Wyoming Sample Letter for Exemption of Ad Valorem Taxes

Description

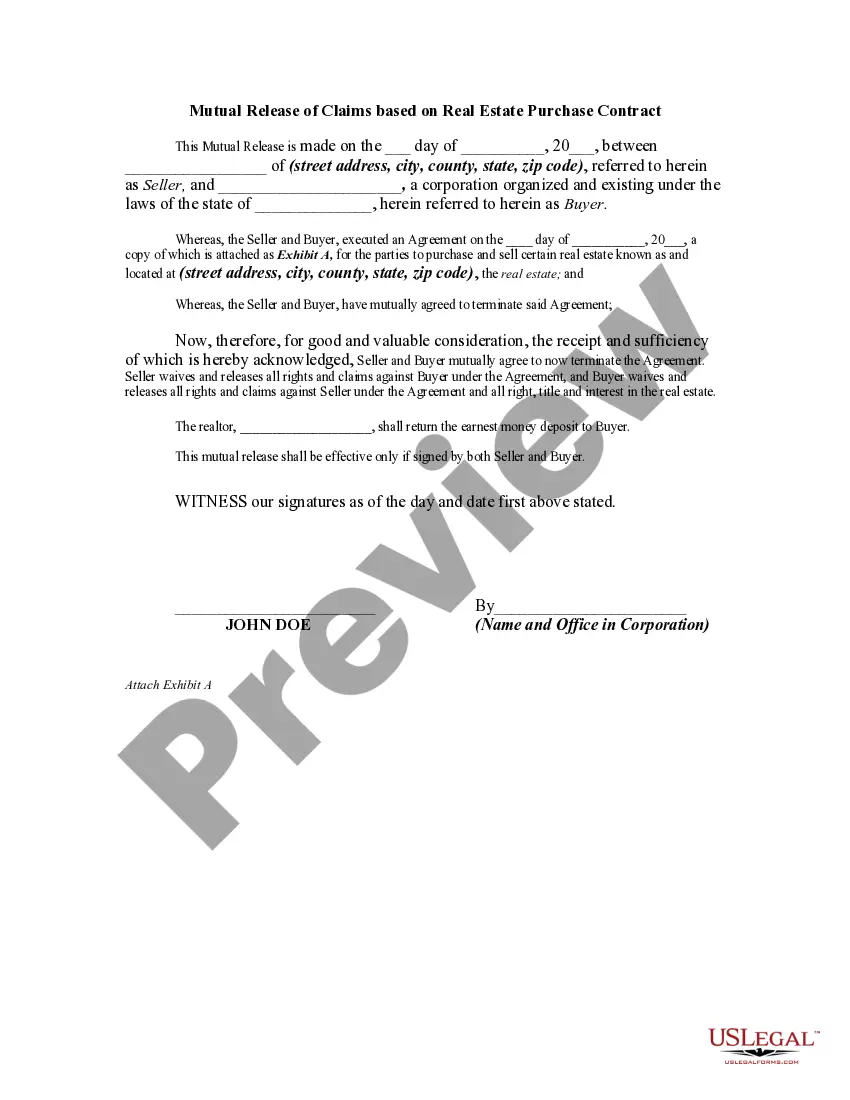

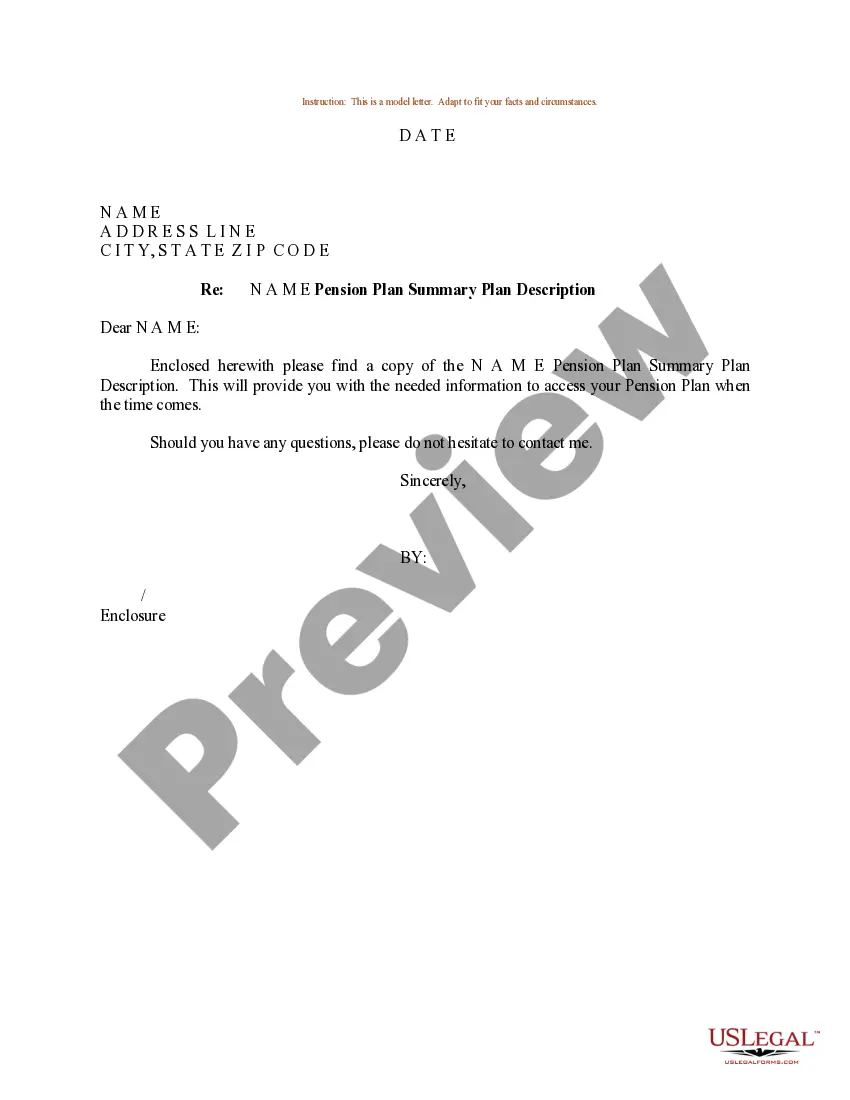

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

If you have to comprehensive, acquire, or printing lawful papers layouts, use US Legal Forms, the biggest assortment of lawful forms, that can be found on-line. Make use of the site`s simple and easy convenient lookup to obtain the paperwork you want. A variety of layouts for company and individual purposes are categorized by categories and suggests, or keywords. Use US Legal Forms to obtain the Wyoming Sample Letter for Exemption of Ad Valorem Taxes in a couple of click throughs.

Should you be presently a US Legal Forms consumer, log in for your accounts and click on the Acquire key to find the Wyoming Sample Letter for Exemption of Ad Valorem Taxes. You can even entry forms you formerly acquired within the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for that appropriate city/nation.

- Step 2. Utilize the Preview choice to check out the form`s content. Never forget about to read through the information.

- Step 3. Should you be unsatisfied with the kind, utilize the Search industry on top of the display to get other variations of the lawful kind web template.

- Step 4. Upon having located the form you want, click on the Buy now key. Opt for the pricing prepare you favor and add your credentials to register to have an accounts.

- Step 5. Method the financial transaction. You can use your credit card or PayPal accounts to accomplish the financial transaction.

- Step 6. Find the structure of the lawful kind and acquire it on your system.

- Step 7. Comprehensive, change and printing or sign the Wyoming Sample Letter for Exemption of Ad Valorem Taxes.

Each and every lawful papers web template you get is yours for a long time. You have acces to every single kind you acquired within your acccount. Select the My Forms area and pick a kind to printing or acquire yet again.

Remain competitive and acquire, and printing the Wyoming Sample Letter for Exemption of Ad Valorem Taxes with US Legal Forms. There are many professional and state-certain forms you can use for your personal company or individual needs.

Form popularity

FAQ

The county treasurer collects a sales or use tax on all vehicle purchases. Sales tax applies where the purchase of the vehicle occurred in Wyoming. Use tax applies where the purchase occurred outside of Wyoming and is for the use, storage or consumption of the vehicle within Wyoming.

A property tax in Wyoming is an ad valorem tax. Therefore, the more your property is worth, the higher your taxes are.

There are two property tax relief programs in Wyoming statute that use age as one of the criteria (Property Tax Deferral Program and the Tax Refund for the Elderly and Disabled) and three other statutory property tax relief programs which Wyoming seniors may qualify for, but do not include the age of the applicant ...

Section 39-13-105 - Exemptions. 39-13-105. Exemptions. (a) The following persons who are bona fide Wyoming residents for at least three (3) years at the time of claiming the exemption are entitled to receive the tax exemption provided by W.S. 39-11-105(a)(xxiv):

Overview of Wyoming Taxes The state's average effective property tax rate is 0.55%, 10th-lowest in the country (including Washington, D.C.). The $1,452 median annual property tax payment in Wyoming is also quite low, as it's around $1,350 below the national mark. Not in Wyoming?

Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items. The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption.

Tax-exempt goods Examples include groceries purchased with food stamps, prescription medications, and most medical supplies. We recommend businesses review the laws and rules put forth by the Wyoming Department of Revenue to stay up to date on which goods are taxable and which are exempt, and under what conditions.

Wyoming does not have an individual income tax. Wyoming also does not have a corporate income tax. Wyoming has a 4.00 percent state sales tax, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 5.36 percent.