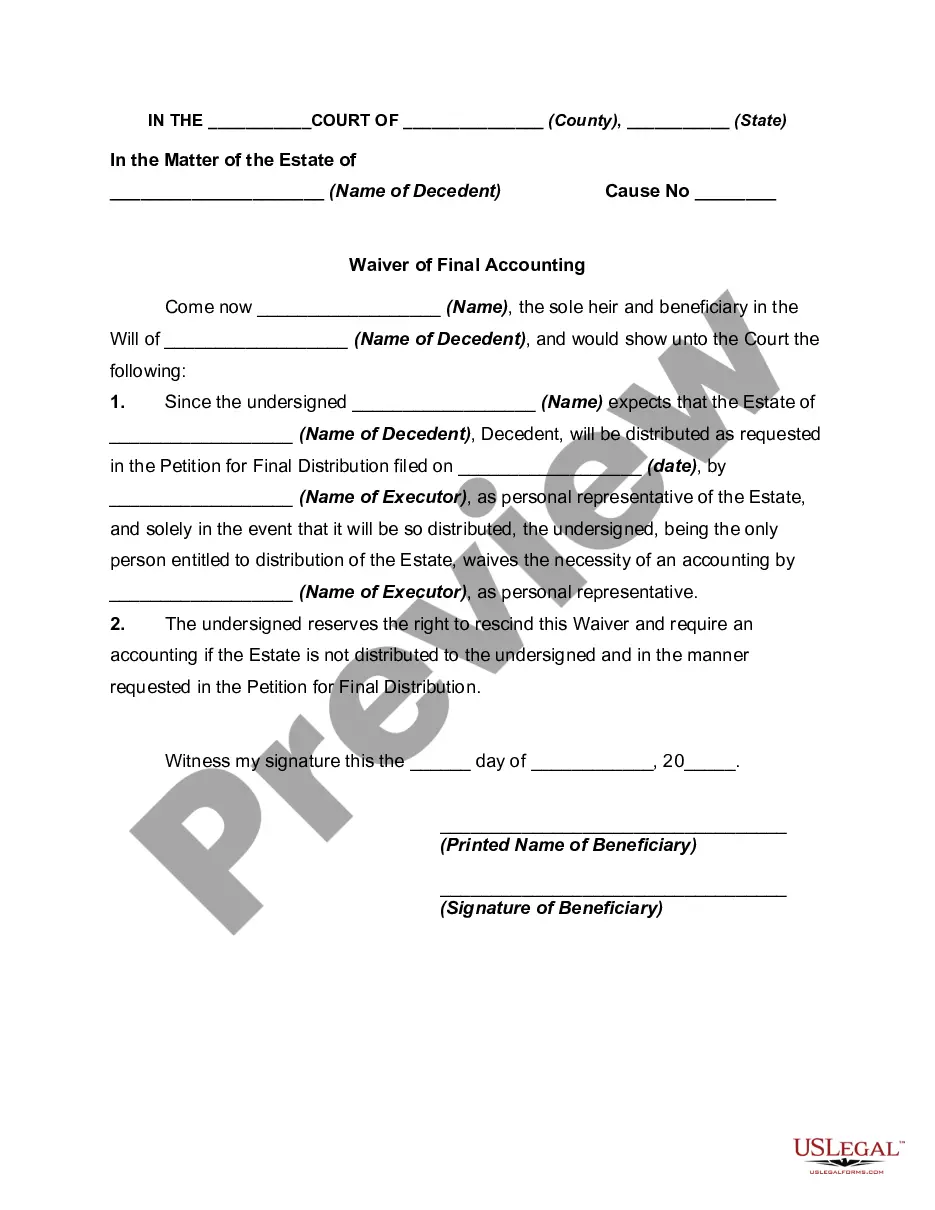

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

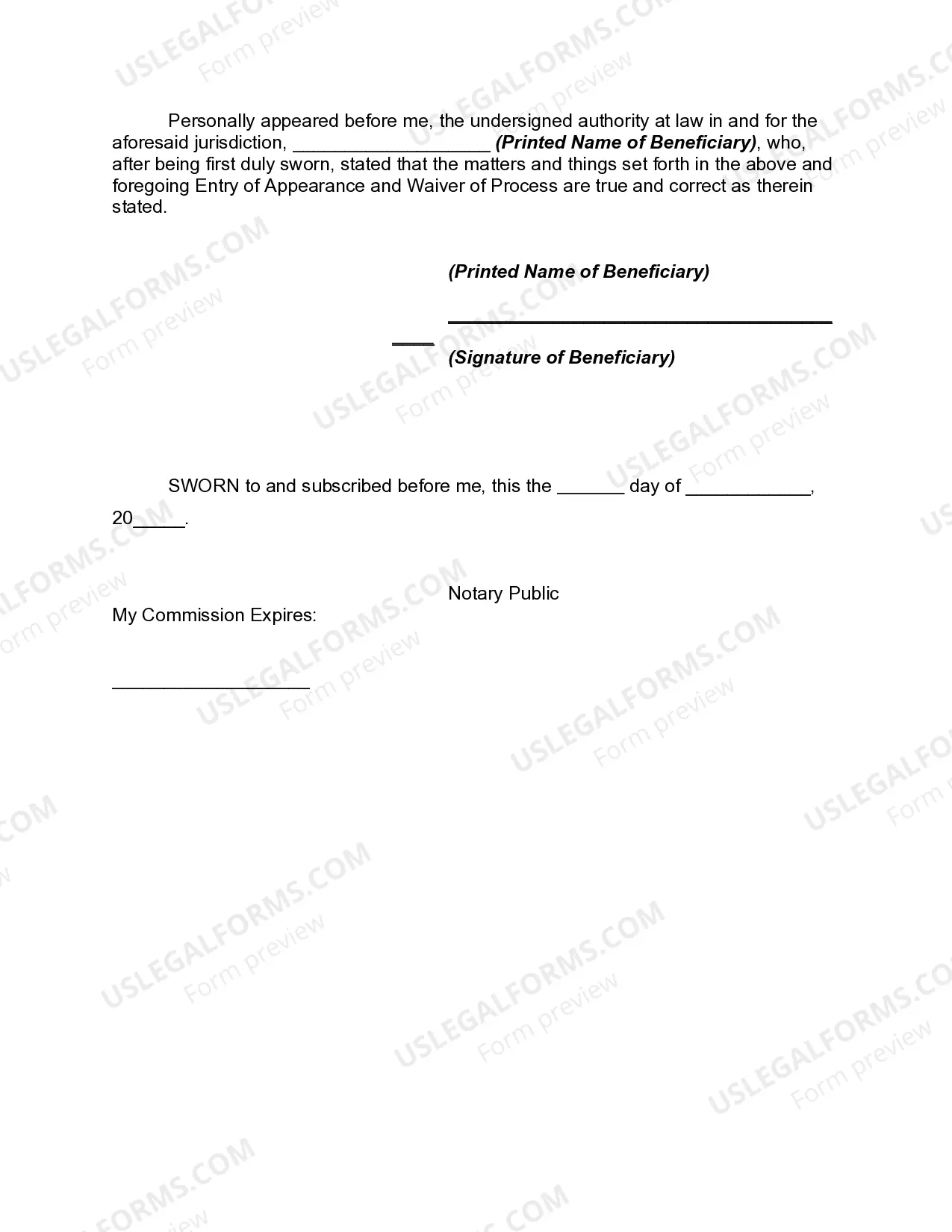

A Wyoming Waiver of Final Accounting by Sole Beneficiary is a legal document that allows a sole beneficiary of a trust or estate to waive their right to receive a final accounting of the assets, liabilities, and distributions that occurred during the administration of the trust or estate. This waiver essentially acknowledges that the beneficiary has received all necessary information and is satisfied with how the trust or estate has been handled. By signing a Wyoming Waiver of Final Accounting, the sole beneficiary releases the trustee or executor from the obligation to provide a detailed report of the financial transactions and distributions associated with the trust or estate. This waiver is typically granted if the beneficiary has full confidence in the trustee's or executor's ability to handle the affairs of the trust or estate effectively and honestly. The Wyoming Waiver of Final Accounting by Sole Beneficiary is particularly relevant for individuals residing or operating within the state of Wyoming. Being aware of and understanding the different types of waivers available within the state is crucial. While there may not be specific variations of the Wyoming Waiver of Final Accounting by Sole Beneficiary, it is essential to consult with an attorney or legal professional to ensure compliance with Wyoming state laws and regulations when drafting or signing such a document. This waiver offers peace of mind to both the beneficiary and the trustee or executor by minimizing the administrative burden associated with providing a detailed final accounting. It streamlines the process of trust or estate administration, allowing for a quicker distribution of assets to the beneficiary. However, it is crucial for the sole beneficiary to carefully evaluate their trust or estate situation before signing the waiver, as it permanently eliminates their right to receive a formal report of the financial transactions involved. In summary, a Wyoming Waiver of Final Accounting by Sole Beneficiary is a legal document used within the state of Wyoming that allows a sole beneficiary to waive their right to receive a detailed final accounting of the trust or estate. While there may not be different types of this waiver specifically, understanding the nuances of Wyoming state laws is paramount. Seeking legal advice is always recommended before proceeding with the signing of such a document to ensure that all aspects of the trust or estate administration are properly addressed and executed.