A Wyoming loan agreement for family members is a legally binding document that outlines the terms and conditions of a loan transaction between family members in the state of Wyoming. This agreement ensures that both parties are aware of their rights, obligations, and responsibilities in the loan arrangement. It is essential to have this written agreement in order to maintain a clear understanding and prevent any potential conflicts or misunderstandings in the future. Key elements of a Wyoming loan agreement for family members include: 1. Parties involved: The agreement starts by identifying the lender (the family member providing the loan) and the borrower (the family member receiving the loan). It is important to clearly state their full legal names and contact information. 2. Loan amount: The agreement must specify the total amount of money being loaned from the lender to the borrower. This amount should be clearly stated in both numeric and written forms. 3. Interest rate: If applicable, the agreement should outline the interest rate that will be charged on the loan amount. Wyoming's law does not have a maximum interest rate for loans between family members, but it is crucial to establish a fair and reasonable rate that is agreeable to both parties. 4. Repayment terms: The agreement should clearly detail the repayment terms, including the frequency (monthly, quarterly, or annually), the due date(s), and the method of payment. It may also mention any late payment penalties or grace period for missed payments. 5. Collateral or security: If the loan is secured against an asset, such as property or a vehicle, the agreement should specify the details of the collateral. This ensures that the lender has a legal claim to the collateral in the event of default. 6. Default provisions: To protect both parties, the agreement should outline the consequences of default, such as penalties, additional interest, or legal actions. The process and remedies for resolving a default should also be stated. 7. Governing law: The agreement should explicitly state that it is governed by Wyoming state laws, which helps clarify any potential legal disputes and ensures compliance with applicable regulations. Different types of Wyoming loan agreements for family members include personal loans, student loans, business loans, or any other form of financial assistance provided within a family circle. The specific type of loan agreement may vary based on the purpose of the loan and the unique circumstances involved. Regardless of the type, it is vital to draft a comprehensive loan agreement to protect both the lender's and borrower's interests.

Wyoming Loan Agreement for Family Member

Description

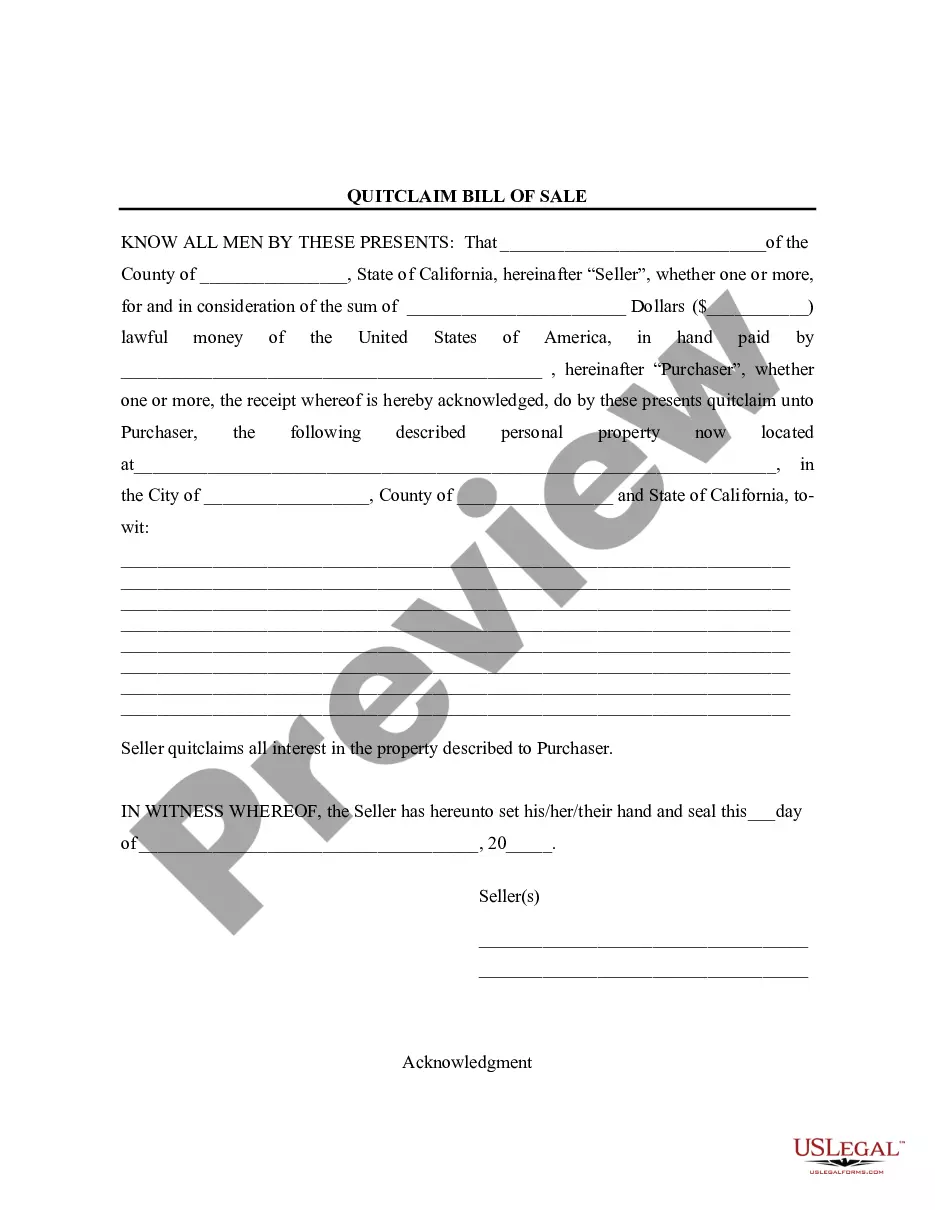

How to fill out Wyoming Loan Agreement For Family Member?

If you wish to total, download, or printing authorized record themes, use US Legal Forms, the greatest assortment of authorized types, that can be found on the web. Utilize the site`s simple and easy handy look for to get the papers you require. Various themes for company and person uses are categorized by types and says, or keywords. Use US Legal Forms to get the Wyoming Loan Agreement for Family Member in just a number of click throughs.

If you are presently a US Legal Forms consumer, log in to the accounts and then click the Download key to get the Wyoming Loan Agreement for Family Member. You may also accessibility types you earlier downloaded within the My Forms tab of your accounts.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have chosen the shape for your correct town/country.

- Step 2. Take advantage of the Preview method to look through the form`s articles. Don`t overlook to see the information.

- Step 3. If you are not satisfied using the form, take advantage of the Lookup discipline at the top of the display screen to locate other types of your authorized form template.

- Step 4. When you have located the shape you require, click on the Acquire now key. Select the rates program you like and add your qualifications to sign up to have an accounts.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Pick the file format of your authorized form and download it on the device.

- Step 7. Full, modify and printing or signal the Wyoming Loan Agreement for Family Member.

Each authorized record template you buy is your own property eternally. You might have acces to every single form you downloaded in your acccount. Click the My Forms segment and choose a form to printing or download again.

Be competitive and download, and printing the Wyoming Loan Agreement for Family Member with US Legal Forms. There are many skilled and state-particular types you can utilize for your company or person demands.

Form popularity

FAQ

The IRS mandates that any loan between family members be made with a signed written agreement, a fixed repayment schedule, and a minimum interest rate. (The IRS publishes Applicable Federal Rates (AFRs) monthly.)

If you loan a significant amount of money to your kids ? over $10,000 ? you should consider charging interest. If you don't, the IRS can say the interest you should have charged was a gift. In that case, the interest money goes toward your annual gift-giving limit of $17,000 per individual (as of tax year 2023).

Once executed a loan agreement will be legally binding and in effect.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

A family loan is a loan between family members ? but it's up to you and the lender to decide how it's structured. A family loan can have interest or not, be repaid in installments or a lump sum and you could even provide collateral.

The IRS mandates that any loan between family members be made with a signed written agreement, a fixed repayment schedule, and a minimum interest rate. (The IRS publishes Applicable Federal Rates (AFRs) monthly.)

So if you loan someone $50,000, neither of you will pay tax on the loan amount ? but you'll likely need to pay income tax on the interest payments you receive from the borrower. And if you don't charge interest, you may be required to pay tax on the interest you could have charged, and things get a little messy.

If you loan a significant amount of money to your kids ? over $10,000 ? you should consider charging interest. If you don't, the IRS can say the interest you should have charged was a gift. In that case, the interest money goes toward your annual gift-giving limit of $17,000 per individual (as of tax year 2023).