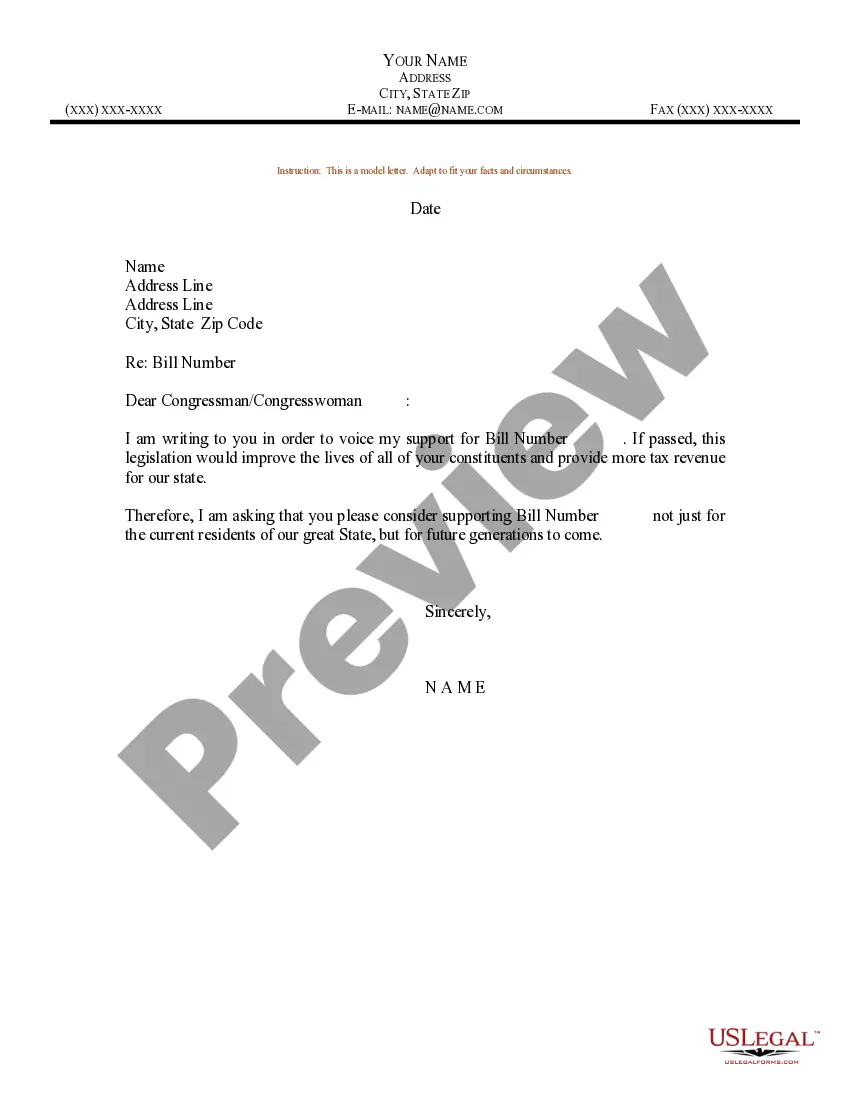

A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account

Description

How to fill out Settlement Offer Letter From A Business Regarding A Disputed Account?

It is feasible to spend hours online searching for the correct legal document template that complies with federal and state regulations you require.

US Legal Forms provides thousands of legal documents that have been reviewed by experts.

You can obtain or create the Wyoming Settlement Offer Letter from a Business Concerning a Disputed Account through our service.

If you wish to find another version of the form, utilize the Research section to locate the template that meets your needs and preferences.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, create, or sign the Wyoming Settlement Offer Letter from a Business Concerning a Disputed Account.

- Every legal document template you obtain is yours permanently.

- To access another version of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the appropriate document template for the state/city of your choice. Refer to the form description to confirm you have chosen the correct form.

- If available, use the Review button to examine the document template as well.

Form popularity

FAQ

A settlement offer letter is a written document sent to a creditor proposing payment terms to settle a debt. In crafting your Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account, clarity and sincerity are crucial. This letter serves as both a formal communication and a negotiation tool, allowing you to present your case effectively and explore a resolution.

Creditors may accept a 50% settlement depending on the circumstances surrounding your account. Many creditors prefer to recoup a portion of the debt rather than risk not receiving payments at all. A well-structured Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account can improve your chances of negotiating such an arrangement, as it shows your commitment to resolving the matter.

The primary purpose of a settlement offer is to negotiate a reduced payment to resolve a debt without further conflict. By presenting a Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account, you facilitate a dialogue with the creditor while outlining your proposed terms. This can lead to a quicker resolution that benefits both parties, allowing you to move forward without the burden of unresolved debts.

When settling a debt, it is common to consider offering between 30% to 70% of the total owed. The specific percentage can vary based on factors such as the creditor's policies and your particular financial circumstances. Ultimately, your goal is to craft a fair proposal in your Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account that persuades the creditor to accept your offer.

An acceptable settlement offer is typically a proposal made to resolve a debt for less than the full amount owed. In the case of a Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account, the offer should demonstrate a genuine willingness to resolve the dispute amicably. A reasonable starting point often lies in offering a percentage that reflects your financial situation and the creditor's willingness to settle.

As previously mentioned, Rule 68 allows parties to make settlement offers, aiming to encourage the resolution of disputes before trial. By effectively utilizing Rule 68, individuals can navigate their legal options with confidence, particularly when drafting a Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account, which can lead to faster resolutions.

Rule 45 relates to subpoenas and outlines how parties can compel the production of documents or testimony from third parties. If you are negotiating a Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account, familiarity with how subpoenas function can help you obtain crucial evidence that supports your case.

Rule 35 pertains to physical and mental examinations, enabling a court to order an examination of a party if their condition is in question. Understanding this rule can be critical in certain cases, such as those involving personal injury claims, where a Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account might be linked to health claims.

Rule 60 addresses relief from judgment and allows parties to request reopening a case under specific circumstances, such as new evidence or incorrect judgment. This can be particularly important for individuals engaging in settlement discussions, especially if new information arises regarding a Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account.

Rule 37 deals with discovery disputes and provides guidance on how to handle failures to provide discovery or comply with court orders. In cases of disputed accounts, this rule ensures that parties adhere to the necessary procedures for exchanging information. Knowledge of Rule 37 can facilitate better negotiation strategies in drafting a Wyoming Settlement Offer Letter from a Business Regarding a Disputed Account.