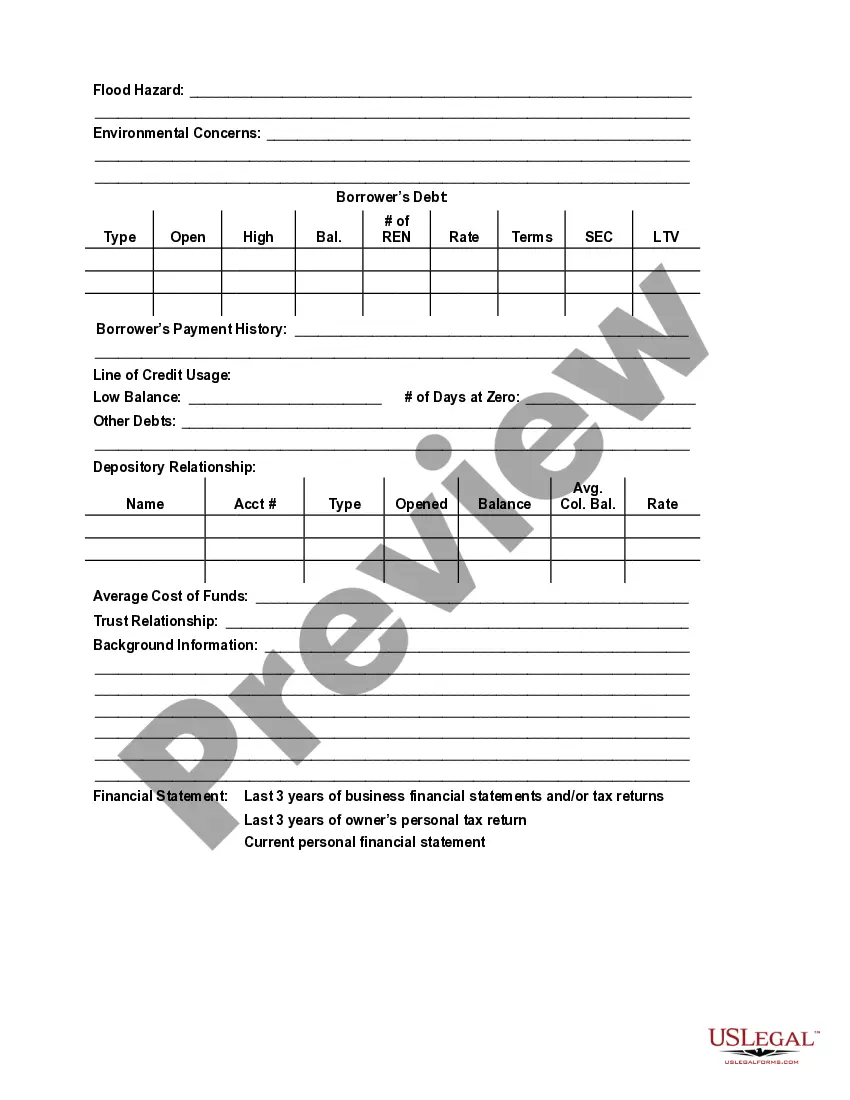

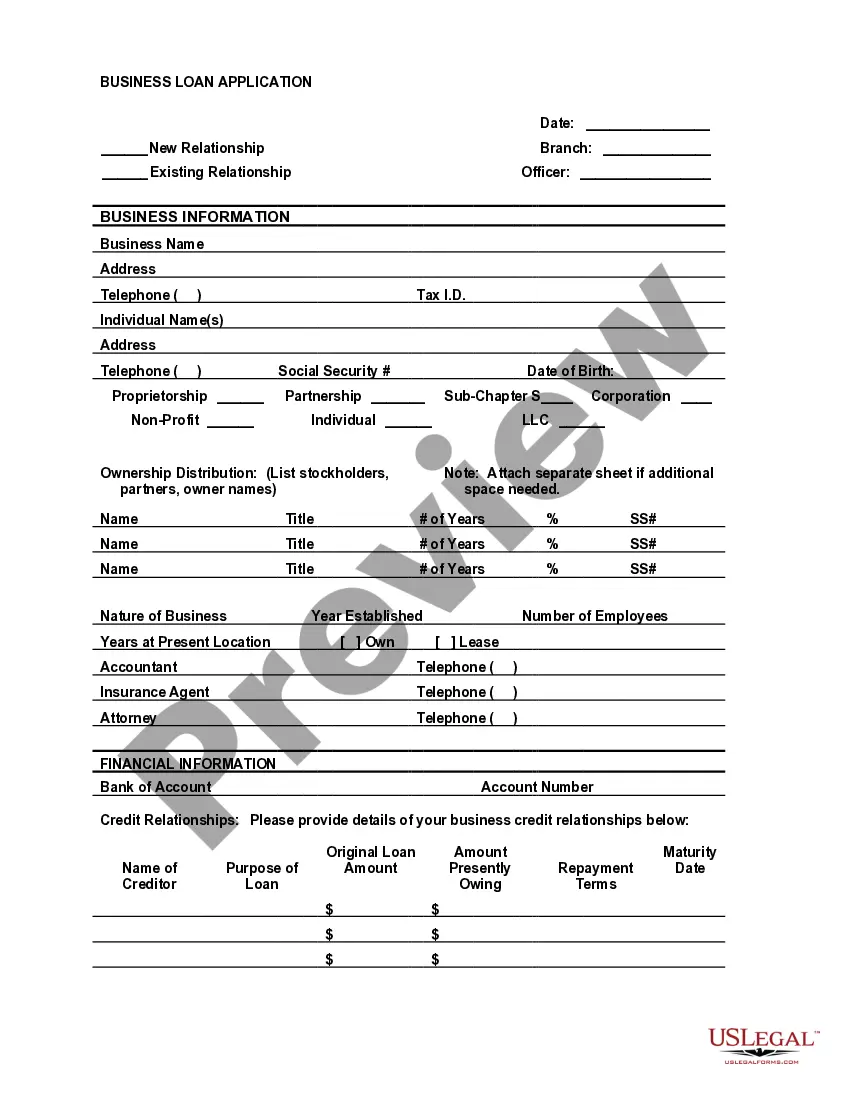

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

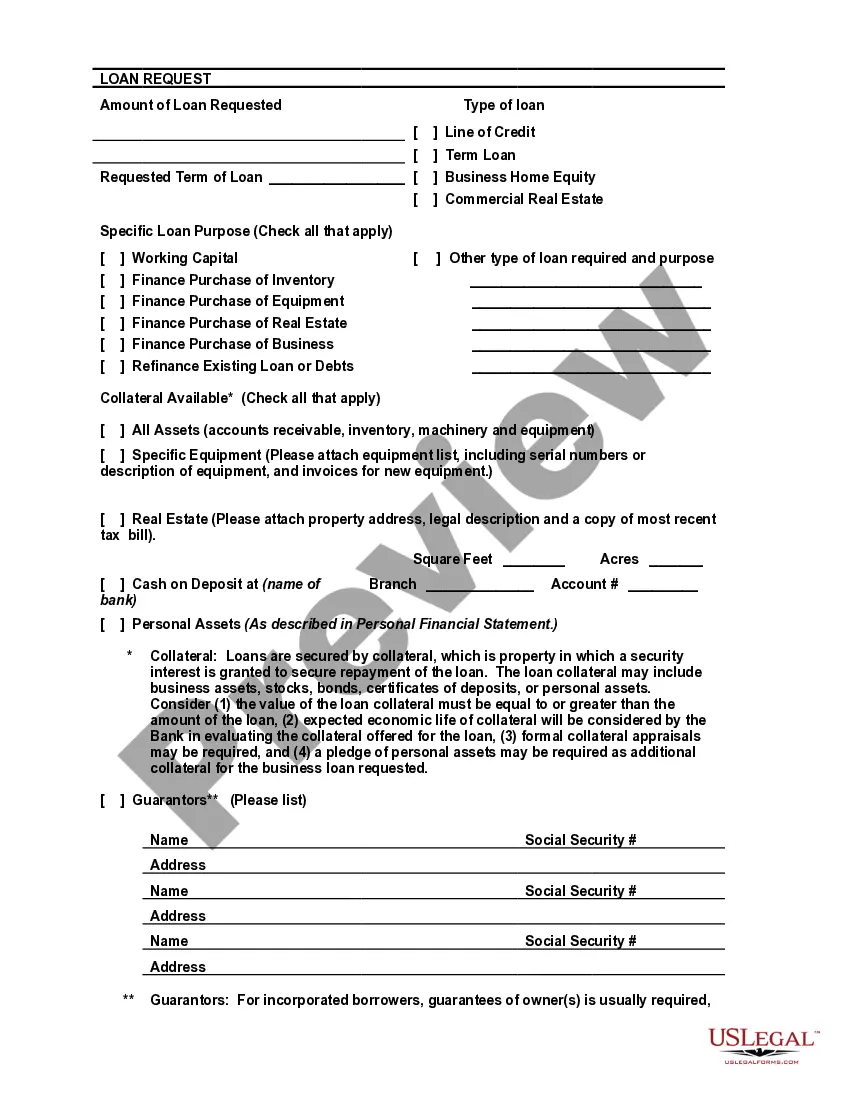

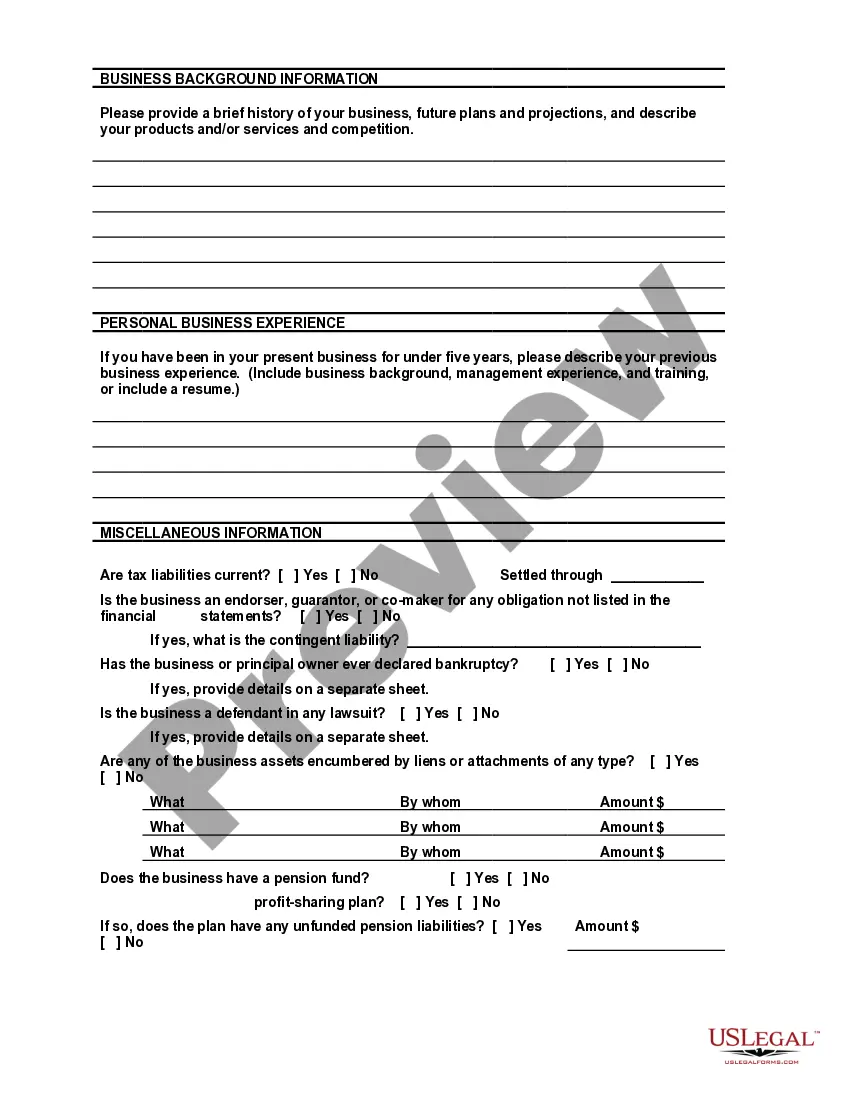

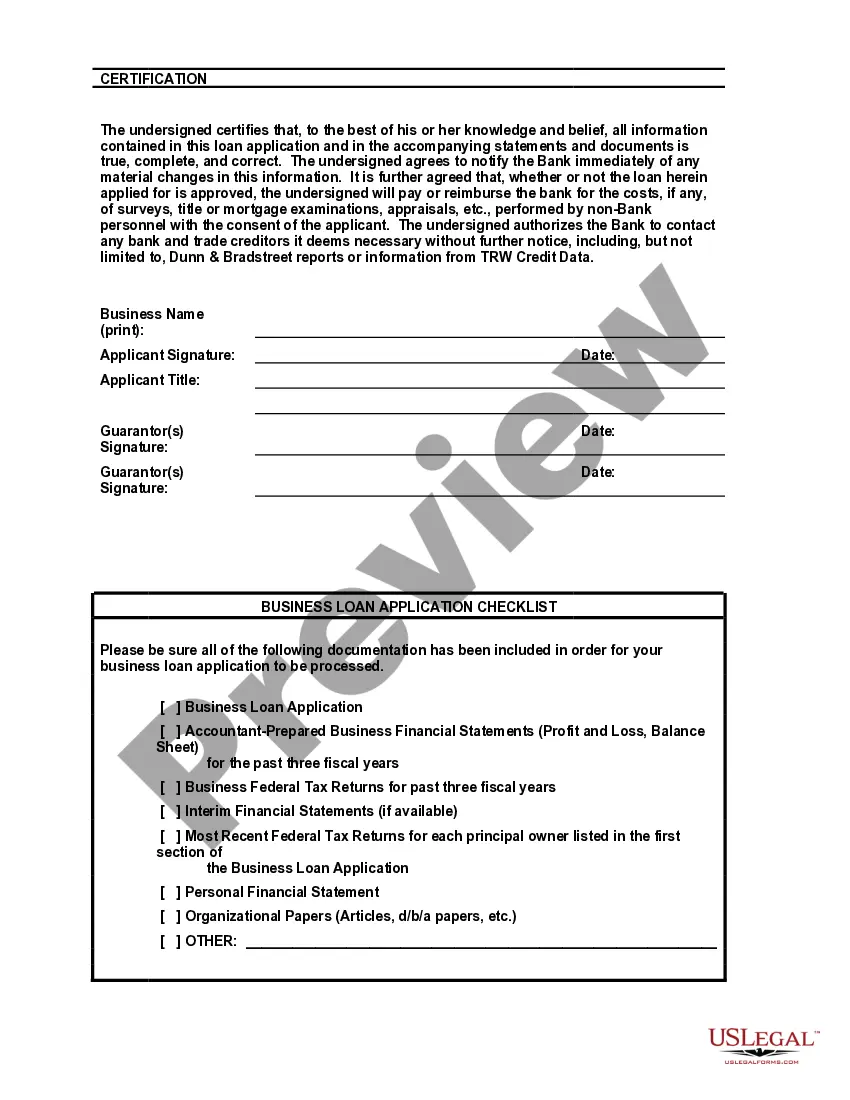

Wyoming Bank Loan Application Form and Checklist — Business Loan: A Comprehensive Guide Introduction: The Wyoming Bank Loan Application Form and Checklist — Business Loan is a crucial document required for individuals and businesses seeking financial assistance from banks based in Wyoming, United States. This comprehensive guide aims to provide detailed information about the purpose, components, and types of Wyoming Bank Loan Application Forms and their respective checklists, ensuring a smooth and successful loan application process. Purpose: The primary purpose of the Wyoming Bank Loan Application Form and Checklist — Business Loan is to gather essential information from borrowers who wish to secure a business loan from a Wyoming bank. This form serves as a standardized document ensuring consistency in the application process, enabling banks to evaluate loan requests efficiently. The checklist assists loan applicants in organizing the necessary supporting documents, enhancing their chances of securing a loan. Components of the Wyoming Bank Loan Application Form: 1. Contact Information: Applicant's personal and business contact details, such as name, address, phone numbers, and email address. 2. Business Information: Detailed information about the business entity, including legal structure, industry, number of employees, and years in operation. 3. Loan Details: Loan amount requested, purpose of the loan, repayment terms, desired interest rate, and proposed collateral (if applicable). 4. Financial Statements: Comprehensive financial statements, including income statement, balance sheet, and cash flow statement, highlighting the business's financial health. 5. Business Plan: A detailed outline of the business's objectives, strategies, market analysis, sales projections, and operational plans. 6. Collateral Details: Identification and valuation of assets offered as collateral against the loan, if required by the bank. 7. Credit History: Comprehensive details about the applicant's credit history, including outstanding loans, credit scores, and any past bankruptcies or defaults. 8. Personal Financial Statements: Personal financial information, including assets, liabilities, income, and expenses of the business owner or applicants associated with the loan. 9. Legal and Regulatory Compliance: Documentation confirming compliance with relevant local, state, and federal regulations. 10. Other Supporting Documents: Various additional documents, such as tax returns, licenses, permits, insurance policies, and any legal agreements associated with the business. Types of Wyoming Bank Loan Application Forms and Checklists: 1. Small Business Loan Application Form and Checklist: Specifically designed for small businesses or startups seeking loans to fund their operations, expansion, or working capital requirements. 2. Commercial Loan Application Form and Checklist: Aimed at established businesses requiring larger loan amounts for significant projects like real estate acquisition, large-scale equipment purchases, or business acquisitions. 3. SBA Loan Application Form and Checklist: Catering to businesses seeking loans guaranteed by the Small Business Administration (SBA) to facilitate easier access to financing. 4. Agricultural Loan Application Form and Checklist: Tailored for agricultural businesses or farmers in need of loans to support farming operations, rural development, or purchase farm equipment. 5. Start-Up Loan Application Form and Checklist: Designed specifically for entrepreneurs or individuals looking for financial support to establish a new business venture. In conclusion, the Wyoming Bank Loan Application Form and Checklist — Business Loan is a comprehensive tool for individuals and businesses seeking financial assistance from Wyoming-based banks. Its purpose is to collect essential information and supporting documents required for loan evaluation. By familiarizing themselves with the different types of loan application forms and associated checklists, applicants can ensure they provide accurate and complete information, bolstering their chances of securing a business loan.Wyoming Bank Loan Application Form and Checklist — Business Loan: A Comprehensive Guide Introduction: The Wyoming Bank Loan Application Form and Checklist — Business Loan is a crucial document required for individuals and businesses seeking financial assistance from banks based in Wyoming, United States. This comprehensive guide aims to provide detailed information about the purpose, components, and types of Wyoming Bank Loan Application Forms and their respective checklists, ensuring a smooth and successful loan application process. Purpose: The primary purpose of the Wyoming Bank Loan Application Form and Checklist — Business Loan is to gather essential information from borrowers who wish to secure a business loan from a Wyoming bank. This form serves as a standardized document ensuring consistency in the application process, enabling banks to evaluate loan requests efficiently. The checklist assists loan applicants in organizing the necessary supporting documents, enhancing their chances of securing a loan. Components of the Wyoming Bank Loan Application Form: 1. Contact Information: Applicant's personal and business contact details, such as name, address, phone numbers, and email address. 2. Business Information: Detailed information about the business entity, including legal structure, industry, number of employees, and years in operation. 3. Loan Details: Loan amount requested, purpose of the loan, repayment terms, desired interest rate, and proposed collateral (if applicable). 4. Financial Statements: Comprehensive financial statements, including income statement, balance sheet, and cash flow statement, highlighting the business's financial health. 5. Business Plan: A detailed outline of the business's objectives, strategies, market analysis, sales projections, and operational plans. 6. Collateral Details: Identification and valuation of assets offered as collateral against the loan, if required by the bank. 7. Credit History: Comprehensive details about the applicant's credit history, including outstanding loans, credit scores, and any past bankruptcies or defaults. 8. Personal Financial Statements: Personal financial information, including assets, liabilities, income, and expenses of the business owner or applicants associated with the loan. 9. Legal and Regulatory Compliance: Documentation confirming compliance with relevant local, state, and federal regulations. 10. Other Supporting Documents: Various additional documents, such as tax returns, licenses, permits, insurance policies, and any legal agreements associated with the business. Types of Wyoming Bank Loan Application Forms and Checklists: 1. Small Business Loan Application Form and Checklist: Specifically designed for small businesses or startups seeking loans to fund their operations, expansion, or working capital requirements. 2. Commercial Loan Application Form and Checklist: Aimed at established businesses requiring larger loan amounts for significant projects like real estate acquisition, large-scale equipment purchases, or business acquisitions. 3. SBA Loan Application Form and Checklist: Catering to businesses seeking loans guaranteed by the Small Business Administration (SBA) to facilitate easier access to financing. 4. Agricultural Loan Application Form and Checklist: Tailored for agricultural businesses or farmers in need of loans to support farming operations, rural development, or purchase farm equipment. 5. Start-Up Loan Application Form and Checklist: Designed specifically for entrepreneurs or individuals looking for financial support to establish a new business venture. In conclusion, the Wyoming Bank Loan Application Form and Checklist — Business Loan is a comprehensive tool for individuals and businesses seeking financial assistance from Wyoming-based banks. Its purpose is to collect essential information and supporting documents required for loan evaluation. By familiarizing themselves with the different types of loan application forms and associated checklists, applicants can ensure they provide accurate and complete information, bolstering their chances of securing a business loan.