Are you in the placement where you require files for either enterprise or personal purposes virtually every working day? There are a lot of legitimate papers layouts available on the net, but locating ones you can rely on isn`t straightforward. US Legal Forms offers a huge number of develop layouts, much like the Wyoming Two Person Member Managed Limited Liability Company Operating Agreement, which are written to fulfill federal and state needs.

If you are previously knowledgeable about US Legal Forms web site and get a free account, merely log in. Next, it is possible to acquire the Wyoming Two Person Member Managed Limited Liability Company Operating Agreement web template.

Unless you offer an account and need to start using US Legal Forms, follow these steps:

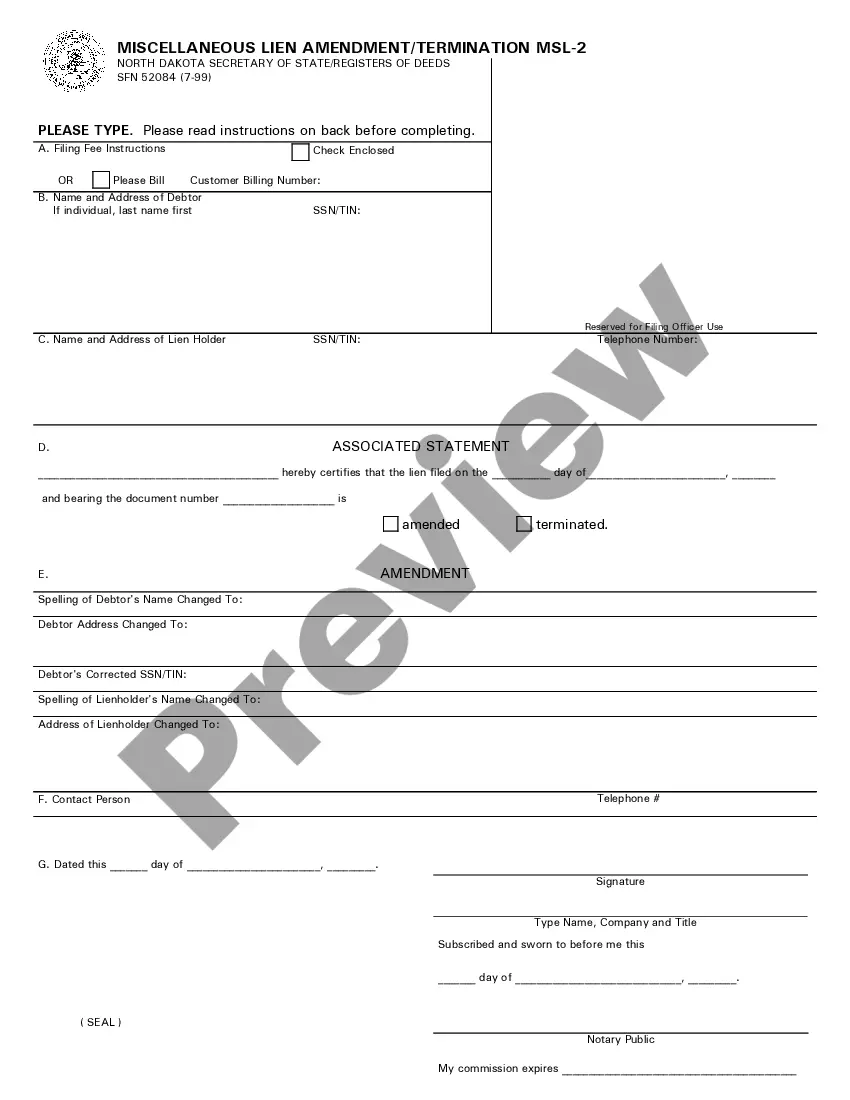

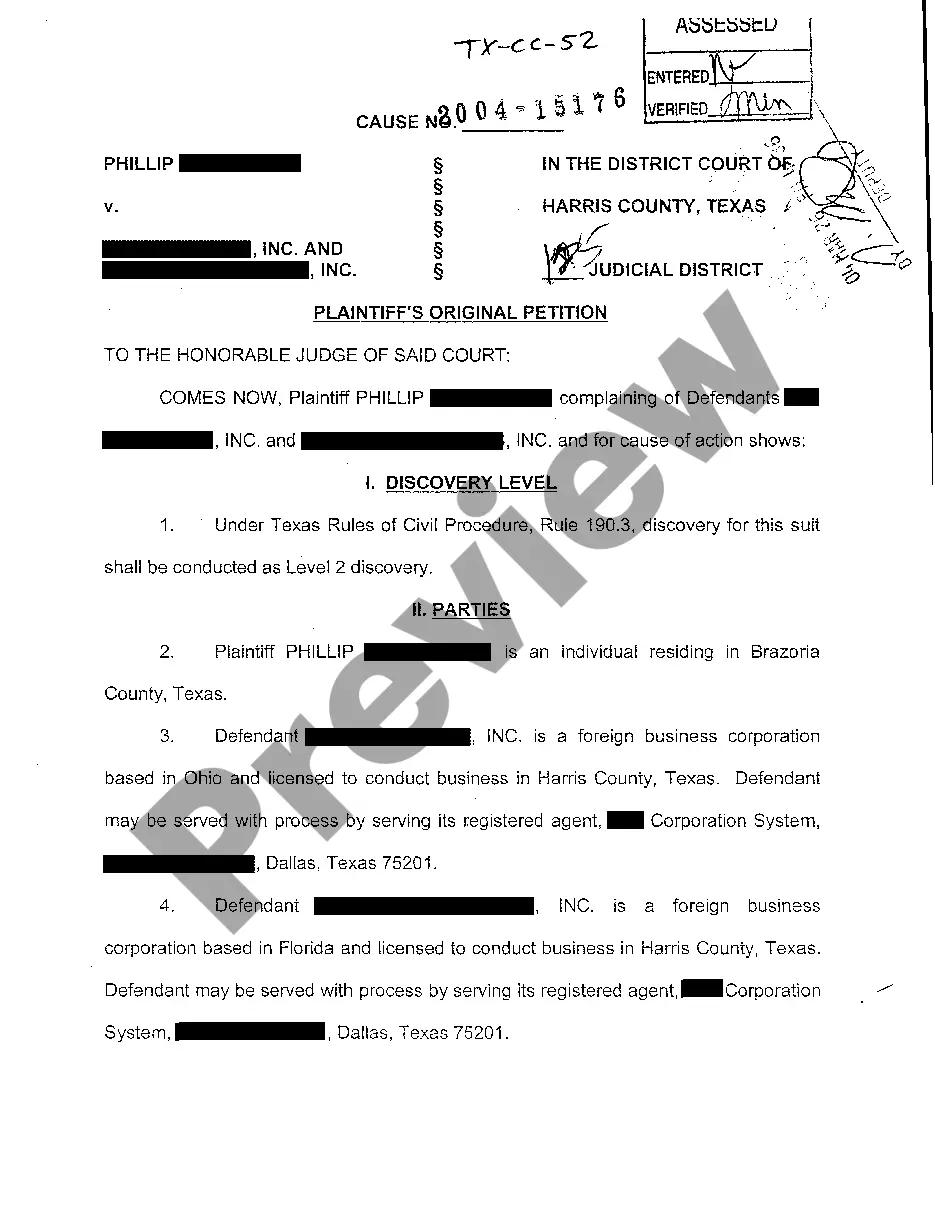

- Discover the develop you will need and ensure it is for that right area/state.

- Take advantage of the Preview button to review the form.

- See the outline to actually have selected the proper develop.

- In case the develop isn`t what you`re searching for, utilize the Look for discipline to get the develop that meets your requirements and needs.

- If you find the right develop, click Get now.

- Opt for the costs prepare you want, fill in the desired info to generate your money, and pay for your order with your PayPal or credit card.

- Select a practical paper structure and acquire your version.

Find each of the papers layouts you have bought in the My Forms food selection. You can obtain a more version of Wyoming Two Person Member Managed Limited Liability Company Operating Agreement any time, if needed. Just click on the needed develop to acquire or print out the papers web template.

Use US Legal Forms, by far the most substantial variety of legitimate kinds, to save lots of time as well as avoid blunders. The service offers appropriately produced legitimate papers layouts that can be used for a selection of purposes. Generate a free account on US Legal Forms and initiate creating your life easier.