The Wyoming Articles of Incorporation, Not for Profit Organization, with Tax Provisions is a legal document that outlines the formation and operation of a nonprofit organization in the state of Wyoming. This document includes specific provisions related to tax obligations and benefits for nonprofit organizations. Here, we will provide a detailed description of what this document entails, including its purpose, key sections, and various types available. Purpose of Wyoming Articles of Incorporation, Not for Profit Organization, with Tax Provisions: The primary purpose of this legal document is to establish a nonprofit organization in Wyoming while ensuring compliance with state laws and regulations. It outlines the structure, objectives, and tax-related provisions necessary for operating as a nonprofit entity in the state. Key Sections of Wyoming Articles of Incorporation, Not for Profit Organization, with Tax Provisions: 1. Name and Purpose: This section states the legal name of the nonprofit organization and describes its purpose or mission statement, emphasizing its non-profit nature. 2. Registered Office and Agent: The organization's physical address within Wyoming, referred to as the registered office, as well as the name and address of the registered agent responsible for receiving legal notices on behalf of the organization, must be provided. 3. Incorporates and Initial Directors: The names and addresses of individuals or entities responsible for drafting and filing the Articles of Incorporation are listed here. Initial directors may also be mentioned, who will govern the organization until the first board of directors is elected. 4. Membership Information: This section provides details about the membership structure, outlining whether the nonprofit organization will have members, and if so, how they will be elected or appointed. 5. Provisions for Indemnification: This addresses the organization's ability to indemnify its directors, officers, employees, and other individuals acting on its behalf from liabilities incurred within the scope of their duties. 6. Dissolution Clause: The procedure for dissolving the nonprofit organization is outlined in this section, including the distribution of remaining assets to other nonprofit organizations or specific beneficiaries, ensuring compliance with state laws. Types of Wyoming Articles of Incorporation, Not for Profit Organization, with Tax Provisions: 1. Basic Articles of Incorporation: This is the standard form for incorporating a nonprofit organization in Wyoming, which covers all the essential sections required for legal recognition. 2. Amended Articles of Incorporation: If changes, such as amendments to the organization's name, purpose, or registered agent, need to be made to the existing Articles of Incorporation, an amended version is filed. 3. Restated Articles of Incorporation: When substantial changes are required, and it is necessary to restate the entire content of the Articles of Incorporation while maintaining the original filing date, a restated version is submitted. In conclusion, the Wyoming Articles of Incorporation, Not for Profit Organization, with Tax Provisions is a crucial legal document for nonprofits operating in the state. Its purpose is to establish and legally recognize a nonprofit organization while addressing specific tax-related provisions. Understanding the key sections and different types available ensures compliance and facilitates the smooth functioning of nonprofit entities in Wyoming.

Wyoming Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

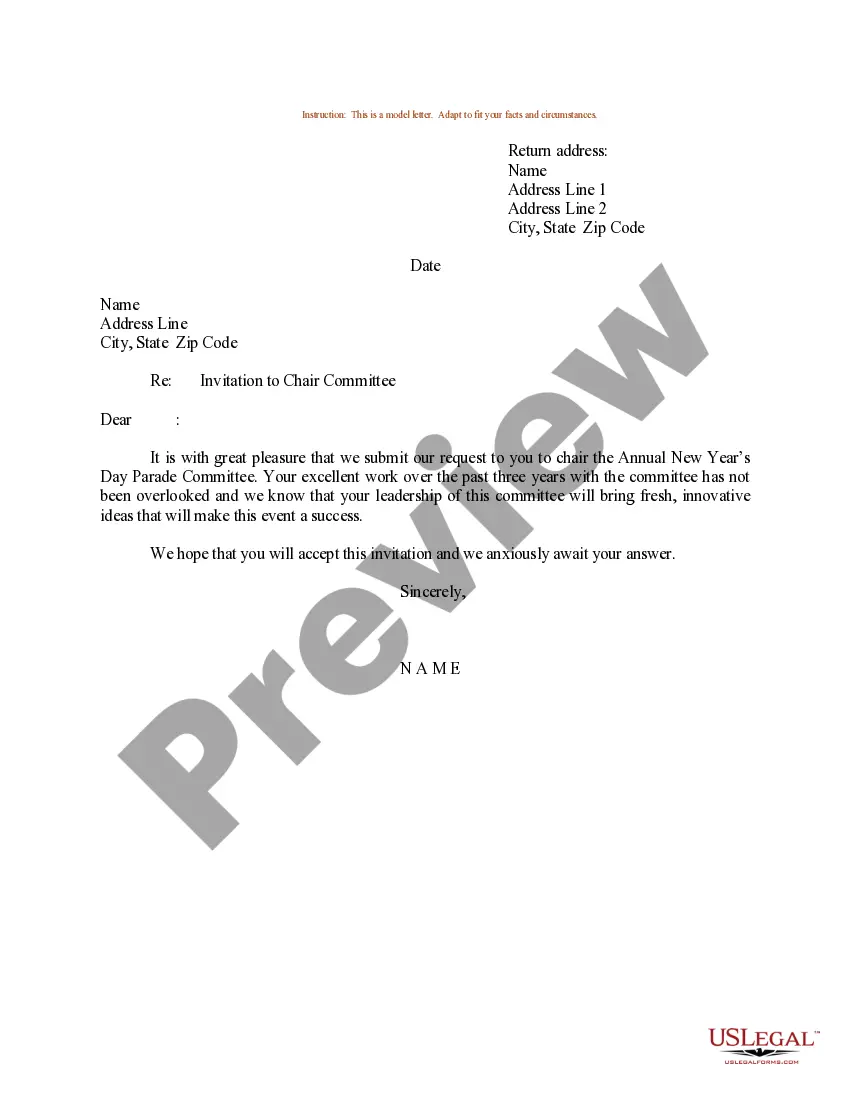

How to fill out Wyoming Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Choosing the best legal record web template can be a have difficulties. Naturally, there are a lot of templates available on the Internet, but how do you find the legal form you need? Take advantage of the US Legal Forms website. The assistance delivers thousands of templates, like the Wyoming Articles of Incorporation, Not for Profit Organization, with Tax Provisions, that can be used for company and personal demands. Every one of the kinds are examined by experts and satisfy state and federal requirements.

In case you are presently registered, log in for your bank account and then click the Obtain button to obtain the Wyoming Articles of Incorporation, Not for Profit Organization, with Tax Provisions. Make use of bank account to appear from the legal kinds you have acquired previously. Visit the My Forms tab of your own bank account and obtain one more backup in the record you need.

In case you are a whole new customer of US Legal Forms, here are basic guidelines for you to comply with:

- Initial, make sure you have chosen the appropriate form for your area/county. You may check out the shape utilizing the Preview button and look at the shape outline to make certain it will be the right one for you.

- If the form does not satisfy your expectations, take advantage of the Seach area to obtain the appropriate form.

- Once you are certain the shape is proper, click the Get now button to obtain the form.

- Choose the pricing program you want and type in the needed information and facts. Build your bank account and purchase the transaction making use of your PayPal bank account or credit card.

- Opt for the submit formatting and download the legal record web template for your product.

- Complete, modify and print and indicator the acquired Wyoming Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

US Legal Forms will be the most significant library of legal kinds in which you can see a variety of record templates. Take advantage of the service to download skillfully-made documents that comply with status requirements.