Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Locating the appropriate legal document format can be fairly challenging. Clearly, there are numerous templates accessible online, but how can you discover the legal form you require.

Utilize the US Legal Forms platform. This service provides an extensive array of templates, including the Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable, which is suitable for both business and personal purposes. Each form is reviewed by experts and complies with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable. Use your account to browse through the legal forms you may have purchased previously. Navigate to the My documents section of your account and download another copy of the document you require.

Fill out, edit, print, and sign the acquired Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable. US Legal Forms is the largest collection of legal forms from which you can view various document templates. Use the service to download professionally crafted paperwork that conforms to state regulations.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

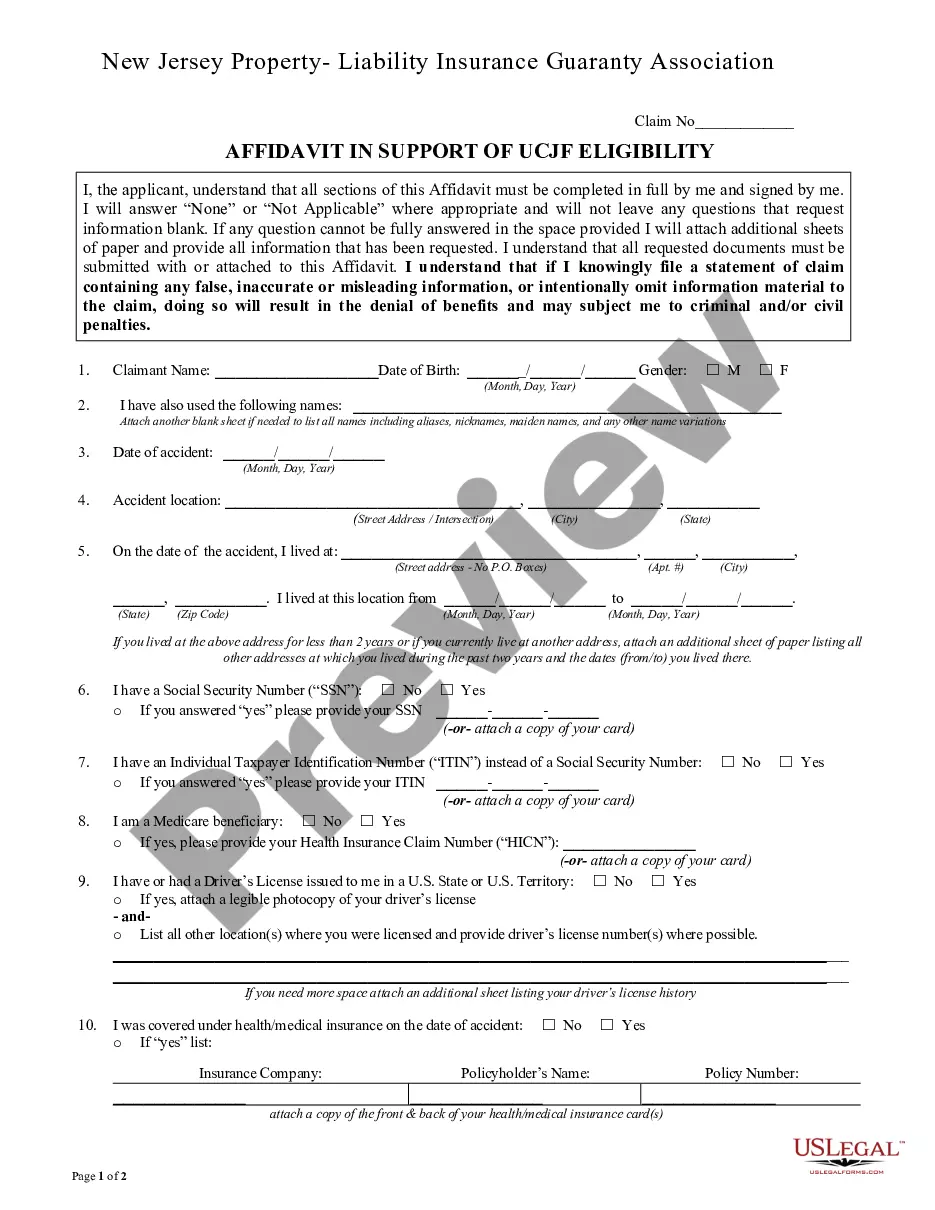

- First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form details to confirm it is suitable for you.

- If the form does not fulfill your requirements, use the Search field to locate the appropriate form.

- Once you are confident that the form is applicable, click the Purchase now button to obtain the form.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card.

- Select the file format and download the legal document format to your device.

Form popularity

FAQ

Accounts Receivable (AR) factoring is not traditionally classified as debt. Instead, it is a sale of your receivables to a third party, like a factor. The Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable supports this understanding by outlining the terms of the sale, helping you differentiate it from traditional borrowing.

The key difference between a pledge and assignment of receivables lies in ownership rights. A pledge requires the pledgee to hold the asset as security without transferring ownership, while assignment of receivables involves transferring rights to collect payment to another party. Understanding these distinctions is crucial, especially when using the Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable for business financing.

To obtain a notice of assignment, you can start by contacting your factor or the party to whom the accounts are assigned. This notice formally informs your customers that their payments should be made to the new party. Utilizing the Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable can streamline this process and ensure you are following the correct legal steps. It's essential to keep your billing practices transparent to avoid confusion.

In the context of factoring, a NoA refers to the Notice of Assignment that communicates to debtors about the assignment of the right to collect payment. This notice is critical to ensure proper payment direction and protect the interests of the factor. By incorporating the NoA with the Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable, businesses can ensure a smooth transition during factoring.

In accounting, NoA stands for Notice of Assignment. This document serves as an official notification to ensure that payment for receivables is directed toward the assignee rather than the original creditor. Understanding the importance of the NoA is essential when navigating processes related to the Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable, as it helps ensure clarity and compliance.

You can obtain a Notice of Assignment (NoA) template through various legal document services, including USLegalForms. These platforms often offer customizable templates that comply with state requirements. Using the Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable can provide you with the necessary structure and compliance assurance for your notice.

A Notice of Assignment (NoA) in finance serves as formal documentation that informs debtors about the transfer of rights to collect outstanding payments. This notice is crucial because it ensures that debtors redirect payments to the new assignee, maintaining transparency. In the context of a Wyoming General Form of Factoring Agreement - Assignment of Accounts Receivable, the NoA plays a vital role in protecting the interests of all parties involved.