Wyoming Business Management Consulting or Consultant Services Agreement — Self-Employed A Wyoming Business Management Consulting or Consultant Services Agreement — Self-Employed is a legally binding contract between a self-employed business management consultant and a client based in Wyoming. This agreement outlines the terms and conditions under which the consultant will provide their services to the client. Keywords: Wyoming, business management, consulting, consultant services agreement, self-employed In this agreement, the consultant offers their expertise, knowledge, and advice to assist the client in improving their business operations, strategy, and overall performance. The consultant may specialize in various areas such as finance, marketing, human resources, or operations, and will tailor their services to meet the specific needs of the client. The agreement typically covers important aspects, including project scope, duration, compensation, confidentiality, intellectual property rights, termination, and dispute resolution. These provisions ensure a clear understanding between the consultant and client, promoting a successful working relationship. Different types of Wyoming Business Management Consulting or Consultant Services Agreement — Self-Employed may include: 1. General Business Management Consulting Agreement: This type of agreement is suitable for consultants offering a wide range of business management services, such as strategic planning, organizational development, financial analysis, and process improvement. 2. Financial Consulting Agreement: Designed for consultants specializing in providing financial advice, this agreement focuses on areas like financial planning, forecasting, budgeting, and investment analysis. 3. Marketing Consulting Agreement: Tailored for consultants who excel in marketing and advertising, this agreement outlines the services related to market research, brand development, digital marketing strategies, and campaign management. 4. Human Resources Consulting Agreement: Geared towards consultants with expertise in human resources, this agreement encompasses services like recruitment, employee training and development, performance management, and compliance with labor laws. 5. Operations Consulting Agreement: This type of agreement suits consultants specializing in operational efficiency, supply chain management, inventory control, process optimization, and quality management systems. It's crucial for both parties to carefully review and negotiate the terms of the agreement before signing it. Consulting agreements provide a clear framework for the engagement, protecting the interests of both the consultant and the client. Consulting agreements can be an essential tool in building successful business relationships and achieving mutual goals.

Wyoming Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

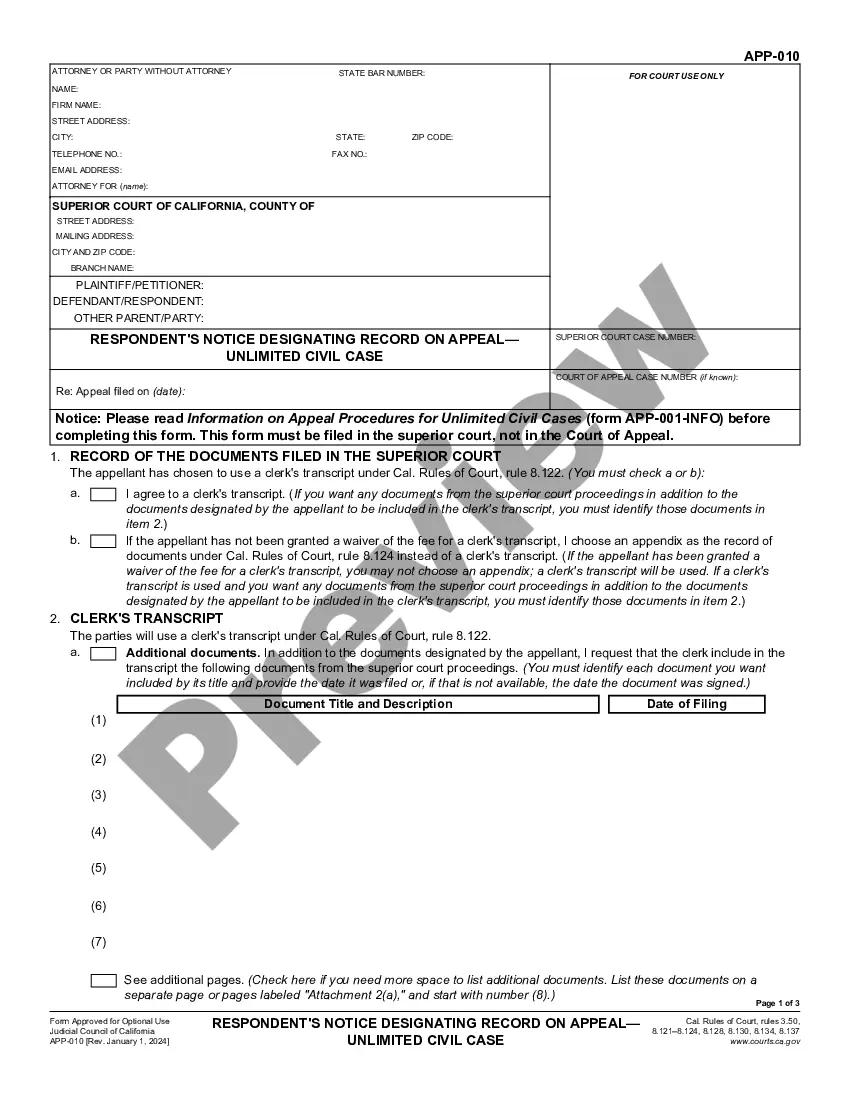

How to fill out Wyoming Business Management Consulting Or Consultant Services Agreement - Self-Employed?

US Legal Forms - among the largest libraries of legitimate varieties in the USA - provides a wide range of legitimate record layouts you are able to download or produce. Utilizing the site, you can get 1000s of varieties for company and specific uses, categorized by groups, says, or keywords.You will discover the most up-to-date types of varieties such as the Wyoming Business Management Consulting or Consultant Services Agreement - Self-Employed in seconds.

If you already possess a monthly subscription, log in and download Wyoming Business Management Consulting or Consultant Services Agreement - Self-Employed from the US Legal Forms library. The Obtain switch will show up on every develop you look at. You get access to all formerly acquired varieties inside the My Forms tab of your own accounts.

If you would like use US Legal Forms the first time, allow me to share straightforward directions to get you started:

- Be sure you have picked the proper develop to your city/area. Click on the Review switch to review the form`s content. Look at the develop information to ensure that you have chosen the correct develop.

- If the develop doesn`t satisfy your demands, use the Look for discipline towards the top of the screen to discover the one that does.

- Should you be satisfied with the form, confirm your choice by visiting the Get now switch. Then, opt for the rates strategy you favor and supply your credentials to sign up to have an accounts.

- Approach the deal. Use your bank card or PayPal accounts to accomplish the deal.

- Pick the formatting and download the form on your own system.

- Make alterations. Load, edit and produce and indication the acquired Wyoming Business Management Consulting or Consultant Services Agreement - Self-Employed.

Every web template you included in your account does not have an expiration day and is your own for a long time. So, if you would like download or produce yet another copy, just proceed to the My Forms portion and then click around the develop you will need.

Obtain access to the Wyoming Business Management Consulting or Consultant Services Agreement - Self-Employed with US Legal Forms, the most considerable library of legitimate record layouts. Use 1000s of expert and state-distinct layouts that meet your business or specific requirements and demands.

Form popularity

FAQ

A consulting services agreement is a formal contract that outlines the terms and conditions between a consultant and a client. This document specifies the scope of services, fees, and expectations for both parties involved. For Wyoming Business Management Consulting, having a clear Consultant Services Agreement can prevent misunderstandings and protect your interests while fostering a professional relationship.

Forming an LLC for your consulting business offers liability protection and can enhance your professional image. It separates your personal assets from your business, reducing personal risk. If you are considering entering into Wyoming Business Management Consulting or a Consultant Services Agreement - Self-Employed, establishing an LLC can provide both flexibility and security in your business operations.

While not always necessary, obtaining an Employer Identification Number (EIN) for your consulting business can be beneficial. An EIN is helpful for opening a business bank account, hiring employees, or if you plan to file certain tax forms. If you engage in Wyoming Business Management Consulting or have a Consultant Services Agreement - Self-Employed, having an EIN simplifies your financial activities.

Generally, you do not need to file a Wyoming state tax return for an LLC, as Wyoming does not impose a state income tax. However, if your business operates in other states or engages in specific business activities, you might need to check other tax obligations. Understanding your tax responsibilities in Wyoming, especially when dealing with Wyoming Business Management Consulting or a Consultant Services Agreement - Self-Employed, is essential for your business health.

Yes, regardless of your state, you may need to file a federal tax return if your LLC has any income. If you choose to treat your LLC as a sole proprietorship, you can report income and expenses on your personal tax return. Engaging in Wyoming Business Management Consulting or establishing a Consultant Services Agreement - Self-Employed can affect how you report your earnings, so it’s wise to stay informed.

A Wyoming LLC typically does not need to file a state tax return, which is one of its many advantages. However, if your LLC is taxed as a corporation, you may need to file a federal return. For those engaging in Wyoming Business Management Consulting or entering into a Consultant Services Agreement - Self-Employed, understanding these requirements can help you manage your tax obligations effectively.

Yes, a business consultant typically operates as a self-employed individual, offering expert guidance on various business matters. This self-employment status allows for flexibility in choosing projects and setting rates. When engaging in Wyoming Business Management Consulting or Consultant Services Agreement - Self-Employed, it is crucial to draft agreements that outline your terms clearly, ensuring smooth transactions and fostering professional relationships.

Writing a simple consulting agreement involves outlining the scope of services, fees, and timelines. Start by including the names of both parties and a clear description of the consulting services you will provide. Using a template for a Wyoming Business Management Consulting or Consultant Services Agreement - Self-Employed can streamline this process, ensuring you cover important legal aspects and protect both parties.

Setting up an LLC for your consulting business can provide personal liability protection and tax benefits. This structure separates your personal assets from your business liabilities, which is especially important in Wyoming Business Management Consulting or Consultant Services Agreement - Self-Employed. Additionally, an LLC simplifies the process of filing taxes and enhances your credibility with clients.

To become a self-employed consultant, start by identifying your niche and target market. Build a strong portfolio to showcase your expertise and network with potential clients. Once you have clients lined up, formalize your agreements using a Consultant Services Agreement - Self-Employed. This will clarify roles and protect both you and your clients, ensuring smooth business transactions.

More info

The individual will report to the CEO of Poll Loco, and may be a co-Owner of the company. The individual's primary duties will be to provide strategic advice and guidance to Poll Loco's management of their growing startup. In this role, the individual will provide strategic advice and guidance to Poll Loco's management of their growing startup. The individual will have the opportunity to receive equity. The ideal candidate will have experience with blockchain software, blockchain platforms, cryptocurrency, distributed ledger, smart contracts, and blockchain/distributed ledger technology, as well as blockchain application and infrastructure. Responsibilities: 1. Work as an integral component of Poll Loco's growth and development team within the development team. 2. Have extensive knowledge of blockchain software, blockchain platforms, cryptocurrency, distributed ledger, smart contracts, and blockchain/distributed ledger technology. 3.