Wyoming Security Agreement Regarding Aircraft and Equipment

Description

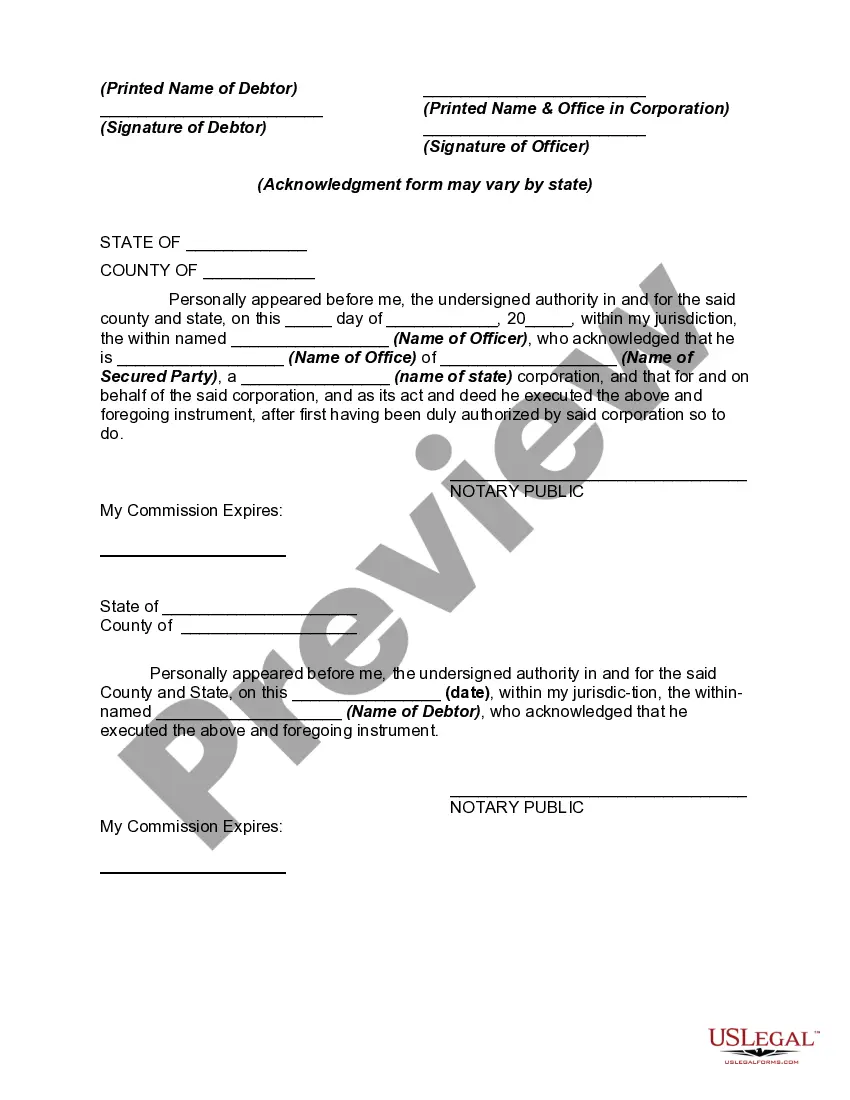

Until a conveyance, lease, or instrument executed for security purposes which may be recorded under ??? 44107(a)(1) or (2) has been filed with the FAA, it is valid only against the parties to the instrument and individuals and entities who have actual knowledge of the instrument. Therefore, the interests of the parties to a transaction, including purchasers, lessor, lessees and secured parties, are not perfected until the instruments creating those interests have been filed with the FAA.

How to fill out Security Agreement Regarding Aircraft And Equipment?

Selecting the appropriate official documents format can be a challenge.

Naturally, there are numerous templates accessible online, but how can you locate the official version you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Wyoming Security Agreement Regarding Aircraft and Equipment, suitable for business and personal needs.

You can examine the document using the Preview option and review the document details to ensure it is the correct one for you.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Acquire button to obtain the Wyoming Security Agreement Regarding Aircraft and Equipment.

- Use your account to search through the official forms you have previously purchased.

- Go to the My documents tab of your account and retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct form for your city/state.

Form popularity

FAQ

Several key documents are essential for any aircraft, including the aircraft's registration certificate, airworthiness certificate, and operating limitations. Additional paperwork, like maintenance records and a Wyoming Security Agreement Regarding Aircraft and Equipment, may also be necessary, especially for financing arrangements. To ensure compliance with aviation regulations, always consult legal resources, such as those available at US Legal Forms.

An aircraft security agreement is a legal document that establishes a lender's security interest in an aircraft or related equipment. This agreement protects the lender’s investment by ensuring they can reclaim the asset in case of default. When dealing with financing or leasing, having a Wyoming Security Agreement Regarding Aircraft and Equipment is crucial to safeguarding your interests. For drafting this agreement, US Legal Forms offers resources tailored to your needs.

To transfer ownership of an aircraft, you need to execute a bill of sale that clearly states the transaction details. After completing this document, file it along with the Application for Aircraft Registration with the FAA. If your ownership involves financing, incorporating a Wyoming Security Agreement Regarding Aircraft and Equipment can provide clarity and security during the transfer. This step ensures that all parties understand their rights and obligations related to the aircraft.

To legally operate an aircraft in the United States, you must have a valid airworthiness certificate and a registration certificate onboard. The airworthiness certificate proves that the aircraft meets safety standards, while the registration certificate confirms ownership. Additionally, understanding the Wyoming Security Agreement Regarding Aircraft and Equipment is crucial for protecting your rights and interests related to the aircraft. For comprehensive assistance with these documents, consider using USLegalForms, which can help you navigate through the necessary legal paperwork.

To obtain a letter of authorization for a Minimum Equipment List (MEL), an aircraft operator must submit a request to the FAA, demonstrating compliance with safety and regulatory standards. This process involves detailed documentation and approvals, ensuring that the aircraft is in compliance with necessary regulations. Utilizing a Wyoming Security Agreement Regarding Aircraft and Equipment can enhance your operations by providing a solid legal foundation.

A mortgage specifically pertains to real estate and grants the lender the right to take ownership if the borrower defaults. In contrast, a security agreement can apply to various types of collateral, including aircraft and equipment. When dealing with aircraft, a Wyoming Security Agreement Regarding Aircraft and Equipment is the relevant document to secure your interests.

While a security agreement and a lien both deal with securing debts, they are not the same. A lien is a legal claim against an asset, while a security agreement is a contract detailing the terms of that claim. Recognizing this difference is vital when drafting a Wyoming Security Agreement Regarding Aircraft and Equipment.

The purpose of a security agreement is to establish a legal framework that secures a lender's interest in a borrower’s collateral. This document specifies the terms, obligations, and rights of both parties. By outlining these elements, a Wyoming Security Agreement Regarding Aircraft and Equipment can effectively protect your assets.

A pledge agreement involves the transfer of personal property as collateral, while a security agreement serves as a contract outlining the terms of securing a debtor's obligation. Both relate to securing loans but differ in their execution and collateral type. Understanding these distinctions can help you appropriately utilize a Wyoming Security Agreement Regarding Aircraft and Equipment.

Proof of ownership of an aircraft typically includes various documents that establish legal title. These documents can range from a bill of sale to a registration certificate. It is crucial to maintain these records, especially when considering a Wyoming Security Agreement Regarding Aircraft and Equipment to ensure clarity of ownership and compliance.