In most states, the process for forming a nonprofit corporation is different from the process for forming a for-profit corporation. A nonprofit corporation must file additional documentation with state and federal authorities to be recognized and obtain the advantages of nonprofit status. You can complete and file the paperwork yourself, or use an online document preparation website. Recognition as a nonprofit corporation confers three main advantages: tax breaks for the corporation, tax breaks for donors, and the legal right to solicit donations. In most states, nonprofit corporations are governed by the Model Nonprofit Corporation Act.

Wyoming Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association

Description

How to fill out Resolution To Incorporate ASCAP Nonprofit Corporation By Members Of Unincorporated Association?

You might spend hours online trying to locate the legal document template that complies with the federal and state regulations you need. US Legal Forms offers thousands of legal templates that have been reviewed by professionals.

You can download or print the Wyoming Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association from the service.

If you already possess a US Legal Forms account, you can Log In and click the Download button. Afterwards, you can complete, modify, print, or sign the Wyoming Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association. Every legal document template you obtain is yours permanently.

Complete the transaction. You may use your credit card or PayPal account to purchase the legal template. Choose the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, edit, and sign the Wyoming Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association. Access and print thousands of document templates using the US Legal Forms website, which provides the largest variety of legal forms. Leverage professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure you have selected the correct document template for the region/city of your choice.

- Review the document description to confirm you have chosen the correct template.

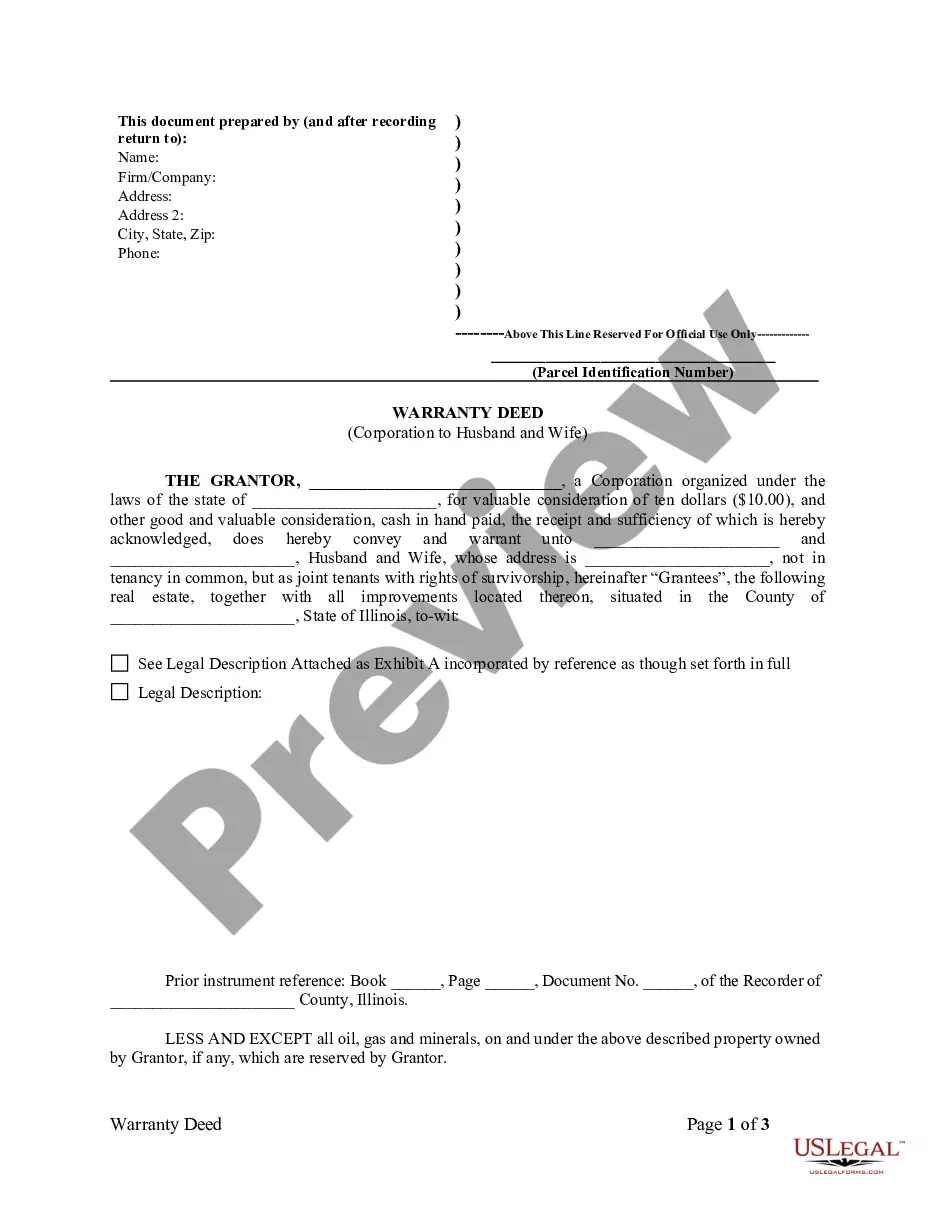

- If available, utilize the Preview button to view the document template as well.

- If you wish to find another version of the template, use the Search field to locate the template that fits your needs and requirements.

- Once you have found the template you want, click Purchase now to proceed.

- Select the pricing plan you desire, enter your credentials, and register for your account on US Legal Forms.

Form popularity

FAQ

The Difference Between Resolutions and BylawsBylaws document the rules for how the corporation shall be governed. Resolutions are prepared as needed to document important decisions and actions taken by the board of directors on behalf of the corporation.

Issuing corporate resolutions is one way for corporations to demonstrate independence and avoid piercing the veil. In fact, all states require C-corporations and S-corporations to issue corporate resolutions to document important board of director decisions.

Clubs and charities are often constituted as unincorporated associations. The members of a management committee of a charity that is formed as an unincorporated association are likely to be charity trustees.

Is that association is the act of associating while corporation is a group of individuals, created by law or under authority of law, having a continuous existence independent of the existences of its members, and powers and liabilities distinct from those of its members.

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.

If an unincorporated association does not apply for tax-exempt status, it files Form 100, California Corporation Franchise or Income Tax Return, with us and computes its tax using the general corporation tax rate. It does not pay the minimum franchise tax.

A nonprofit corporation is able to contract directly with suppliers, financial institutions, and other organizations or individuals. With an unincorporated association, one or more of the association's members must personally enter into such contracts.

An unincorporated association is defined as an association of two or more persons formed for some religious, educational, charitable, social or other non-commercial purpose. Accounts of a sole proprietorship or a DBA are not insured under this account category.

Nonprofit corporations often deal with government agencies on issues of public concern, which may involve applying for grants, loans or other governmental approvals. In many situations, the government agency requires a corporate resolution to verify the board's approval for making the government application.

A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.