Wyoming Outline of Lease of Business Premises

Description

How to fill out Outline Of Lease Of Business Premises?

If you wish to accumulate, download, or create legal document templates, utilize US Legal Forms, the leading collection of legal forms available online.

Take advantage of the site's straightforward and convenient search feature to obtain the documents you need.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the payment.

Step 6. Choose the format of the legal form and download it to your device.

- Use US Legal Forms to acquire the Wyoming Outline of Lease of Business Premises in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to retrieve the Wyoming Outline of Lease of Business Premises.

- You can also find forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

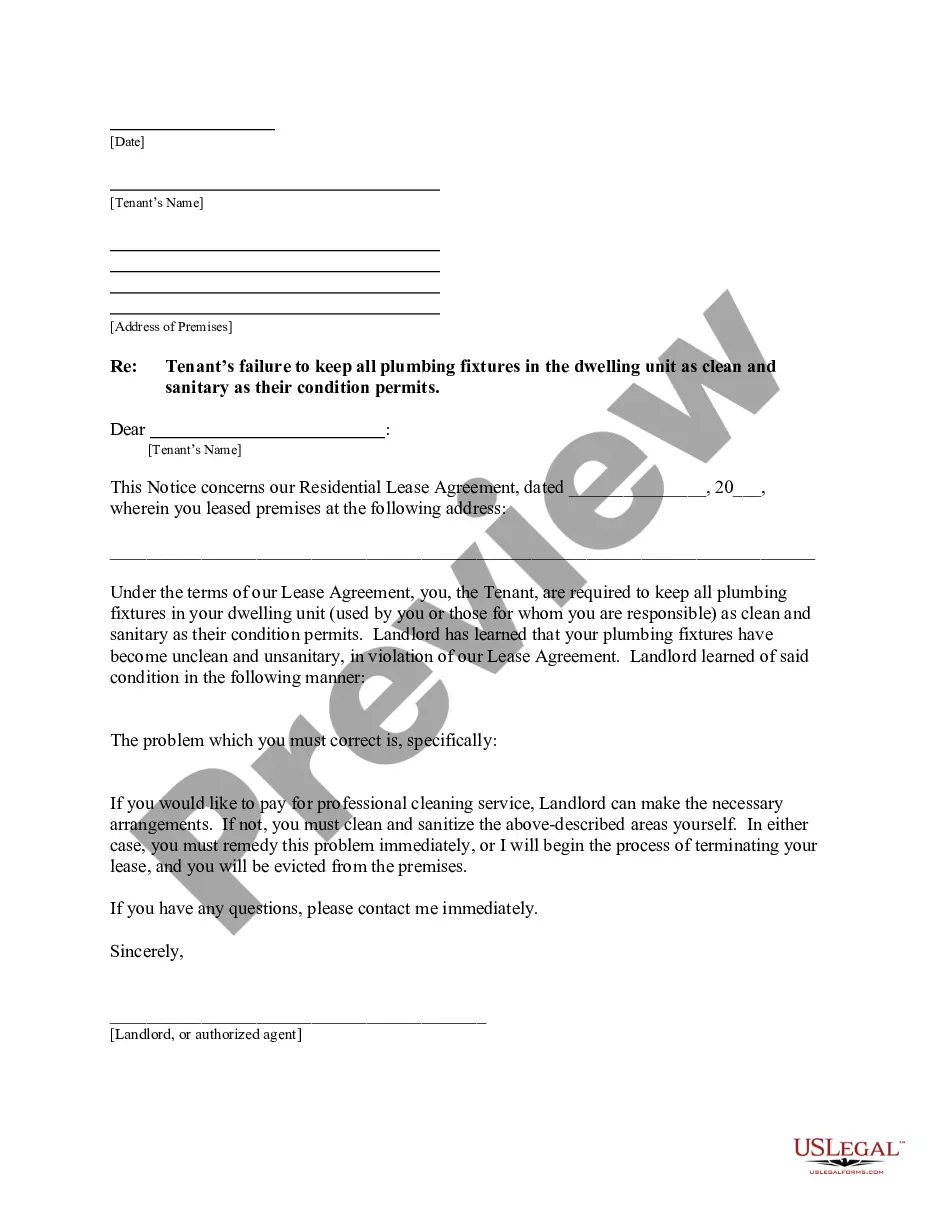

- Step 2. Use the Preview option to review the contents of the form. Remember to read the description.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

To fill out a commercial lease agreement, begin by reviewing the Wyoming Outline of Lease of Business Premises for specific terms to include. Provide details like the lease duration, rental amount, and responsibilities of both the landlord and tenant. Be thorough and accurate, and ensure both parties review and sign the document to finalize the lease.

Yes, a handwritten lease agreement can be legally binding as long as it includes the essential terms and is signed by both parties. However, following the Wyoming Outline of Lease of Business Premises can help in ensuring clarity and avoiding disputes. It is important to document all agreements to protect your interests.

Yes, you can type up your own lease agreement using templates based on the Wyoming Outline of Lease of Business Premises. Utilize clear language to outline the terms, conditions, and obligations of both parties. If you are unsure about any terms, consider consulting a legal expert to ensure compliance with state laws.

While it is not mandatory to hire a lawyer to draft a lease agreement, having legal assistance can be beneficial. A lawyer can help you understand the nuances of the Wyoming Outline of Lease of Business Premises and ensure that your lease adheres to applicable laws. This can provide peace of mind and prevent future legal issues.

To lease a business property, start by identifying your requirements and budget. Next, search for suitable properties and review their lease agreements in light of the Wyoming Outline of Lease of Business Premises. Once you find a property, negotiate terms with the landlord and ensure all agreements are documented in writing.

Absolutely, a landlord can create their own lease agreement following the Wyoming Outline of Lease of Business Premises. This allows landlords to tailor the lease according to their needs and specifications. However, it is critical to include legally required terms and conditions to protect both the landlord's and tenant's rights.

Yes, you can write your own lease agreement by following the Wyoming Outline of Lease of Business Premises. Make sure to include essential terms such as rental amount, duration, and responsibilities of both parties. However, it's crucial to ensure that your lease complies with state laws and regulations.

To get out of a lease in Wyoming, review your lease document to identify exit options. You may also negotiate with your landlord for an early termination. Resources like US Legal Forms can provide you with the Wyoming Outline of Lease of Business Premises to ensure that you follow the correct legal procedures.

Yes, it is possible to break a lease in Wyoming, although specific conditions must be met. The Wyoming Outline of Lease of Business Premises outlines various factors, such as lease violations or tenant rights, that might allow you to terminate your lease early. Understanding these provisions can empower you to make informed decisions.

Lease documents are generally considered private agreements between the landlord and tenant. However, certain information may be accessible through public property records, depending on jurisdiction. For clarity on the Wyoming Outline of Lease of Business Premises, consider consulting local regulations or resources that specialize in lease agreements.