Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping

Description

How to fill out General Consultant Agreement To Advise Client On Accounting, Tax Matters, And Record Keeping?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal templates you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly find the latest versions of forms such as the Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping in mere seconds.

If you have a monthly subscription, Log In and download the Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit the downloaded Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping. Every form you upload to your account has no expiration date and is available to you indefinitely. To download or print another copy, simply go to the My documents section and click on the form you wish to access. Access the Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping with US Legal Forms, the most extensive repository of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have chosen the appropriate form for your city/state.

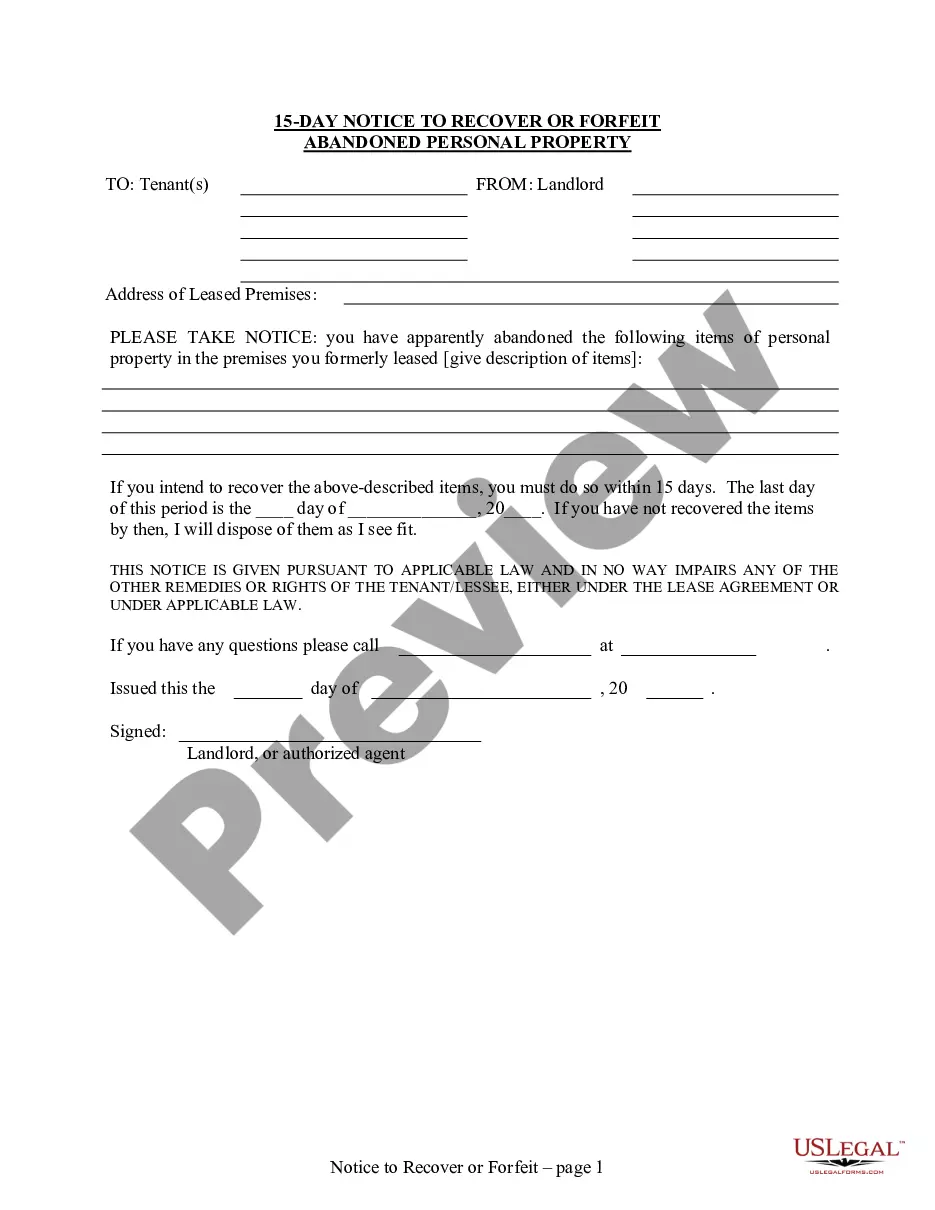

- Click the Preview button to review the content of the form.

- Examine the form description to confirm that you have selected the right form.

- If the form doesn't meet your needs, use the Search box at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Next, choose the pricing plan you prefer and provide your details to sign up for an account.

Form popularity

FAQ

A consulting agreement is a formal contract between a consultant and a client that defines the terms of service, payment, and responsibilities. This agreement protects both parties by outlining roles, deliverables, and legal obligations. For consultants working in fields such as accounting or tax advising, the Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping offers a structured format that addresses both compliance and client needs efficiently.

Begin a consultancy agreement by outlining the purpose of the agreement, followed by specifics about the services to be rendered. Clearly state payment terms, confidentiality requirements, and any obligations related to accounting and tax matters. Using resources such as the Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping will help you streamline this process while ensuring all necessary legalities are met.

To write a simple consulting agreement, start by clearly defining the services you intend to provide and the client's expectations. Include essential elements such as the scope of work, payment structure, and terms for termination. Utilizing a template like the Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can simplify this process, ensuring all key points are covered and meeting legal standards.

A consultancy agreement typically outlines the relationship between a consultant and a client, specifying services provided, payment terms, and duration of the engagement. For those looking specifically at the Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, it can include details about accounting responsibilities, timelines for reports, and compliance requirements. This document serves as a clear framework for both parties to ensure mutual understanding and expectations.

A contract for the provision of accounting services specifically details the accounting tasks to be performed, fees, and timelines for delivery. This type of agreement is critical for establishing a clear working relationship between the accountant and the business. By implementing a Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, you can ensure that your accounting needs are met professionally and comprehensively.

A contract for the provision of services outlines the specific tasks to be performed, the payment terms, and the obligations of both parties. It provides legal protection and sets expectations for the service provider and the client. Utilizing a Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can simplify this process, ensuring all necessary details are clearly communicated and agreed upon.

Having an accountant can significantly enhance your ability to make informed financial decisions. Accountants provide insights based on data analysis, helping you understand your financial position. A Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can facilitate this partnership and ensure you receive valuable guidance when managing your finances.

Yes, there are government contracts specifically for accounting services that grant businesses the opportunity to serve various public agencies. These contracts require compliance with certain regulations and standards, which can often be complex. Consulting a Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping can guide your understanding of these requirements and help you navigate the contracting process effectively.

An agreement in accounting outlines the roles, responsibilities, and expectations between parties involved in financial matters. It serves as a foundation for providing clarity and direction in the accounting process. Using a Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping ensures that both the consultant and client understand their obligations.

The contract for the provision of accounting services is a formal agreement that outlines the responsibilities, scope, and compensation for services rendered. This contract is crucial for setting clear expectations between the accountant and the client. Using a Wyoming General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping ensures that all parties understand their obligations, which fosters a successful working relationship.