A Wyoming Installment Promissory Note with Bank Deposit as Collateral is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of Wyoming. This specific type of promissory note is unique as it includes a bank deposit as collateral, providing added security to the lender. The Wyoming Installment Promissory Note with Bank Deposit as Collateral typically includes the following key elements: 1. Parties Involved: The promissory note identifies the borrower, who is responsible for repaying the loan, and the lender, who provides the loan amount. 2. Loan Amount: The promissory note specifies the principal amount borrowed by the borrower. 3. Interest Rate: The interest rate is outlined in the promissory note, determining the cost of borrowing for the borrower. It may be a fixed or variable rate, and it is crucial to state whether it is simple or compound interest. 4. Installments: This type of promissory note typically involves the repayment of the loan in regular installments over a predetermined period. The note will specify the frequency, such as monthly, bi-monthly, or quarterly, and the due dates for these payments. 5. Collateral: In this particular type of promissory note, a bank deposit is used as collateral to secure the loan. The note will outline the specifics of the deposit, including the institution holding the deposit, the account number, and any specific requirements or restrictions related to the collateral. 6. Default and Remedies: The promissory note will address the consequences of default by the borrower, including late payment penalties, interest rate adjustments, or potential legal actions. It will also outline the specific remedies available to the lender in the event of default or breach of the agreement. It is important to note that there may be variations and different types of Wyoming Installment Promissory Notes with Bank Deposit as Collateral, depending on specific circumstances and agreements between the borrower and lender. For example, there may be variations in interest rates, payment terms, or additional clauses related to prepayment penalties, late fees, or modification of the agreement. Ultimately, the specifics of the promissory note will depend on the mutual agreement and negotiation between the borrower and the lender, as well as compliance with Wyoming state laws and regulations governing promissory notes and collateralized loans.

Wyoming Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Wyoming Installment Promissory Note With Bank Deposit As Collateral?

US Legal Forms - one of several biggest libraries of lawful forms in America - provides a variety of lawful file web templates it is possible to acquire or produce. Utilizing the web site, you can get a huge number of forms for organization and person uses, sorted by groups, says, or keywords.You can get the newest types of forms just like the Wyoming Installment Promissory Note with Bank Deposit as Collateral in seconds.

If you have a subscription, log in and acquire Wyoming Installment Promissory Note with Bank Deposit as Collateral from the US Legal Forms catalogue. The Download switch will show up on every single kind you perspective. You have access to all formerly acquired forms in the My Forms tab of the profile.

If you would like use US Legal Forms the very first time, listed here are easy instructions to obtain started:

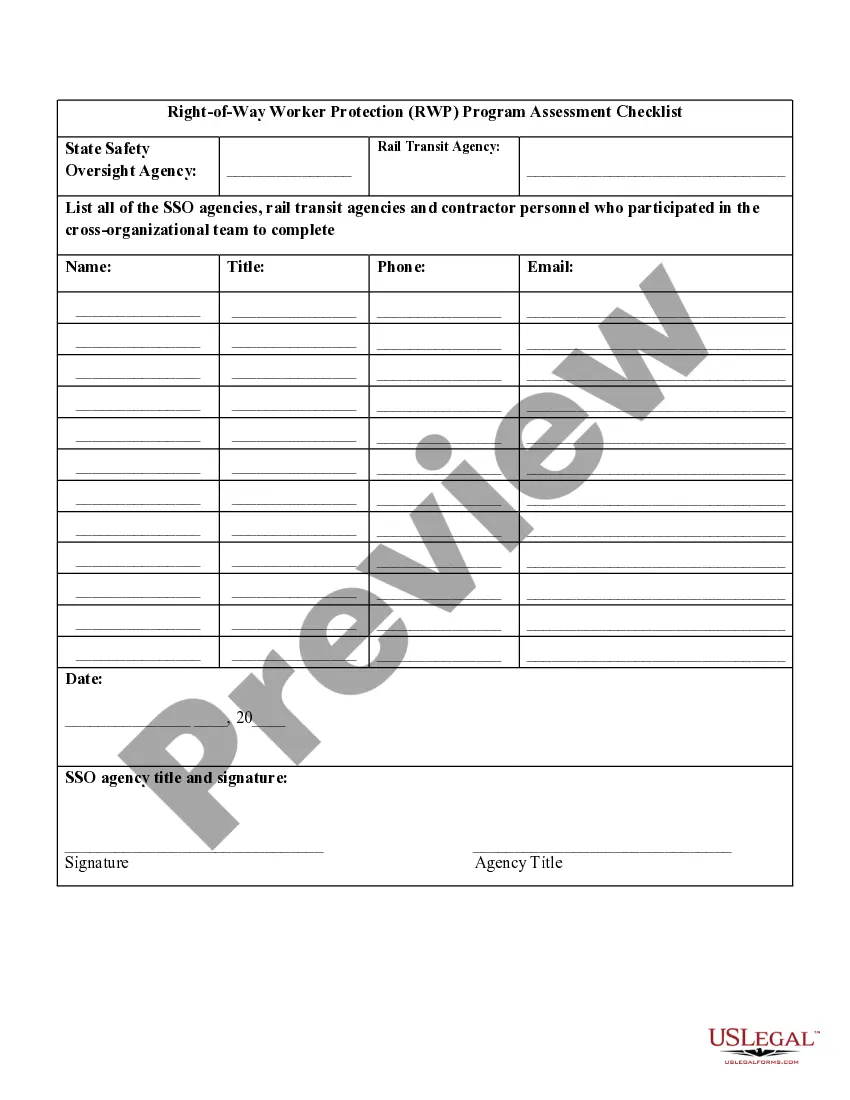

- Be sure to have picked the best kind for your city/county. Click on the Preview switch to analyze the form`s content. Browse the kind description to ensure that you have selected the right kind.

- In the event the kind does not fit your needs, use the Search field at the top of the monitor to get the one that does.

- Should you be pleased with the shape, affirm your option by simply clicking the Get now switch. Then, pick the pricing program you want and provide your references to register for an profile.

- Method the deal. Utilize your bank card or PayPal profile to perform the deal.

- Select the formatting and acquire the shape on your device.

- Make modifications. Load, modify and produce and indication the acquired Wyoming Installment Promissory Note with Bank Deposit as Collateral.

Every single design you included with your account lacks an expiry day and it is your own eternally. So, if you want to acquire or produce yet another version, just check out the My Forms segment and click about the kind you require.

Gain access to the Wyoming Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms, the most comprehensive catalogue of lawful file web templates. Use a huge number of professional and status-distinct web templates that satisfy your small business or person needs and needs.