Wyoming Angel Investor Agreement: A Comprehensive Guide In the realm of startup financing, angel investors play a crucial role in providing early-stage funding to entrepreneurs and small businesses with high growth potential. Angel investor agreements are legal contracts that outline the terms and conditions of this investment relationship, ensuring the rights, obligations, and expectations of both the investor and the recipient company are properly addressed. Within the state of Wyoming, there are various types of angel investor agreements available. Each agreement type may have specific focuses or clauses designed to cater to unique business requirements or investment preferences. Let's explore some common types of Wyoming Angel Investor Agreements: 1. Convertible Note Agreement: This type of agreement is often used in early-stage financing rounds, where the investor provides capital to the business in the form of a loan that can later convert into equity. The terms of conversion, interest rates, and maturity dates are typically specified in this agreement. 2. Equity Financing Agreement: In this agreement, the angel investor directly purchases equity shares of the company in exchange for their investment. The agreement usually outlines the percentage of ownership, voting rights, and any protective provisions that the investor may have. 3. SAFE (Simple Agreement for Future Equity): This relatively newer type of agreement is gaining popularity in startup ecosystems. It allows investors to provide funding in exchange for the right to obtain equity in subsequent funding rounds. The terms regarding conversion, valuation caps, and discount rates are typically defined in the agreement. 4. Stock Purchase Agreement: This agreement is commonly utilized when an angel investor wishes to purchase existing shares directly from the company or its founders. The agreement would specify the number of shares, purchase price, and any conditions or restrictions associated with the transaction. 5. Restrictive Covenant Agreement: Sometimes, angel investors may require entrepreneurs to sign a separate agreement that includes restrictive covenants, such as non-compete or non-disclosure clauses. These clauses aim to protect the investor's investment by preventing the entrepreneur from engaging in activities that may harm the company or provide sensitive information to competitors. 6. Voting Agreement: In certain scenarios, angel investors may request a separate voting agreement to secure their influence over significant company decisions. This agreement typically designates the voting rights and procedures, granting the investor the ability to influence the board of directors and key corporate matters. It is important to note that the specific terms and conditions of Wyoming Angel Investor Agreements may vary based on the individual investor's preferences, the business's unique circumstances, and the negotiation between parties. Seeking legal advice from an attorney experienced in startup financing is highly recommended ensuring compliance with Wyoming laws and regulations while tailoring the agreement to meet the needs of all involved parties.

Wyoming Angel Investor Agreement

Description

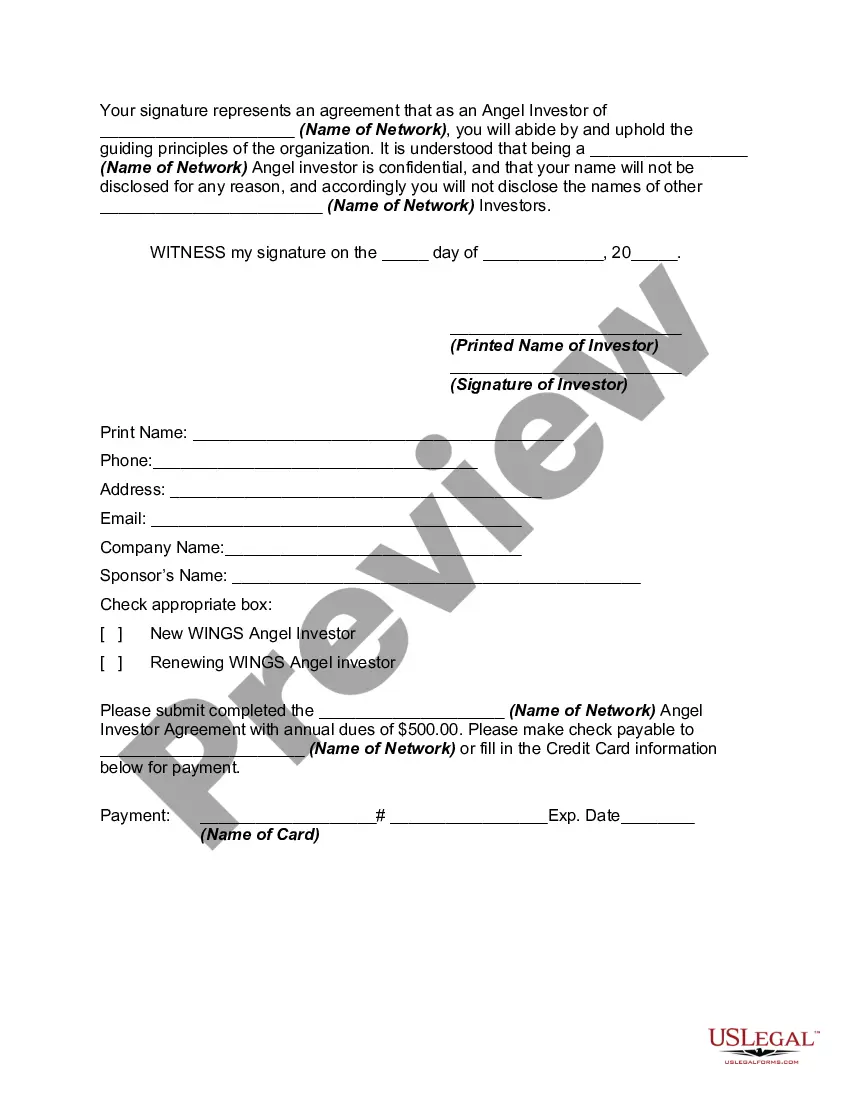

How to fill out Wyoming Angel Investor Agreement?

Have you been in the position that you will need papers for sometimes enterprise or personal functions virtually every time? There are tons of legitimate document web templates accessible on the Internet, but locating types you can trust isn`t effortless. US Legal Forms provides thousands of type web templates, like the Wyoming Angel Investor Agreement, that happen to be written to fulfill federal and state requirements.

If you are currently knowledgeable about US Legal Forms internet site and have a merchant account, merely log in. Afterward, you are able to acquire the Wyoming Angel Investor Agreement template.

Should you not come with an account and wish to start using US Legal Forms, follow these steps:

- Get the type you want and make sure it is for that appropriate town/county.

- Utilize the Preview key to check the form.

- Browse the information to ensure that you have selected the correct type.

- In the event the type isn`t what you are trying to find, take advantage of the Look for area to find the type that fits your needs and requirements.

- Whenever you obtain the appropriate type, click on Get now.

- Pick the rates strategy you need, fill out the required information to make your account, and buy the order utilizing your PayPal or credit card.

- Decide on a convenient document file format and acquire your version.

Find every one of the document web templates you have purchased in the My Forms menu. You can get a additional version of Wyoming Angel Investor Agreement anytime, if required. Just go through the necessary type to acquire or print the document template.

Use US Legal Forms, the most extensive variety of legitimate forms, to conserve time and avoid blunders. The support provides skillfully created legitimate document web templates that you can use for a variety of functions. Produce a merchant account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

To set up a Wyoming holding company, begin by choosing a unique name and submitting the Articles of Organization. You should also designate a registered agent and create an operating agreement. A properly drafted Wyoming Angel Investor Agreement will be crucial at this stage for managing the relationship with your investors. Using platforms like uslegalforms can simplify this process and ensure compliance with state laws.

Though Wyoming offers many benefits for LLCs, there are potential disadvantages to consider. For example, if you're not a resident, managing an LLC in Wyoming may require traveling or hiring local help. Additionally, you may need to deal with fees for maintaining compliance. However, a strong Wyoming Angel Investor Agreement can help you effectively navigate these challenges, ensuring your investors' interests are well-protected.

Absolutely, you can open an LLC in Wyoming while living in another state. Many people take advantage of Wyoming’s favorable tax environment and privacy laws. This, combined with a well-structured Wyoming Angel Investor Agreement, can facilitate attracting out-of-state investors. Just keep in mind that you might still need to register your LLC in your home state to legalize your operation there.

Yes, you can form an LLC in Wyoming even if you do not reside in the state. Wyoming has become a popular choice for business owners across the U.S. due to its business-friendly laws. By establishing your LLC and including a proper Wyoming Angel Investor Agreement, you can attract investors from various locations. Just be sure you comply with any requirements regarding registered agents and local regulations.

Yes, while Wyoming does not require an operating agreement for an LLC, having one is highly recommended. An operating agreement outlines the management structure and operating procedures of your LLC. This can be beneficial when structuring a Wyoming Angel Investor Agreement, as it clarifies roles and expectations among investors. Additionally, it helps prevent disputes by specifying how decisions will be made.

The timeline for securing angel investment can vary widely, often ranging from a few weeks to several months. It depends on factors such as interest from investors, the complexity of your proposal, and negotiation processes. Using a comprehensive Wyoming Angel Investor Agreement can streamline discussions and lead to a faster funding process.

Getting in front of angel investors requires strategic networking and effective pitching. You can attend startup events, join entrepreneurial groups, and utilize online platforms. Crafting a compelling Wyoming Angel Investor Agreement can also demonstrate your professionalism and readiness when presenting to potential investors.

The success rate of angel investors varies, but research shows that around 60% of startups receive no return on investment. However, successful investments can lead to significant financial rewards. A well-structured Wyoming Angel Investor Agreement can help both parties navigate the investment landscape, aiming for better outcomes.

To qualify as an angel investor, one typically needs to meet certain income and net worth criteria, often set by financial regulators. In addition, experience in business or investing can enhance qualifications. Understanding the details of a Wyoming Angel Investor Agreement can also provide clarity on the responsibilities and opportunities involved in angel investing.

Securing an angel investor can be a tough journey for many entrepreneurs. Investors look for strong business plans, clear market potential, and trustworthy founders. With a well-prepared Wyoming Angel Investor Agreement, you can effectively communicate your vision and increase your chances of attracting funding.