Wyoming Personal Services Partnership Agreement

Description

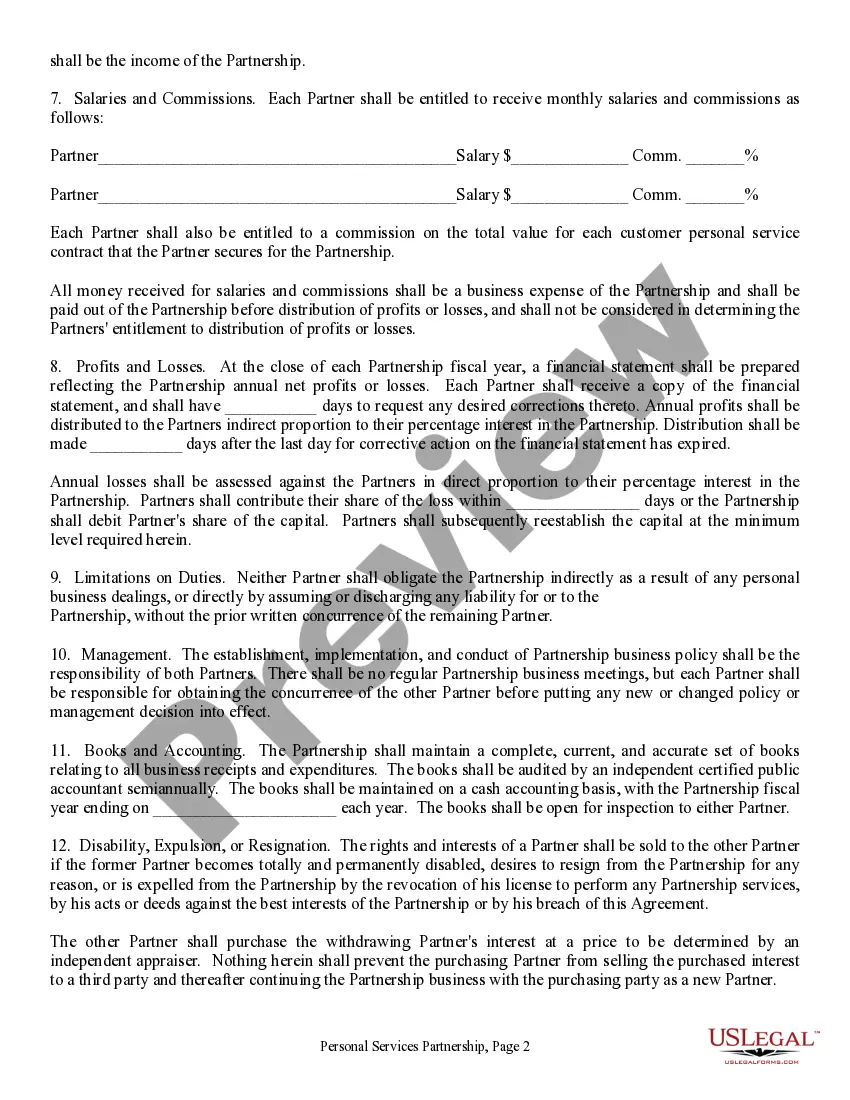

How to fill out Personal Services Partnership Agreement?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can discover thousands of forms for both business and personal use, categorized by types, states, or keywords. You can access the latest versions of forms such as the Wyoming Personal Services Partnership Agreement within moments.

If you already have a membership, Log In and obtain the Wyoming Personal Services Partnership Agreement from your US Legal Forms library. The Download option will appear on every form you view.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your selection by clicking on the Download now button. Then, choose the pricing plan you prefer and provide your information to create an account.

- You can access all previously downloaded forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to help you start.

- Ensure you have chosen the right form for your city/state.

- Click on the Preview option to review the content of the form.

- Read the form description to confirm you have selected the appropriate document.

Form popularity

FAQ

Filing a DBA, or 'Doing Business As,' in Wyoming involves a few straightforward steps. First, you need to select a unique name that complies with Wyoming naming laws. Then, complete the necessary application forms and submit them to the appropriate county clerk's office. If you plan to create a Wyoming Personal Services Partnership Agreement, using uslegalforms can simplify this process, ensuring that your filing is accurate and legally sound.

If your partnership has had no activity, you generally do not need to file a tax return in Wyoming. However, it is advisable to check with tax regulations or a tax professional to ensure complete compliance. Having a Wyoming Personal Services Partnership Agreement can help manage expectations regarding filing and activity levels among partners.

If your partnership generates income, you will need to file a partnership tax return for that income. Filing is essential for compliance with state laws and for reporting any profits, losses, or tax obligations. Having a strategic Wyoming Personal Services Partnership Agreement can help clarify these requirements for all partners involved.

To create a limited partnership in Wyoming, you need to file a Certificate of Limited Partnership with the Secretary of State. This document should detail the partnership’s name, the legal address, and the names of the general and limited partners. A well-drafted Wyoming Personal Services Partnership Agreement can also provide essential guidelines for managing your partnership effectively.

If your partnership earns income in Wyoming, then yes, you must file a tax return. Even if your business operates under a Wyoming Personal Services Partnership Agreement, you must adhere to the state's tax filing requirements. Proper filing ensures that you maintain compliance with state regulations.

Yes, Wyoming does require a partnership return for businesses operating within the state. This involves filing a form that reports the partnership’s income, deductions, and credits for the tax year. It is important for partnerships, including those under a Wyoming Personal Services Partnership Agreement, to comply with filing requirements to ensure legal standing and avoid penalties.

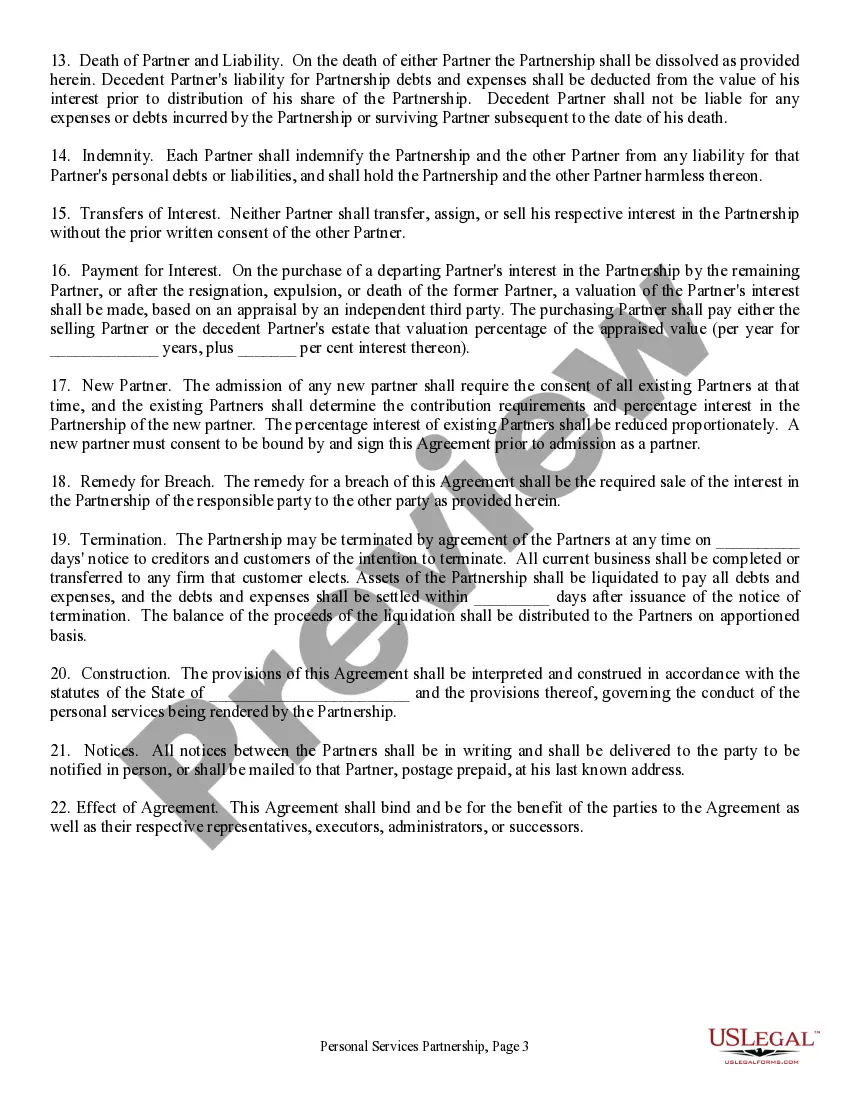

Filling out a partnership form for a Wyoming Personal Services Partnership Agreement involves providing basic information about the partnership and its partners. Begin with the partnership name and the contact details of each partner. Next, include provisions such as capital contributions, profit-sharing ratios, and management responsibilities. Once completed, make sure all partners review and sign the form for validity.

To fill out a Wyoming Personal Services Partnership Agreement, start by gathering essential information about all partners, including names and addresses. Clearly outline the purpose of the partnership and specify each partner's roles and responsibilities. Then, detail the distribution of profits and losses among partners. Finally, ensure everyone signs the agreement to make it legally binding.

While Wyoming does not legally require an operating agreement for partnerships, it is a best practice to have one. A Wyoming Personal Services Partnership Agreement outlines essential partnership regulations, promoting transparency and teamwork. This document is instrumental in guiding your partnership through various phases while safeguarding everyone's interests.

Yes, Wyoming allows single-member LLCs, providing flexibility for entrepreneurs. If you are considering forming a partnership, you might also explore the benefits of operating as a single-member LLC. Whether you choose a partnership or LLC, having a Wyoming Personal Services Partnership Agreement can ensure clarity and structure in your business dealings.