A Wyoming Simple Promissory Note for Family Loan refers to a legally binding document that outlines the terms and conditions of a loan agreement between family members in the state of Wyoming. This type of promissory note is commonly used when a family member borrows money from another family member and wishes to establish clear repayment terms. The Wyoming Simple Promissory Note for Family Loan serves several important purposes. First and foremost, it acts as evidence of the loan agreement, ensuring that both the lender and the borrower are protected legally. It sets out the rights and obligations of both parties involved, minimizing potential conflicts or misunderstandings in the future. The key elements typically included in a Wyoming Simple Promissory Note for Family Loan are as follows: 1. Date: The date on which the promissory note is executed. 2. Names of Parties: The full names and addresses of the lender (also known as the "payee") and the borrower (also known as the "maker"). 3. Loan Amount: The exact amount of money being lent, stated both numerically and in words. 4. Interest Rate: If applicable, the agreed-upon interest rate charged on the loan amount. 5. Payment Terms: Details regarding the repayment schedule, including the frequency of payments, due dates, and any late payment penalties or grace periods. 6. Security or Collateral: Whether any collateral or security is provided by the borrower to secure the loan, such as property or assets. 7. Default Terms: Outlining the consequences if the borrower fails to make payments as agreed, including possible legal actions or additional interest charges. 8. Governing Law: Specifying that the laws of the state of Wyoming govern the promissory note. 9. Signatures: The signatures of both the lender and the borrower, along with the date on which they signed the document. While the term "Wyoming Simple Promissory Note for Family Loan" can be used broadly, there may not be specific subtypes of this promissory note within Wyoming law. However, it is crucial to consult with an attorney or legal professional to ensure compliance with all relevant regulations and to adapt the promissory note to any unique circumstances. In summary, a Wyoming Simple Promissory Note for Family Loan serves as a legally binding contract that regulates a loan agreement between family members. It provides clarity and protection to both parties and establishes the terms and conditions for repayment of the loan.

Wyoming Simple Promissory Note for Family Loan

Description

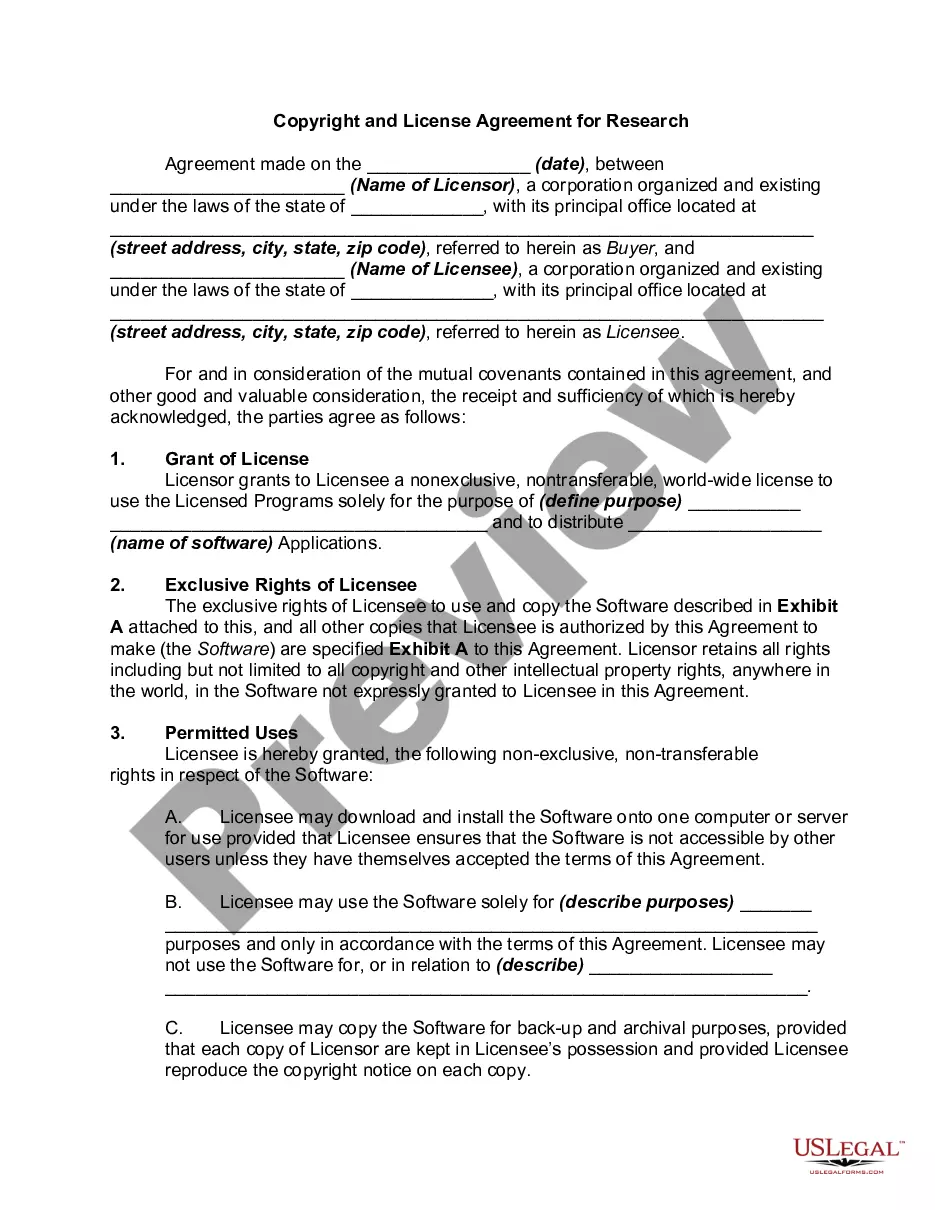

How to fill out Wyoming Simple Promissory Note For Family Loan?

If you wish to complete, obtain, or print out legitimate record themes, use US Legal Forms, the greatest selection of legitimate kinds, which can be found online. Make use of the site`s easy and hassle-free research to get the documents you require. Numerous themes for company and specific reasons are sorted by groups and states, or search phrases. Use US Legal Forms to get the Wyoming Simple Promissory Note for Family Loan in just a handful of clicks.

If you are already a US Legal Forms buyer, log in in your account and click the Obtain switch to obtain the Wyoming Simple Promissory Note for Family Loan. You can also access kinds you earlier downloaded inside the My Forms tab of your respective account.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for that correct city/region.

- Step 2. Utilize the Review option to look through the form`s content. Don`t forget to read through the description.

- Step 3. If you are unsatisfied using the develop, utilize the Search industry near the top of the display screen to locate other variations of your legitimate develop web template.

- Step 4. When you have located the shape you require, click the Purchase now switch. Choose the pricing strategy you prefer and add your credentials to register for an account.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal account to complete the financial transaction.

- Step 6. Select the file format of your legitimate develop and obtain it on your own gadget.

- Step 7. Comprehensive, revise and print out or indication the Wyoming Simple Promissory Note for Family Loan.

Every legitimate record web template you purchase is yours forever. You might have acces to each develop you downloaded within your acccount. Click on the My Forms area and select a develop to print out or obtain again.

Contend and obtain, and print out the Wyoming Simple Promissory Note for Family Loan with US Legal Forms. There are millions of expert and state-distinct kinds you may use for your company or specific needs.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Pros. Easier approval: There's typically no formal application process, credit check or verification of income when you're borrowing from family. Traditional lenders often require documents such as W-2s, pay stubs and tax forms as part of the loan application process.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

The name and address of the person loaning the money. The name and address of the person borrowing the money. Terms of repayment: schedule of repayment, amount of each payment and manner of payments (in-person, cash, check, etc.) Interest to be charged related to the loan, if any.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

More info

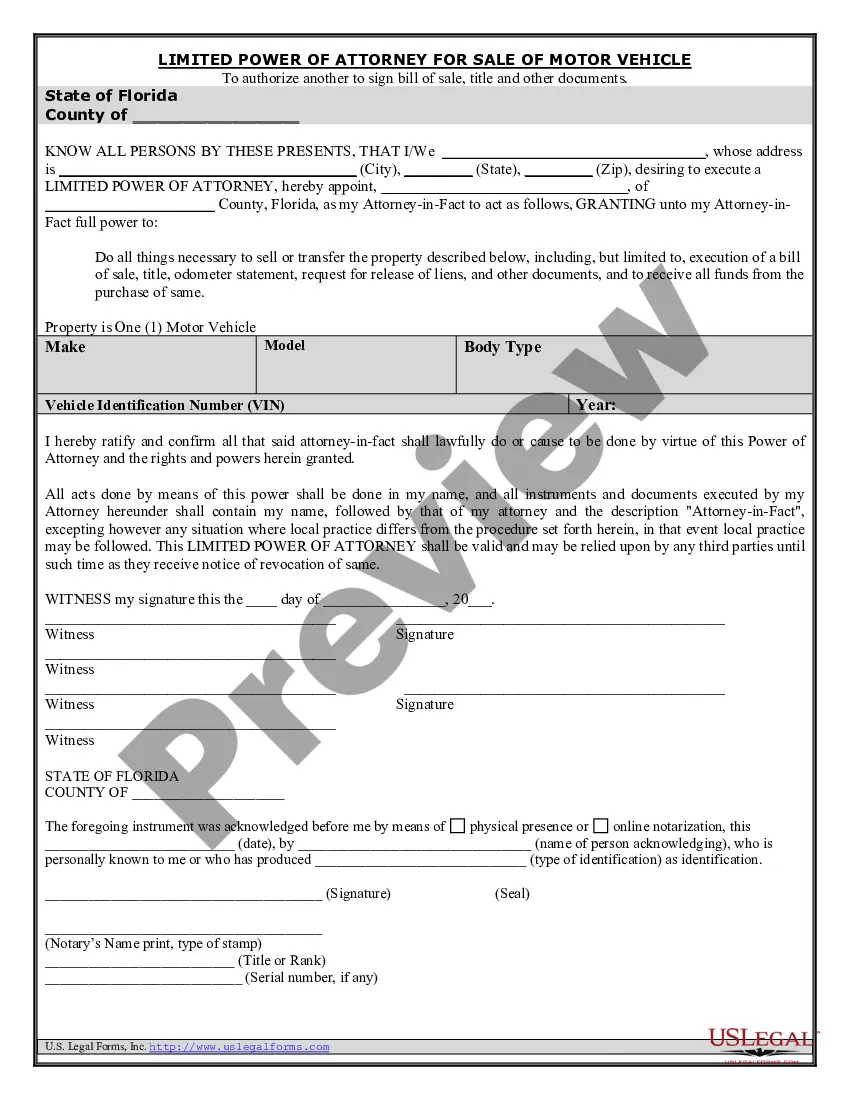

Over One Power of Attorney Last Will Testament Living Will Health Care Directive Revocable Save.