Wyoming Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

If you seek to completely, download, or create official document templates, utilize US Legal Forms, the largest collection of legal forms that can be accessed online.

Make use of the site’s user-friendly and convenient search to locate the documents you require.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to discover alternative versions of the legal form template.

Step 4. Once you have located the form you need, click the Purchase now option. Choose the pricing plan you prefer and enter your information to register for an account.

- Use US Legal Forms to obtain the Wyoming Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain option to retrieve the Wyoming Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps listed below.

- Step 1. Ensure that you have selected the form for the appropriate city/state.

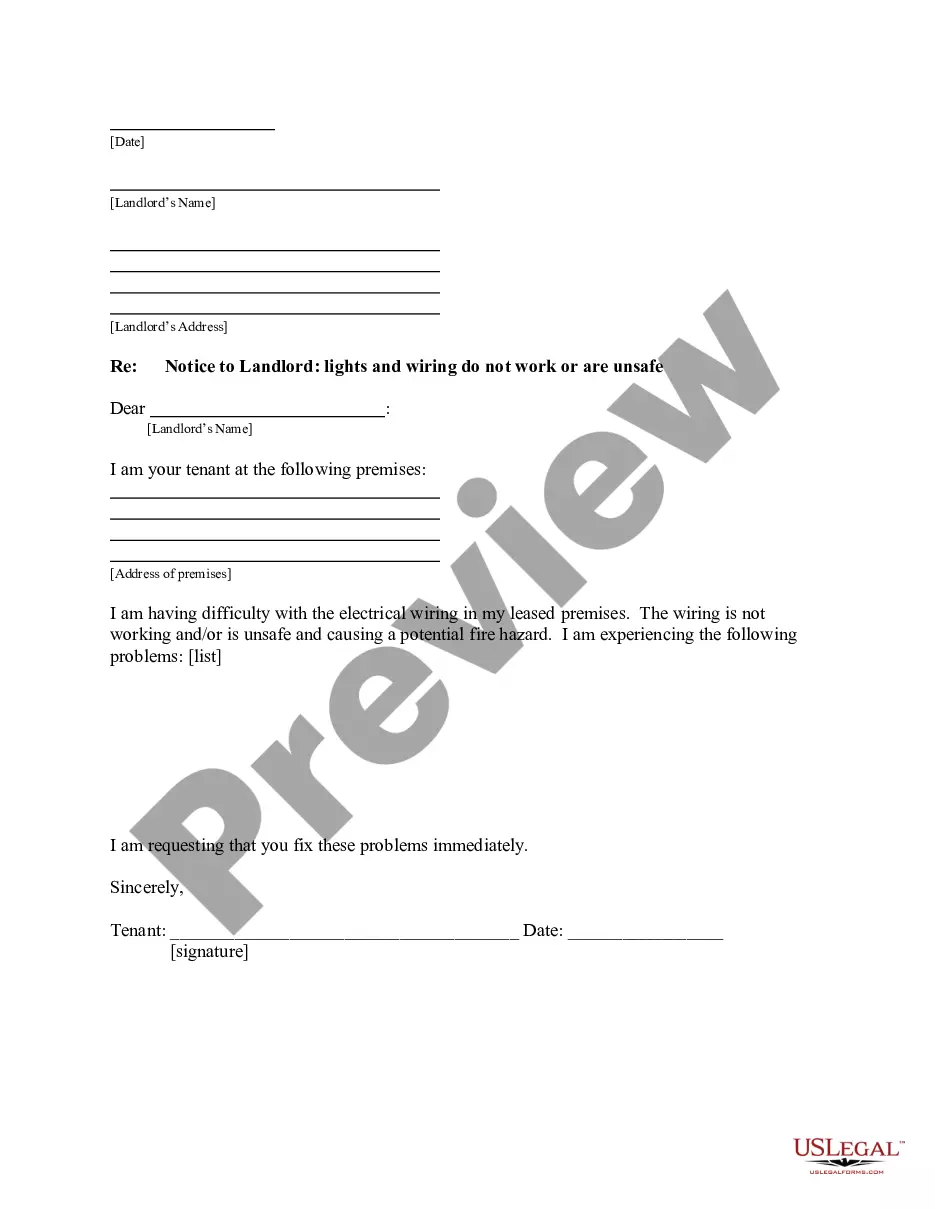

- Step 2. Use the Preview option to review the form’s contents. Be sure to read the summary.

Form popularity

FAQ

If you inherit from a simple trust, you must report and pay taxes on the money. By definition, anything you receive from a simple trust is income earned by it during that tax year. The trustee must issue you a Schedule K-1 for the income distributed to you, which you must submit with your tax return.

Well, because a testamentary trust allows the grantor some control over the assets during his or her lifetime. After the grantor passes away, the testamentary trust, which is considered an irrevocable trust, is created. Irrevocable trusts can sometimes protect assets against judgments and creditors.

In Trusts.The residuary beneficiary of a living trust receives all property transfered into the trust that isn't passed to specific beneficiaries. The residuary property is usually easily defined, because the only property to take into consideration is the property that was transferred into the trust.

Article 996 of the New Civil Code provides that If a widow or widower and legitimate children or descendants are left, the surviving spouse has in the succession the same share as that of each of the children.

Generally, capital gains are considered corpus and pass to the residuary beneficiaries. Therefore, capital gains are generally taxed to the trust and reduce the amount passing to the residuary beneficiaries. To reduce income taxes, consideration should be given to distributing income from the trust or estate.

Trusts are a crucial element to Estate Planning as they help provide more control over asset distribution after death. Among the various types available, a Testamentary Trust can be one of the best options for those thinking of their young children or grandchildren.

You calculate TAI by adding together all items of income and then subtracting all expenses attributable to income. If you're required to distribute all of the income in the trust, calculating TAI gives you the exact number you need to pay the beneficiary.

The taxable income of a trust is generally calculated in the same manner as the taxable income of an individual, but the tax may be paid by the trust or by a combination of the trust and its beneficiaries. This is true because trusts are entitled to a deduction known as the Income Distribution Deduction (IDD).

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

A residuary clause in a will sets out who will inherit the remainder of the deceased's assets once any debts, funeral expenses, inheritance tax and legacies have been paid, and any items specifically bequeathed have been distributed to the appropriate beneficiaries.