An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

Wyoming Marital Deduction Trust - Trust A and Bypass Trust B

Description

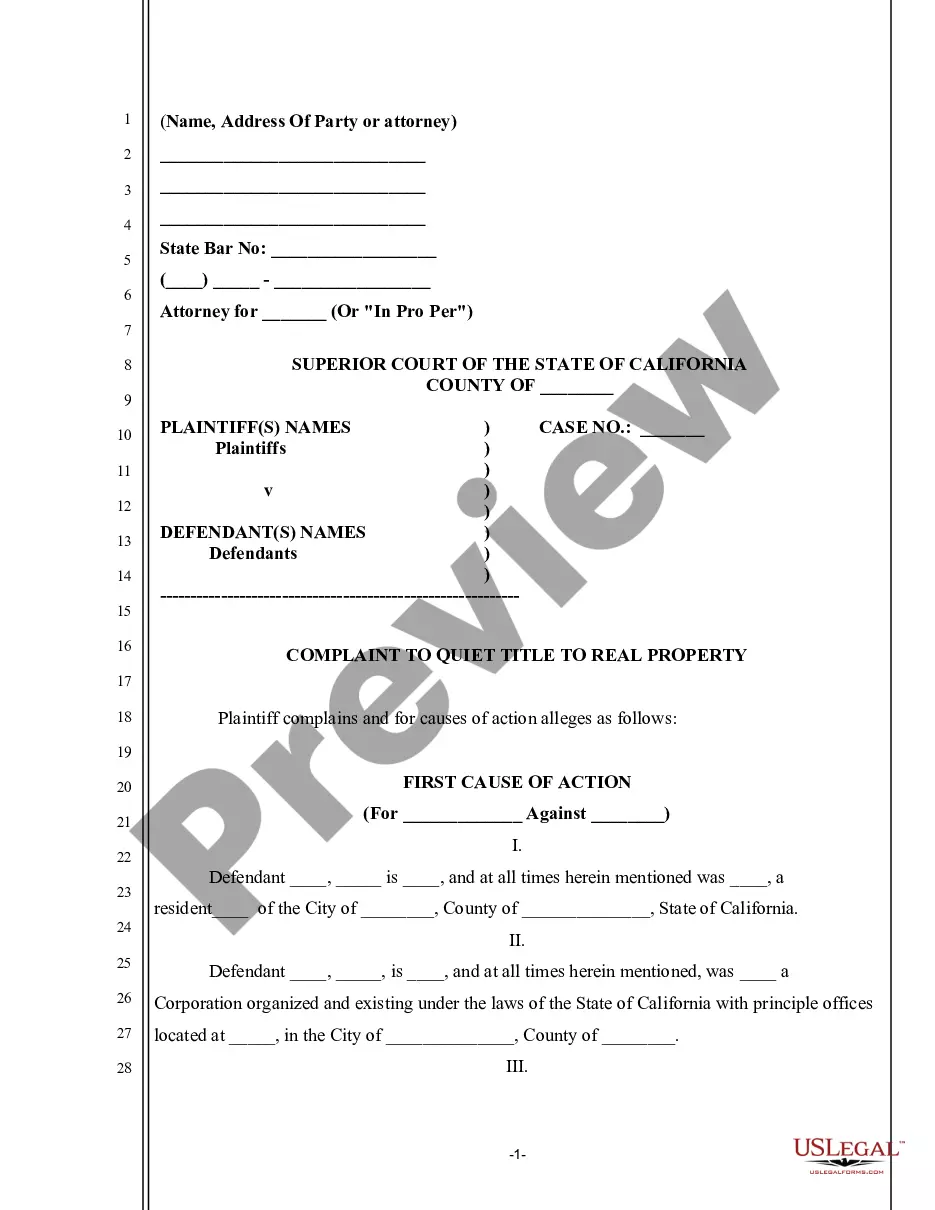

How to fill out Marital Deduction Trust - Trust A And Bypass Trust B?

You have the capability to allocate time on the internet searching for the valid document template that meets the federal and state requirements you require.

US Legal Forms offers thousands of valid templates that have been reviewed by experts.

You can obtain or print the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B through my assistance.

If available, utilize the Review option to examine the document template as well.

- If you currently have a US Legal Forms account, you can Log In and select the Download option.

- Then, you can fill out, modify, print, or sign the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B.

- Every valid document template you buy is yours forever.

- To obtain another copy of any purchased form, go to the My documents section and select the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the appropriate document template for your state/city of choice.

- Review the document description to confirm you have chosen the correct form.

Form popularity

FAQ

The primary difference lies in how they distribute assets upon the death of the grantor. A bypass trust allows for assets to bypass the surviving spouse's estate and avoid estate taxes, while a QTIP trust provides the spouse with income during their lifetime. Understanding these distinctions can help you decide between options like the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B.

Yes, trusts generally need to file annual tax returns, particularly if they earn income. This process enables the IRS to track the income generated by the trust and ensure that taxes are appropriately accounted for. Understanding this obligation is critical when managing a Wyoming Marital Deduction Trust - Trust A and Bypass Trust B.

Yes, a bypass trust is required to file its own tax return. This is usually done using IRS Form 1041. Proper filing ensures that the income from the trust is correctly reported, which is fundamental for beneficiaries and aligns with the intricacies of the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B.

A trust can qualify for the marital deduction if it meets certain conditions. Generally, if the trust provides for the surviving spouse in a manner that aligns with IRS guidelines, it qualifies. It’s essential to understand how the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B interacts with these requirements for optimal estate planning.

Yes, income generated from a bypass trust is typically taxable. When the trust earns income, it is reported on the trust's tax return. While the beneficiaries may also report this income on their own tax returns, this is a key aspect of understanding the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B.

A bypass trust can be an excellent strategy for those seeking to minimize estate taxes and provide for their loved ones. By ensuring that your assets pass outside the estate of the surviving spouse, you create a lasting financial legacy. Evaluating your specific situation with the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B can highlight the advantages and potential drawbacks. Always consult with a professional to make the best decision for your estate plan.

Setting up a bypass trust typically involves drafting a trust document and deciding which assets to place into the trust. You must also designate a trustee to manage the trust and its assets according to your wishes. Utilizing the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B is an effective strategy for bypass trusts, ensuring the assets are handled appropriately. Working with a legal professional can streamline this process for you.

Income generated by a bypass trust is generally taxed to the trust itself, rather than the beneficiaries. This means the trust can retain more earnings, allowing it to grow over time. However, it's essential to consider how these tax implications affect your overall estate plan when utilizing the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B. Consulting with a tax professional can provide further clarity on this.

Although a marital trust and a bypass trust serve different purposes, they are complementary in estate planning. A marital trust allows the surviving spouse to benefit from the trust assets, while a bypass trust protects those assets from estate taxes after the death of the first spouse. Understanding the differences between these trusts can help you effectively utilize the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B in your financial plan.

Creating a bypass trust involves drafting a trust document that designates the assets intended for the trust. Upon the death of the first spouse, assets are transferred into the trust, which can help reduce estate taxes for the surviving spouse. This trust is often part of an overall estate plan that integrates the Wyoming Marital Deduction Trust - Trust A and Bypass Trust B. Engaging with a qualified legal professional can help ensure the trust is set up correctly.