Wyoming Assignment of Shares is a legal document that facilitates the transfer of ownership of shares from one party to another within a Wyoming corporation. This document typically outlines the terms and conditions of the share transfer and ensures compliance with state laws. Keywords: Wyoming, Assignment of Shares, transfer of ownership, legal document, Wyoming corporation, terms and conditions, compliance, state laws. There are several types of Wyoming Assignment of Shares, each serving a distinct purpose. Some of these types include: 1. General Assignment of Shares: This type of assignment is used when an individual or entity wishes to transfer their ownership of shares to another party without any specific conditions or restrictions. It is a straightforward method to transfer shares. 2. Specific Assignment of Shares: This type of assignment is utilized when the transfer of shares is subject to specific conditions or restrictions set forth by the transferring party. Such conditions may include price thresholds, preemptive rights, or board approval requirements. 3. Conditional Assignment of Shares: This type of assignment applies when the transfer of shares is contingent upon certain conditions being met. These conditions could include the occurrence of a specific event, the completion of a transaction, or the fulfillment of specified terms. 4. Partial Assignment of Shares: This assignment type allows for the transfer of only a portion of an individual's or entity's shares, rather than the entire ownership. It is commonly used when divesting a small portion of the total shares owned. 5. Irrevocable Assignment of Shares: This assignment type, once executed, cannot be revoked by the transferring party. It provides a legally binding agreement that ensures the transfer of shares is permanent and cannot be reversed. 6. Revocable Assignment of Shares: In contrast to the irrevocable assignment, this type of assignment allows the transferring party to revoke or cancel the share transfer at any time before it becomes effective. This flexibility can be useful when conditions change or if the parties involved decide not to proceed with the transfer. It is important to consult legal professionals and an attorney specializing in corporate law in Wyoming to ensure compliance with specific rules and requirements when dealing with the assignment of shares in a Wyoming corporation.

Wyoming Assignment of Shares

Description

How to fill out Assignment Of Shares?

Are you presently in a position the place you require paperwork for both enterprise or individual reasons virtually every day time? There are tons of legitimate file templates available on the net, but getting ones you can trust is not simple. US Legal Forms offers a large number of form templates, much like the Wyoming Assignment of Shares, that are created to fulfill federal and state needs.

In case you are already knowledgeable about US Legal Forms website and have an account, just log in. Afterward, you can download the Wyoming Assignment of Shares format.

Unless you provide an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the form you will need and ensure it is for the right area/county.

- Take advantage of the Preview option to examine the form.

- Browse the explanation to actually have selected the appropriate form.

- In the event the form is not what you are looking for, take advantage of the Look for field to get the form that meets your requirements and needs.

- If you find the right form, click Purchase now.

- Choose the pricing plan you want, submit the desired information to make your bank account, and buy the transaction using your PayPal or bank card.

- Pick a convenient document format and download your copy.

Get each of the file templates you might have bought in the My Forms food list. You can get a additional copy of Wyoming Assignment of Shares any time, if needed. Just click the required form to download or printing the file format.

Use US Legal Forms, by far the most substantial selection of legitimate types, in order to save time as well as stay away from faults. The support offers professionally created legitimate file templates which you can use for a range of reasons. Create an account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

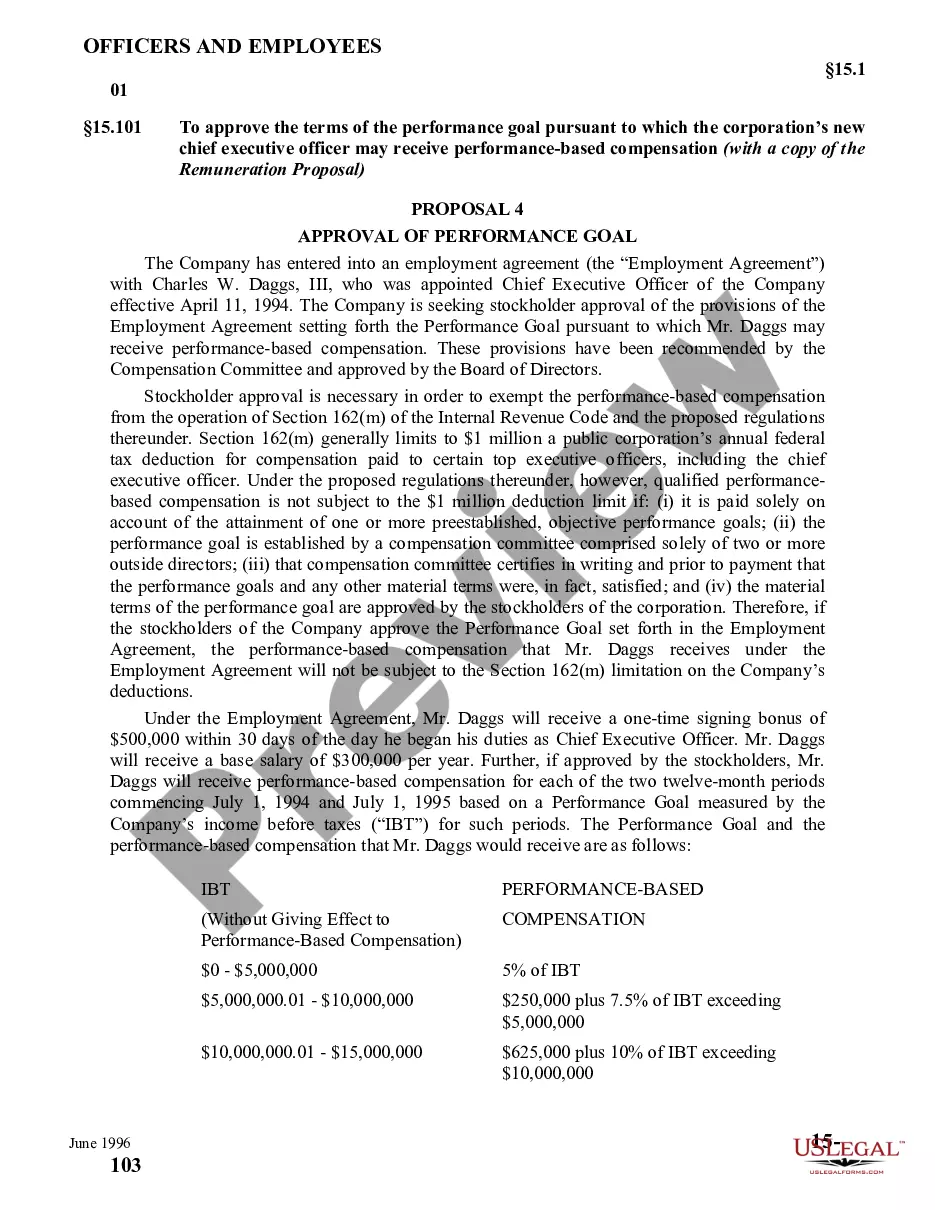

Advantages of an S corporation Limited liability protection. Owners are not typically responsible for business debts and liabilities. Pass-through taxation. No tax is paid at the business level on the corporation's profits. ... Unlimited life. ... Easy transfer of ownership. ... Easier to raise capital.

Wyoming has many advantages over other states for building an LLC. It has no state income tax, filing and reporting costs are low, members' privacy is assured, and it has charging order protection laws.

Authority to transact business required. (a) A foreign corporation may not transact business in this state until it obtains a certificate of authority from the secretary of state.

Owner employment: In an S corp, owners who work for the company must receive a reasonable salary and are subject to payroll taxes. In contrast, owners of an LLC can take profits without paying payroll taxes, although they are subject to self-employment taxes.

Three states are particularly known for having legal systems beneficial for businesses: Delaware, Nevada, and Wyoming. Advantages of forming a business in Delaware: Delaware offers businesses flexibility in setting up their corporate officers and board structures.

Action without meeting. (a) Unless the articles of incorporation or bylaws provide otherwise, action required or permitted by this act to be taken at a board of directors' meeting may be taken without a meeting if the action is taken by the requisite number of members of the board.

One major advantage of an S corporation is that it provides owners limited liability protection, regardless of its tax status. Limited liability protection means that the owners' personal assets are shielded from the claims of business creditors?whether the claims arise from contracts or litigation.

The shared responsibility child support amount shall be divided by the number of children to determine the presumptive support obligation for each child, which amount shall then be allocated to each parent based upon the number of those children in the physical custody of that parent.