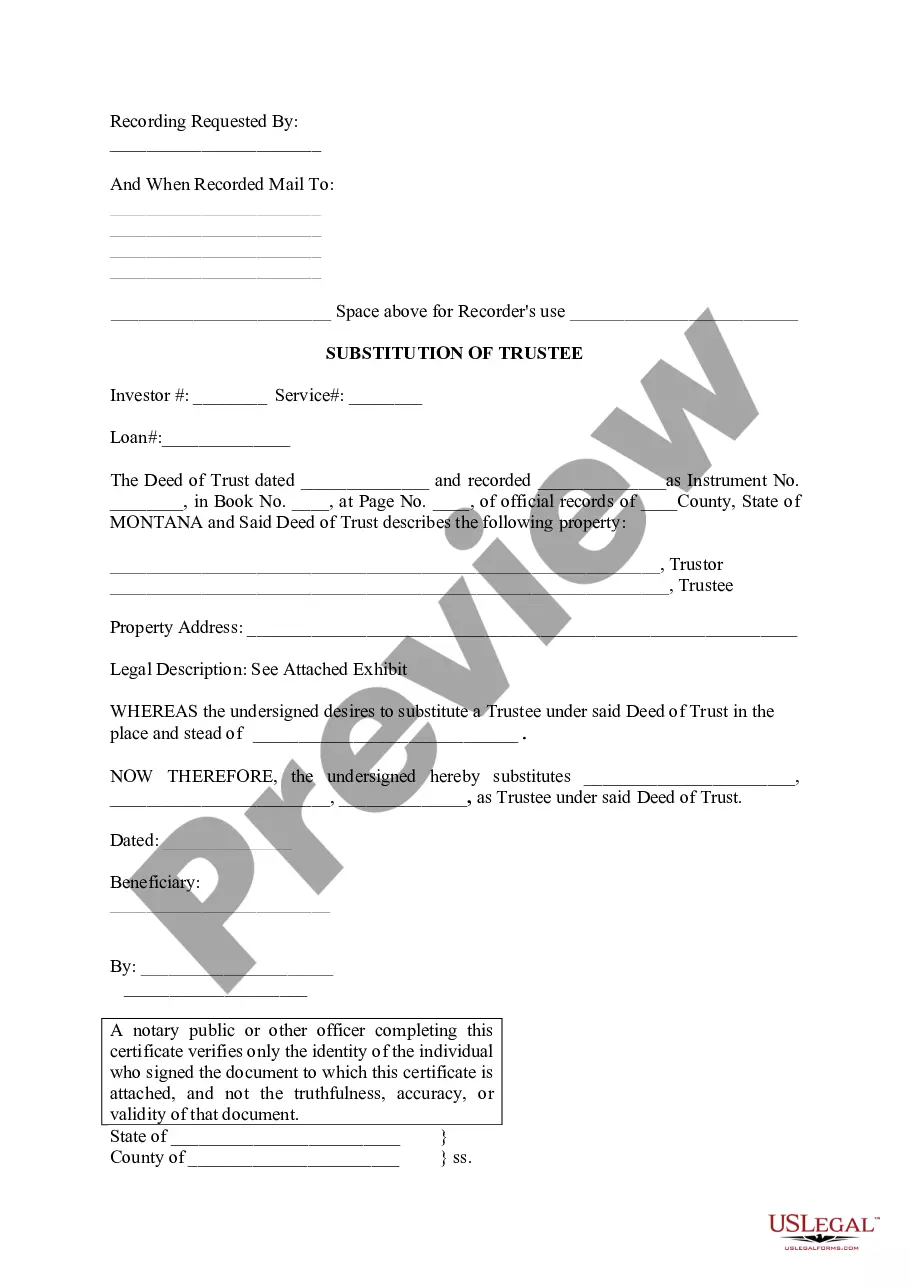

An agreement modifying a loan agreement and a deed of trust should be signed by both parties to the transaction and recorded in the office of the register of deeds and deeds of trust where the original deed of trust was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Wyoming Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate refers to a legal document that allows the borrower and lender to mutually agree on extending the term of a loan and adjusting the interest rate. This agreement is specifically applicable to properties located in Wyoming. The extension of the loan agreement refers to a situation where the borrower requires additional time to repay the loan beyond the originally agreed-upon maturity date. The lender, upon evaluating the borrower's financial situation, may grant an extension to provide the borrower with the necessary time to fulfill their repayment obligations. A deed of trust, on the other hand, is a legal instrument that secures the repayment of a loan using the property itself as collateral. It involves the transfer of the property's title to a neutral third party, known as the trustee, who holds the title until the loan is fully paid off. If the borrower defaults on the loan, the trustee has the power to sell the property and use the proceeds to repay the outstanding debt. In the context of a Wyoming Extension of Loan Agreement, the maturity date refers to the date on which the loan was initially scheduled to be repaid in full. The extension allows for modification of this date, giving the borrower more time. Furthermore, this particular agreement also involves an increase in the interest rate. This adjustment can be due to various reasons, such as changes in the market conditions, the borrower's creditworthiness, or the renegotiation of terms based on mutual agreement. The increased interest rate helps compensate the lender for the extended period during which they are not receiving the full loan payment. Different types of Wyoming Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate may include: 1. Single Extension: This type of extension involves granting a one-time extension to the borrower. The lender and borrower agree upon a new maturity date and an updated interest rate for the extended term. 2. Multiple Extensions: In some cases, borrowers may require multiple extensions over a longer period. This type of agreement allows for multiple extensions, each with its own adjusted maturity date and interest rate. The specific terms and conditions of each extension are typically outlined in the initial loan agreement. 3. Fixed Rate Extension: When extending the loan agreement, the lender and borrower may opt for a fixed interest rate. This means that the interest rate remains constant throughout the extended term, providing predictability for both parties. 4. Variable Rate Extension: Alternatively, the borrower and lender may agree on a variable interest rate for the extended term. In this case, the interest rate fluctuates based on a predetermined benchmark, such as the prime rate or the LIBOR (London Interbank Offered Rate). Overall, a Wyoming Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate allows borrowers in Wyoming to modify the repayment terms of their loan by extending the maturity date and adjusting the interest rate. The specific type and terms of the extension are determined through mutual agreement between the borrower and lender.