Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to

Description

How to fill out Revocable Trust Agreement With Husband And Wife As Trustors And Income To?

Are you in a circumstance where you require documents for either commercial or particular reasons nearly every day? There are numerous legitimate document templates available online, but finding reliable versions isn't easy.

US Legal Forms provides thousands of templates, including the Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to, which are crafted to comply with federal and state regulations.

If you are currently acquainted with the US Legal Forms platform and possess an account, simply Log In. After that, you can download the Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to template.

- Select the template you require and ensure it corresponds to the correct city/state.

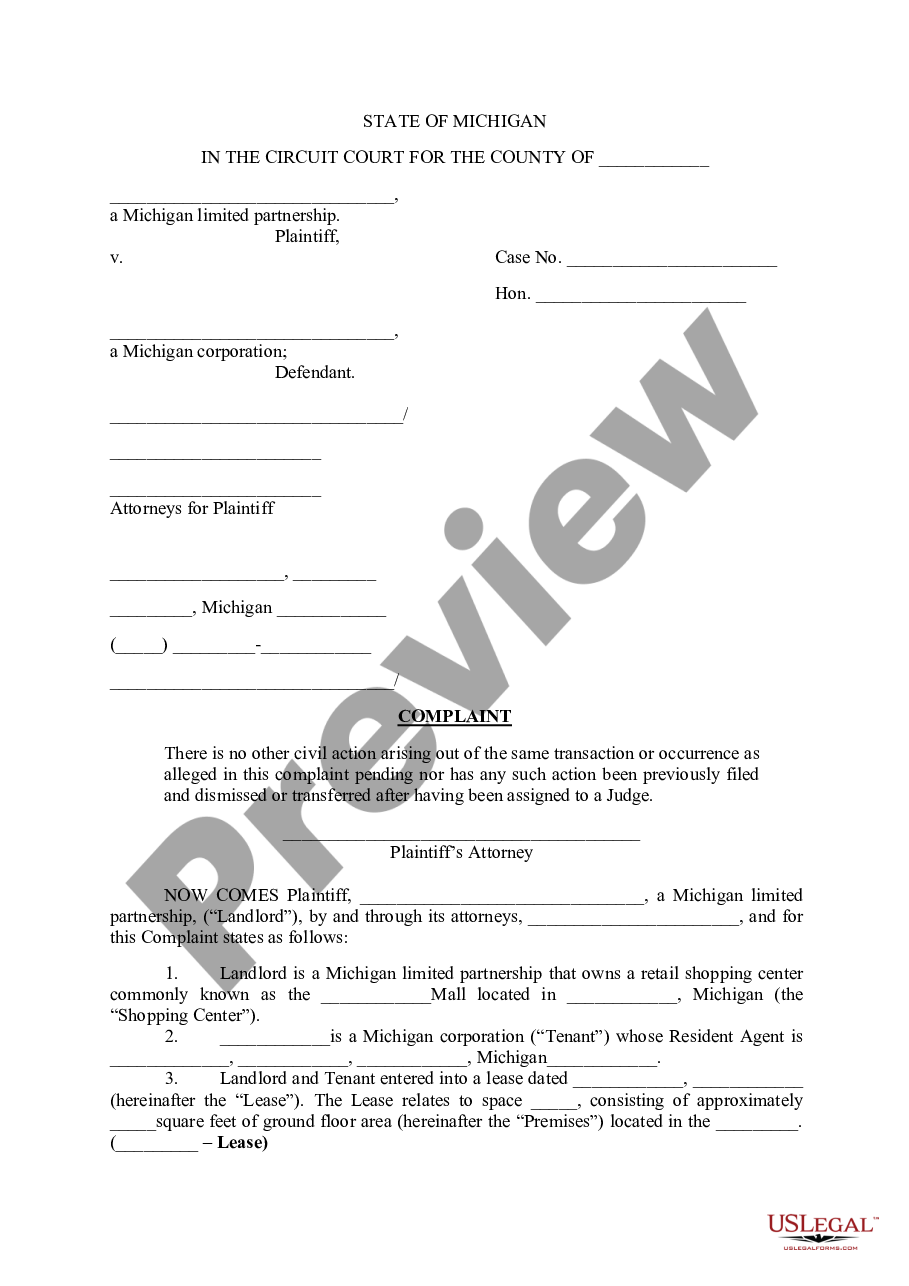

- Utilize the Preview button to review the document.

- Examine the details to confirm you have selected the right template.

- If the template isn't what you need, use the Search field to find one that fits your needs and requirements.

- Once you have acquired the correct template, click Purchase now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and place the order using PayPal or a Visa or Mastercard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

Suze Orman emphasizes the importance of revocable trusts as tools for estate planning. She highlights that revocable trusts can help avoid probate, ensuring a smoother transfer of assets upon death. Orman also notes that these trusts offer flexibility and control over your assets while you're alive, making them an ideal option like a Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to. Utilizing professional services like uslegalforms can simplify the process.

Yes, income generated from a marital trust is typically taxable to the grantors or beneficiaries. This income must be reported on personal tax returns, affecting the overall tax situation of the couple. Understanding the tax implications is vital when setting up a Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to. Consulting with a tax professional can help you navigate these complexities.

A joint revocable trust might limit flexibility for individual beneficiaries and complicate matters if a spouse passes away. With both partners as trustors, it may be challenging to handle changes in circumstances without the consent of both parties. Additionally, it could create issues in management if there are disagreements between spouses. Evaluating these factors is essential when considering a Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to.

Husband and wife can choose to create separate revocable trusts or a joint trust. Separate trusts may offer more control over individual assets and can simplify estate planning in certain situations. However, a joint revocable trust can streamline the management of shared assets and provide a clear plan for both partners. Ultimately, the choice should reflect your specific financial goals and family dynamics.

A trust, such as the Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to, allows married couples to pool their assets and manage them collectively. Each spouse typically holds equal rights over the trust, which makes decision-making easier. This arrangement simplifies asset distribution and helps ensure that both partners' wishes are honored in the event of illness or death. Overall, it serves as a proactive financial planning tool.

The Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to is often considered one of the best types of trusts for married couples. It offers flexibility, allowing both spouses to make changes, revoke, or dissolve the trust as needed. This trust also enables the couple to manage their assets together while ensuring a smooth transition for beneficiaries after death, providing peace of mind.

Wyoming does not impose a state income tax on trusts, making it an appealing option for a Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to. This means that any income generated by the trust is not taxed at the state level, which can enhance the couple’s overall tax efficiency. By establishing a trust in Wyoming, couples can retain more income for their benefit and enjoy long-term financial advantages.

A joint revocable trust, like the Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to, typically does not face separate taxation. Instead, the income generated by the trust is reported on the personal tax returns of both trustors. This means the couple must report any earnings, such as dividends or rent, on their individual tax returns. Effectively, this can simplify tax filings since the couple can combine income and deductions.

One major downfall of having a trust is the misconception that it easily avoids all legal challenges or disputes. In reality, a Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to can still be contested by disgruntled heirs or family members. Furthermore, trusts generally require regular maintenance and updates, which can become burdensome if not managed properly.

A potential disadvantage of a family trust is the complexity involved in managing it, especially during changes in family dynamics. While a Wyoming Revocable Trust Agreement with Husband and Wife as Trustors and Income to facilitates asset distribution, it still requires ongoing oversight. Additionally, complications can arise if not all family members understand the trust's terms and their implications.