The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

Wyoming Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

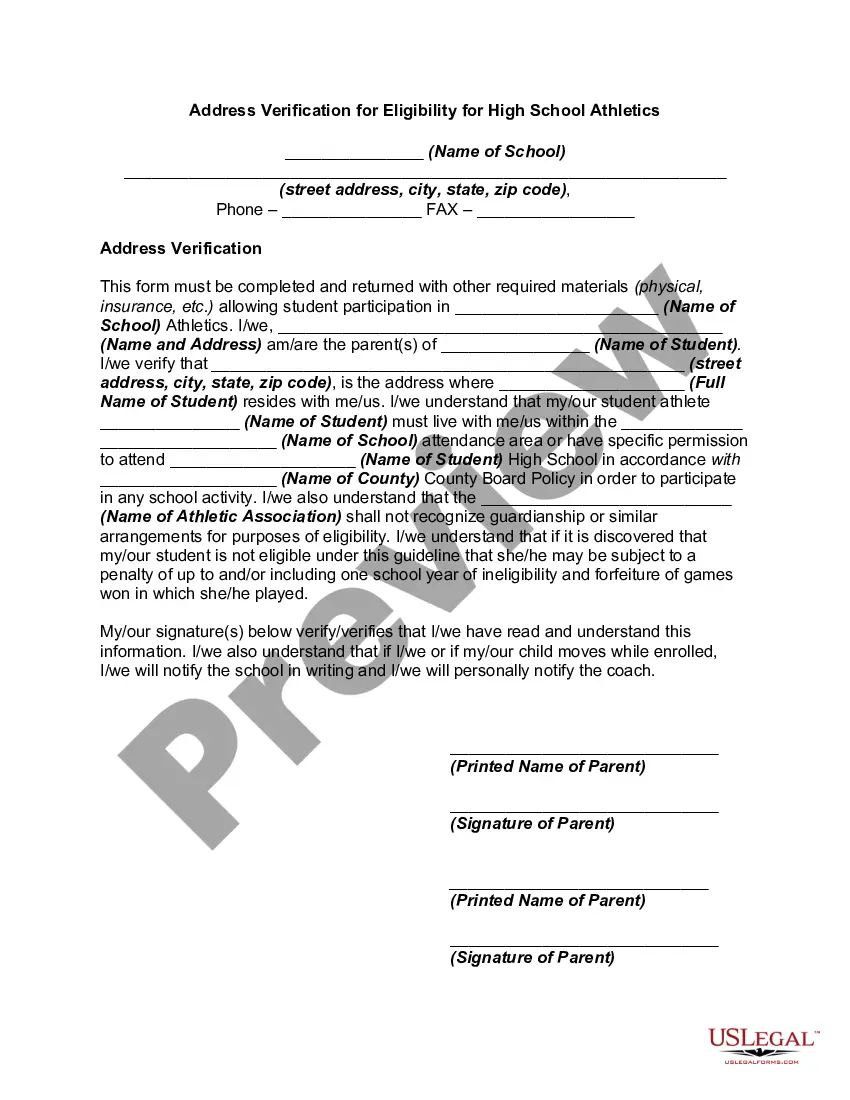

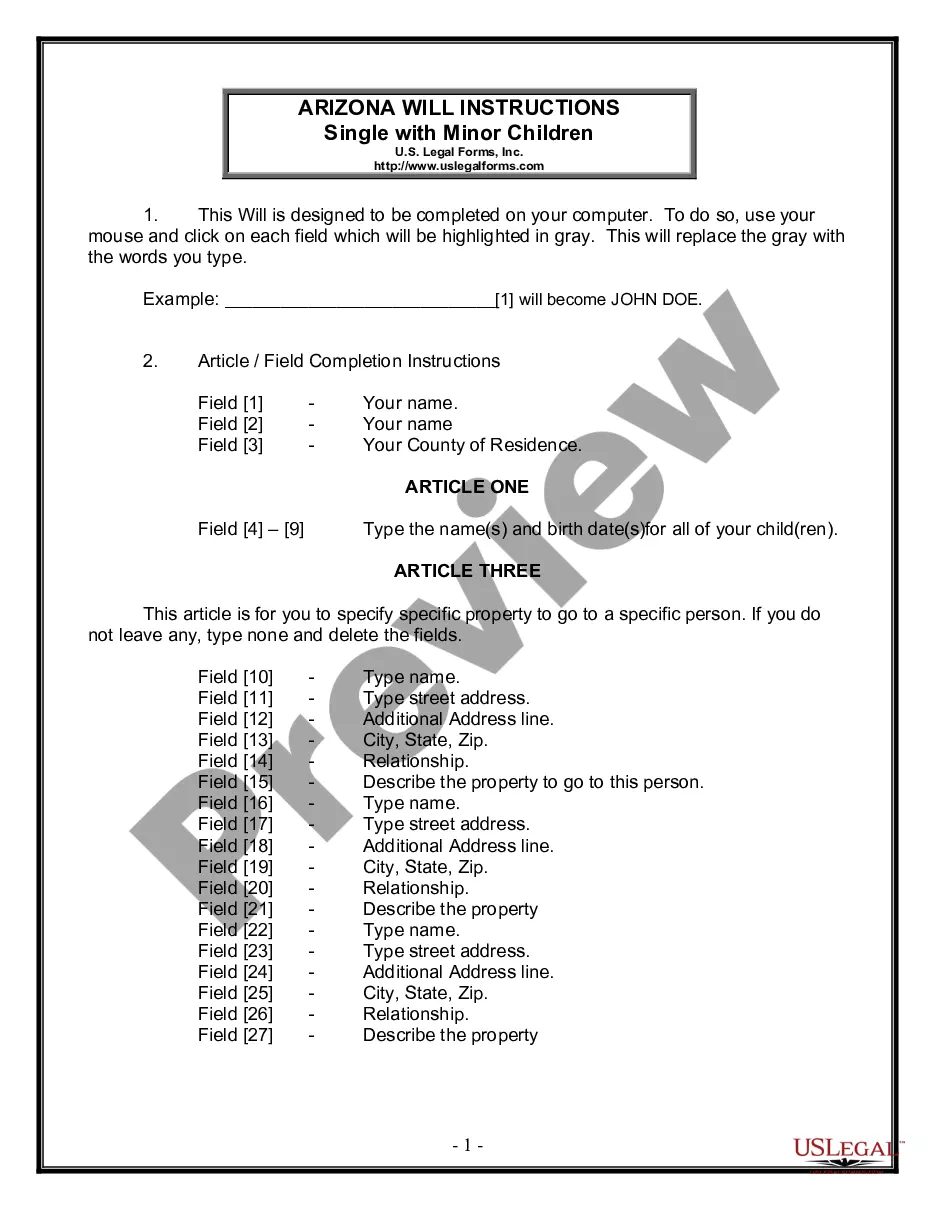

How to fill out Request For Disclosure Of Reasons For Increasing Charge For Credit Regarding Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

You are able to invest time on-line trying to find the legal file template that meets the federal and state requirements you require. US Legal Forms provides 1000s of legal types which are analyzed by experts. You can easily obtain or printing the Wyoming Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency from my services.

If you already have a US Legal Forms bank account, you are able to log in and click on the Obtain option. Afterward, you are able to complete, modify, printing, or indicator the Wyoming Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency. Every legal file template you buy is your own for a long time. To obtain another copy for any acquired form, check out the My Forms tab and click on the related option.

If you work with the US Legal Forms site for the first time, adhere to the easy guidelines beneath:

- Initial, make sure that you have selected the proper file template for your area/area of your liking. Read the form outline to ensure you have picked out the right form. If offered, take advantage of the Review option to check through the file template as well.

- If you want to get another variation in the form, take advantage of the Lookup industry to discover the template that meets your requirements and requirements.

- After you have located the template you desire, just click Acquire now to continue.

- Pick the pricing program you desire, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You may use your bank card or PayPal bank account to fund the legal form.

- Pick the format in the file and obtain it to the device.

- Make changes to the file if necessary. You are able to complete, modify and indicator and printing Wyoming Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Obtain and printing 1000s of file themes making use of the US Legal Forms Internet site, that provides the largest variety of legal types. Use professional and state-certain themes to tackle your organization or person requirements.

Form popularity

FAQ

Some examples of violations include: failing to report that a debt was discharged in bankruptcy. reporting old debts as new or re-aged. reporting an account as active when it was voluntarily closed by a consumer and.

Truth in Lending Act | Federal Trade Commission.

What do credit card providers look for in an application? Proof of your home address and how long you've been there. Your current work role and how long you've been in it (as proof you have a regular income) If you have a current account (and how long for) Your regular outgoings (such as monthly bills, etc)

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

Credit card disclosure must include a list of fees associated with your card. Some common credit card fees include annual fees, cash advance fees, foreign transaction fees, often called a "currency conversion" fee. Other fees include late payment fees, over-the-limit fees, and returned payment fees.

If a credit bureau's violations of the Fair Credit Reporting Act are deemed ?willful? (knowing or reckless) by a Court, consumers can recover damages ranging from $100 ? $1,000 for each violation of the FCRA.

A credit card application asks for personal information like your full name, home address, email address, date of birth, and Social Security number. Federal law requires credit card issuers to verify your identity before account opening with the personal information in your application.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Common violations of the FCRA include: Failure to update reports after completion of bankruptcy is just one example. Agencies might also report old debts as new and report a financial account as active when it was closed by the consumer. Creditors give reporting agencies inaccurate financial information about you.

Consumer reporting agencies may not report outdated negative information. In most cases, a consumer reporting agency may not report negative information that is more than seven years old, or bankruptcies that are more than 10 years old. Access to your file is limited.