The Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant is a financial tool that allows individuals to secure a steady income stream during their retirement years. This agreement, exclusive to Wyoming residents, enables individuals to transfer assets (such as real estate, stocks, or a business) to a trust in exchange for guaranteed payments for the rest of their life. One key aspect of the Wyoming Private Annuity Agreement is its tax benefits. The annuity arrangement is structured so that the transfer of assets is not subject to immediate capital gains taxes. Instead, the annuitant receives payments over their lifetime, and taxes are only imposed on the distributed income each year. This feature can provide significant tax savings, especially for those with appreciated assets that they wish to divest without incurring substantial tax liabilities. There are several types of Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant available, tailored to suit different financial needs and goals. These variations include: 1. Regular Payment Annuity: This is the standard type of annuity agreement where the annuitant receives regular fixed payments for their lifetime. The payments can be made monthly, quarterly, or annually, providing stable income throughout retirement. 2. Increasing Payment Annuity: This type of annuity agreement offers payments that increase over time. It provides for adjustments to the payment amount to account for inflation or other factors, ensuring the annuitant's income keeps pace with rising expenses. 3. Joint and Survivor Annuity: With this option, the annuitant can choose to include their spouse or another beneficiary in the agreement. Payments will continue to the surviving beneficiary for the rest of their life after the annuitant passes away, ensuring financial security for both individuals. 4. Single Premium Annuity: In this variant, the annuitant makes a lump sum payment to initiate the annuity agreement, and in return, they receive periodic payments for life. This type is suitable for those who have a significant amount of liquid assets available or wish to consolidate their investments into a single income stream. 5. Deferred Annuity: This type allows the annuitant to delay the start of payments until a specified date in the future. By deferring income, the annuitant can maximize the growth potential of their assets and potentially receive higher payments when they are ready to start receiving income. The Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant is a valuable financial instrument that offers considerable tax advantages and stable income for retirement. It provides Wyoming residents with flexibility in selecting the annuity type that best suits their financial goals, whether it be regular payments, adjustments for inflation, or ensuring financial security for a spouse or beneficiary.

Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Wyoming Private Annuity Agreement With Payments To Last For Life Of Annuitant?

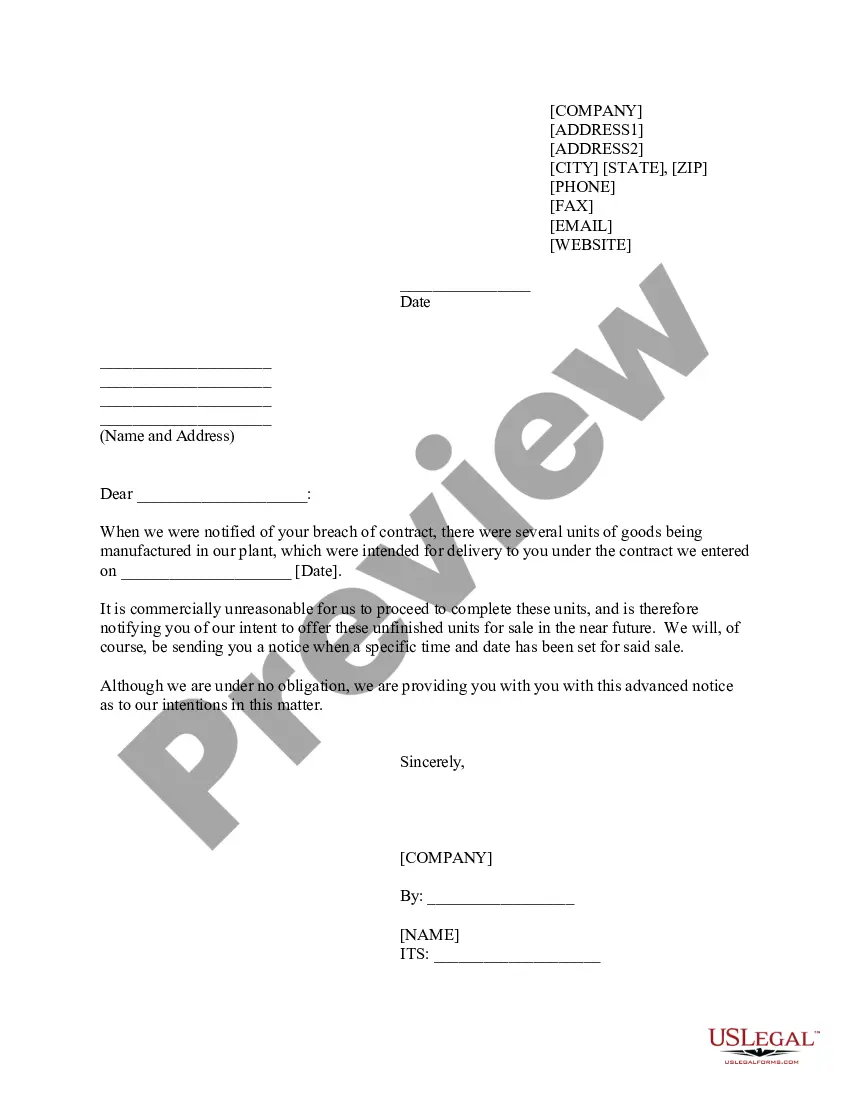

Choosing the right lawful file web template could be a battle. Needless to say, there are plenty of web templates accessible on the Internet, but how can you find the lawful develop you will need? Make use of the US Legal Forms web site. The support gives thousands of web templates, such as the Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant, that can be used for enterprise and private demands. All the varieties are examined by professionals and meet federal and state needs.

Should you be already registered, log in to the accounts and click the Obtain switch to have the Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant. Use your accounts to appear with the lawful varieties you might have purchased in the past. Visit the My Forms tab of the accounts and have an additional version in the file you will need.

Should you be a new customer of US Legal Forms, listed here are basic guidelines so that you can follow:

- Initially, ensure you have selected the correct develop to your town/state. You are able to look through the shape making use of the Review switch and study the shape information to make certain it will be the right one for you.

- In the event the develop will not meet your preferences, make use of the Seach discipline to get the correct develop.

- Once you are sure that the shape is proper, select the Buy now switch to have the develop.

- Select the rates program you desire and enter the necessary information. Build your accounts and buy the order utilizing your PayPal accounts or Visa or Mastercard.

- Pick the document structure and down load the lawful file web template to the device.

- Complete, change and printing and indication the received Wyoming Private Annuity Agreement with Payments to Last for Life of Annuitant.

US Legal Forms will be the largest library of lawful varieties in which you will find different file web templates. Make use of the service to down load appropriately-made files that follow condition needs.

Form popularity

FAQ

If you decide that you no longer want the annuity within the set time frame, then you can simply cancel the contract without incurring a surrender charge from the insurance company. Think of the free-look period as a get-out-of-jail-free card but with a crucial caveat.

The straight life income annuity option pays the annuitant a guaranteed income for his or her lifetime.

If the annuitant dies before the annuity start date, the beneficiary will receive a lump-sum payment of the total premiums paid into the annuity. If the annuitant dies after the annuity start date, the beneficiary will generally continue to receive payments from the annuity.

The life with period certain option is designed to pay the annuitant an income for life, but guarantees a minimum period of payments whether the individual is alive or not. Before he died, Gary received a total of $9,200 in monthly income payments from his $15,000 straight life annuity.

A lifetime annuity is a financial product you can buy with a lump sum of money. In return, you will receive income for the rest of your life. A lifetime annuity guarantees payment of a predetermined amount for the rest of your life. This is different from a term annuity which only pays you for a fixed amount of time.

A lifetime payout annuity is a type of retirement investment that pays a portion of the underlying portfolio of assets for the life of the investor. The guaranteed payments associated with lifetime payout annuities eliminate the risk for investors of outliving their retirement funds.

Also known as a straight-life or life-only annuity, a single-life annuity allows you to receive payments your entire life. Unlike some other options that allow for beneficiaries or spouses, this annuity is limited to the lifetime of the annuitant with no survivor benefit.

Depending on the terms of the contract, annuity payments will end after the death of the annuity owner. But annuities that have a death-benefit provision allow the owner to designate a beneficiary to receive the greater of either all the remaining money or a guaranteed minimum.

With a single-life or immediate annuity, the payments will simply cease at that point. However, you can purchase contracts that will provide payments to one or more beneficiaries after the annuitant's passing.

There are four basic types of annuities to meet your needs: immediate fixed, immediate variable, deferred fixed, and deferred variable annuities. These four types are based on two primary factors: when you want to start receiving payments and how you would like your annuity to grow.