This is a triple net lease between two Churches. A triple net lease is a lease agreement on a property where the tenant or lessee agrees to pay all Real Estate Taxes (Net), Building Insurance (Net) and Common Area Maintenance (Net) on the property in addition to any normal fees that are expected under the agreement (rent, etc.). In such a lease, the tenant or lessee is responsible for all costs associated with repairs or replacement of the structural building elements of the property.

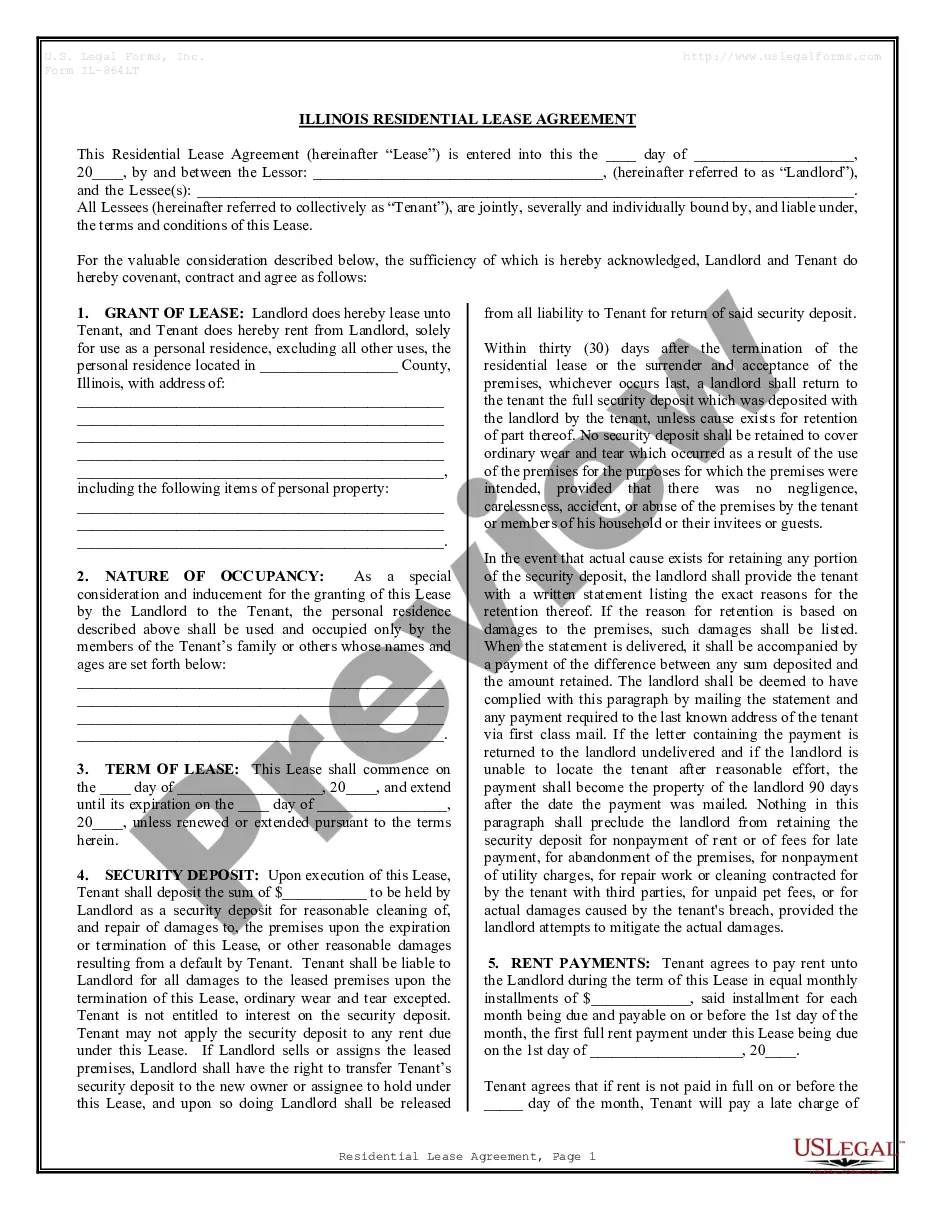

A Wyoming Lease Agreement Between Two Nonprofit Church Corporations is a legally binding document that governs the terms and conditions of a lease agreement between two nonprofit church organizations in the state of Wyoming. This agreement defines the rights and responsibilities of both parties involved in the lease of a property, ensuring a smooth and transparent leasing process. Key Elements of a Wyoming Lease Agreement Between Two Nonprofit Church Corporations: 1. Parties Involved: The lease agreement identifies the two nonprofit church corporations involved in the lease, stating their legal names, addresses, and primary contact persons. 2. Property Details: This section outlines the details of the property being leased, including its physical address, legal description, and any other relevant information necessary for identification. 3. Lease Term: The agreement specifies the duration of the lease, such as the start and end dates, and may also include provisions for renewal or termination. 4. Rent Payments: This clause details the rental amount, payment schedule, and accepted payment methods. It may also include information about security deposits, late fees, and consequences for non-payment. 5. Use of Premises: This section specifies the permitted use of the leased property, emphasizing that it must align with the nonprofit church corporations' activities. It may contain any restrictions or limitations on the use, such as no subleasing or commercial use. 6. Maintenance and Repairs: The agreement clearly outlines the responsibilities of maintaining and repairing the leased property. It may define which party is responsible for specific repairs and maintenance tasks, ensuring the property remains in a suitable condition throughout the lease term. 7. Insurance: This clause outlines the insurance requirements for the lease agreement, such as general liability insurance and property insurance. Both parties may be required to provide evidence of insurance coverage. 8. Indemnification: An indemnification clause protects the parties involved from legal liability by requiring one party to compensate the other for any claims, damages, or losses arising out of the lease agreement. 9. Dispute Resolution: This section establishes the method for resolving any conflicts or disputes that may arise between the two nonprofit church corporations during the lease term. It may call for informal negotiation or mandatory mediation before seeking legal remedies. 10. Governing Law: The lease agreement identifies that it will be governed by the laws of the state of Wyoming and any specific county or city regulations applicable. Types of Wyoming Lease Agreements Between Nonprofit Church Corporations: 1. Long-Term Lease Agreement: This type of lease agreement is beneficial for nonprofit church corporations looking for a stable, extended leasing period, allowing for long-term planning and stability for both organizations. 2. Short-Term Lease Agreement: Nonprofits may opt for a short-term lease agreement if they require temporary use of a property or if they are unsure about their future space needs. This type of agreement typically covers a shorter duration, such as one or two years. 3. Lease Agreement with Purchase Option: In some cases, nonprofit church corporations may negotiate a lease agreement that includes an option for purchasing the property at a later date. This can be advantageous if the organizations plan to eventually acquire and own the property. 4. Sublease Agreement: Nonprofit church corporations that have excess space within their leased property may enter into a sublease agreement with another nonprofit organization, allowing them to share the space and split the rental costs. It is important to consult legal professionals or attorneys specializing in real estate and nonprofit law to ensure compliance with Wyoming state regulations and address any specific requirements or provisions related to nonprofit church corporations and leasing arrangements.