Wyoming Short Sale Affidavit of Buyer

Description

An arms-length or short sale affidavit is a document created by a bank in an attempt to prevent sellers from selling to relatives or friends to act as a straw buyer. Sometimes sellers make such side agreements. Then, after the transaction closes, the pretend buyers quickly transfer title back to the seller. This practice, in affect, means the sellers have repurchased their home at maybe half the cost, which greatly benefits those sellers.

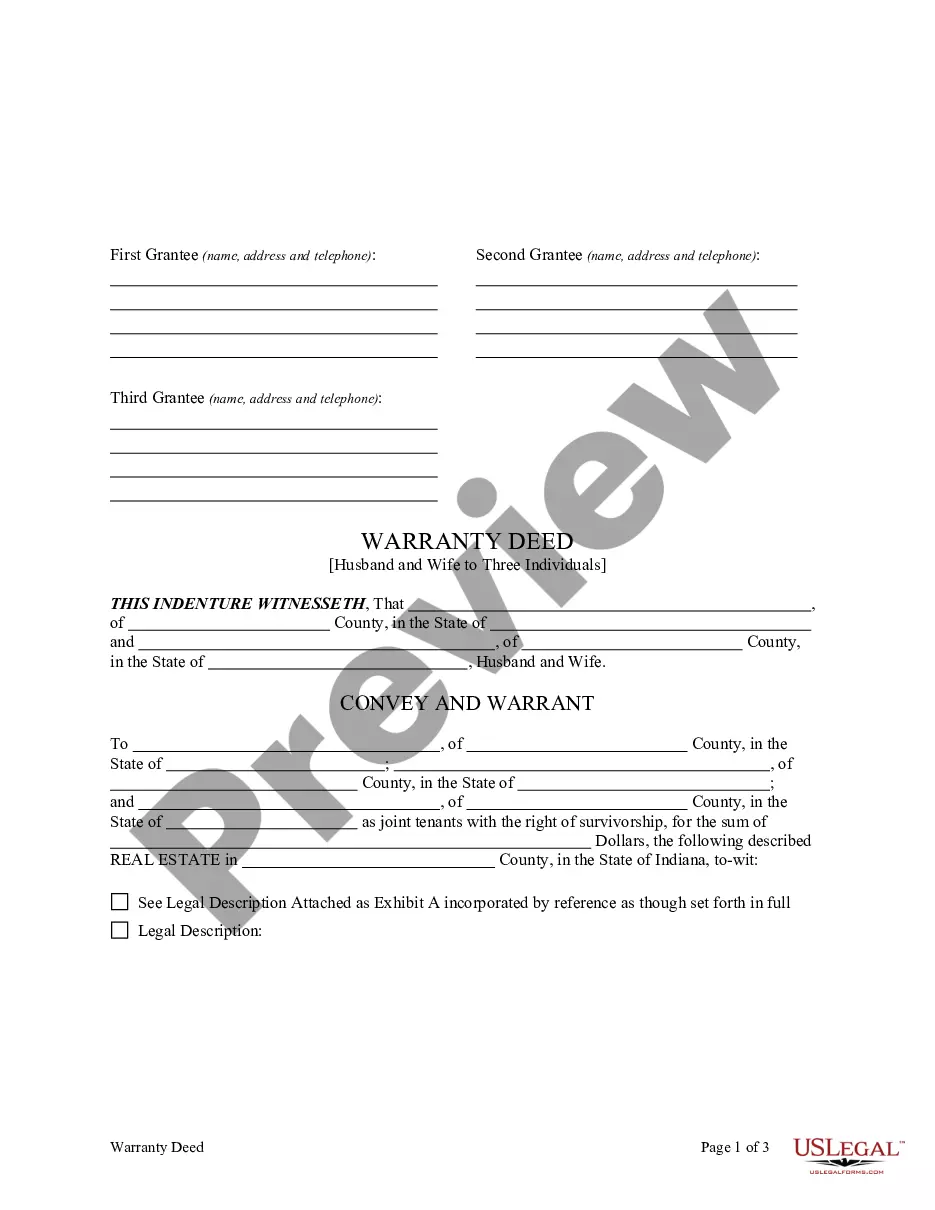

How to fill out Short Sale Affidavit Of Buyer?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an extensive array of legal form templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can quickly access the latest documents, such as the Wyoming Short Sale Affidavit of Buyer.

If you hold a subscription, Log In and download the Wyoming Short Sale Affidavit of Buyer from the US Legal Forms collection. The Download button will appear for every form you view. You can access all previously purchased forms from the My documents section of your account.

Proceed with the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Wyoming Short Sale Affidavit of Buyer. Each document added to your account does not expire and is yours permanently. So, if you want to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Wyoming Short Sale Affidavit of Buyer using US Legal Forms, the most comprehensive collection of legal form templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct form for your region/state.

- Click the Preview button to view the form's details.

- Review the form description to confirm you have chosen the right document.

- If the form does not meet your requirements, use the Search box at the top of the page to find the appropriate one.

- If satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

A short sale occurs when a homeowner sells their property for less than the amount owed on their mortgage, often due to financial hardship. In such cases, the lender must approve the sale, making the process more complex. The Wyoming Short Sale Affidavit of Buyer plays a crucial role, as it formalizes the buyer's commitment to the transaction. Understanding how a short sale works can empower buyers to make informed decisions while working with platforms like uslegalforms, which provide necessary legal documents.

A short sale affidavit is a legal document that outlines the details of a short sale transaction. It is essential in the process, especially with the Wyoming Short Sale Affidavit of Buyer, as it confirms the buyer's understanding and intent to acquire the property under specific conditions. This affidavit serves to protect both buyers and sellers, ensuring transparency and compliance with local laws. Understanding this document can significantly enhance your confidence in the short sale process.

A bank may deny a short sale for several reasons, including insufficient documentation or if they believe they can recover more than the short sale offer. They may also reject a sale if the buyer's financial situation raises concerns. Submitting a comprehensive package, including the Wyoming Short Sale Affidavit of Buyer, can increase your chances of approval.

To write a short bill of sale, include essential details such as the buyer's name, seller's name, property description, and the sale amount. Ensure to also incorporate the Wyoming Short Sale Affidavit of Buyer, as this adds legal weight to the document by confirming both parties’ commitment. Clear documentation helps avoid misunderstandings and establishes straightforward terms.

To report a short sale, you should notify the lender about your intention to sell the property for less than what you owe. It is crucial to prepare the necessary documentation, including the Wyoming Short Sale Affidavit of Buyer, which formally states your intent. Proper reporting helps streamline the lender's approval process and makes it easier for buyers to understand the sale.

In a short sale, typically the seller does not bear the burden of paying closing costs, as the lender often covers these fees. However, this can vary based on the agreement made during the negotiation process. With the Wyoming Short Sale Affidavit of Buyer, it's essential to outline the responsibilities regarding closing costs to ensure clarity for all parties involved.

Lenders may deny a short sale for various reasons, including perceived financial capability, incomplete documentation, or market conditions. If a Wyoming Short Sale Affidavit of Buyer lacks sufficient detail, it can lead to rejection. Additionally, if the lender believes they can recover more through foreclosure instead, they may choose to deny the short sale request. Open communication and providing thorough information are key to reducing the chances of denial.

In a short sale situation, the mortgage lender must approve the sale, as they typically hold the financial interest in the property. As part of the process, you will submit a Wyoming Short Sale Affidavit of Buyer along with your request to demonstrate your financial status. Only after the lender reviews all documentation and evaluates the situation will they grant or deny approval for the sale.

Documenting a short sale includes compiling financial records, hardship letters, and the Wyoming Short Sale Affidavit of Buyer. These documents illustrate your financial position and justify the need for a short sale. Each piece of information should be accurate and complete to avoid delays in approval. Moreover, ensure you communicate any changes in your situation promptly to the lender.

Obtaining approval for a short sale primarily involves demonstrating financial hardship to your lender. Providing a Wyoming Short Sale Affidavit of Buyer can be a valuable part of this process, as it clearly states your circumstances. Gathering all necessary documentation and maintaining open communication with the bank can significantly facilitate earning that crucial approval.