A chose in action is essentially a right to sue. It is an intangible personal property right recognized and protected by the law, that has no existence apart from the recognition given by the law, and that confers no present possession of a tangible ob

Wyoming Assignment of Money Judgment

Description

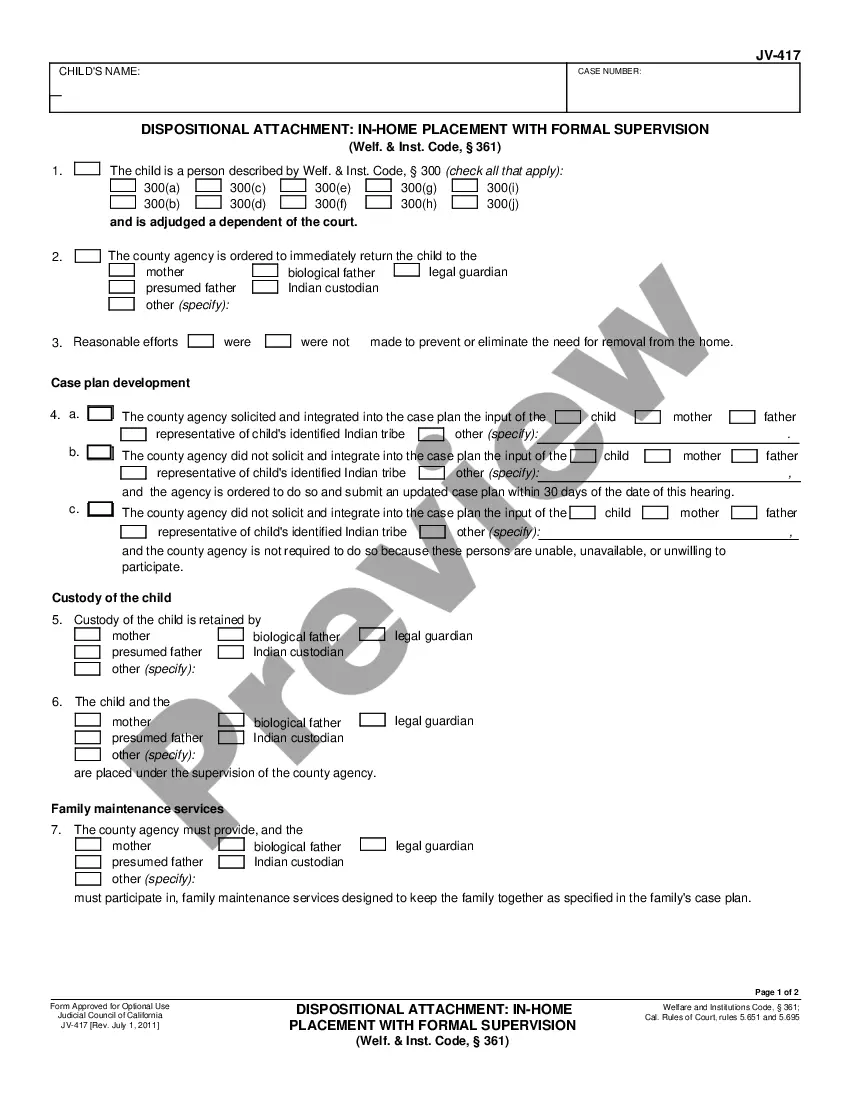

How to fill out Assignment Of Money Judgment?

Discovering the right lawful record format might be a have a problem. Of course, there are a lot of layouts available online, but how can you find the lawful form you require? Make use of the US Legal Forms web site. The service provides 1000s of layouts, for example the Wyoming Assignment of Money Judgment, which you can use for business and private requires. All of the kinds are checked by specialists and satisfy state and federal requirements.

Should you be presently registered, log in in your profile and click the Acquire key to get the Wyoming Assignment of Money Judgment. Make use of profile to look through the lawful kinds you have bought formerly. Go to the My Forms tab of the profile and get an additional duplicate of the record you require.

Should you be a fresh end user of US Legal Forms, allow me to share basic directions that you should stick to:

- Initially, be sure you have chosen the appropriate form for the city/region. You can check out the form making use of the Review key and study the form description to make certain it is the right one for you.

- In the event the form will not satisfy your needs, take advantage of the Seach discipline to obtain the right form.

- When you are certain that the form is proper, click the Buy now key to get the form.

- Opt for the pricing plan you desire and enter in the necessary info. Make your profile and buy the order with your PayPal profile or bank card.

- Select the data file file format and obtain the lawful record format in your system.

- Full, change and print and sign the attained Wyoming Assignment of Money Judgment.

US Legal Forms is definitely the largest library of lawful kinds in which you can find various record layouts. Make use of the service to obtain expertly-created files that stick to condition requirements.

Form popularity

FAQ

(A) In addition to the disclosures required by paragraph (1), (1.1) or (1.2), a party must disclose to the other parties the identity of any witness it may use at trial to present evidence under Wyoming Rule of Evidence 702, 703, or 705. (B) Witnesses Who Must Provide a Written Report.

This rule freely authorizes the taking of depositions under the same circumstances and by the same methods whether for the purpose of discovery or for the purpose of obtaining evidence.

At any time more than 60 days after service of the complaint and at least 28 days before the date set for trial, any party may serve on an opposing party an offer to allow settlement or judgment on specified terms, with the costs then accrued.

The court on motion of a defendant may grant a new trial to that defendant if required in the interest of justice. If trial was by the court without a jury, the court, on motion of a defendant for a new trial, may vacate the judgment if entered, take additional testimony, and direct the entry of a new judgment.

This rule applies to a dismissal of any counterclaim, crossclaim, or third-party claim. A claimant's voluntary dismissal under Rule 41(a)(1)(A)(i) must be made: (1) before a responsive pleading is served; or (2) if there is no responsive pleading, before evidence is introduced at a hearing or trial.

Rule 56 - Summary judgment (a) Motion for Summary Judgment or Partial Summary Judgment. A party may move for summary judgment, identifying each claim or defense-or the part of each claim or defense-on which summary judgment is sought.

Rule 60 - Relief from a judgment or order (a) Corrections Based on Clerical Mistakes; Oversights and Omissions. The court may correct a clerical mistake or a mistake arising from oversight or omission whenever one is found in a judgment, order, or other part of the record.

At any time more than 60 days after service of the complaint and at least 28 days before the date set for trial, any party may serve on an opposing party an offer to allow settlement or judgment on specified terms, with the costs then accrued.