Wyoming Loan Agreement for Car: A Detailed Description A Wyoming Loan Agreement for Car refers to a legally binding contract between a lender and a borrower in Wyoming that outlines the terms and conditions of a loan specifically for purchasing a car. This agreement specifies the responsibilities of both parties, including repayment terms, interest rates, and collateral requirements. Keywords: Wyoming, Loan Agreement, Car, lender, borrower, legally binding contract, terms and conditions, loan, purchasing a car, responsibilities, repayment terms, interest rates, collateral requirements. Different Types of Wyoming Loan Agreement for Car: 1. Secured Car Loan Agreement: This agreement type requires the borrower to provide collateral, such as the car being purchased, which serves as security against the loan. In the event of default, the lender has the right to repossess the vehicle to recover the outstanding debt. 2. Unsecured Car Loan Agreement: Unlike a secured loan, an unsecured car loan does not require collateral. However, due to the higher risk involved for the lender, the interest rates for unsecured loans are generally higher. 3. Installment Sales Agreement: This type of loan agreement allows the borrower to purchase a car through installment payments. The agreement specifies the down payment, the number and amount of monthly installments, and any interest or charges associated with the loan. 4. Dealer Financing Agreement: Some car dealerships offer financing options directly to buyers. This type of loan agreement is facilitated through the dealership and often involves negotiations on the purchase price, down payment, interest rates, and loan terms. The agreement may also outline warranties, maintenance requirements, and after-sales services. 5. Refinance Car Loan Agreement: This agreement comes into play when a borrower wishes to refinance their existing auto loan, either to lower the interest rate or monthly payments. The terms and conditions for refinancing are incorporated into this agreement. In conclusion, a Wyoming Loan Agreement for Car is a legally binding contract that establishes the terms and conditions of a loan specifically designed for purchasing a car in Wyoming. Different types of agreements can include secured or unsecured loans, installment sales agreements, dealer financing agreements, or refinancing agreements. Each type caters to specific requirements and preferences of the borrower and lender.

Wyoming Loan Agreement for Car

Description

How to fill out Wyoming Loan Agreement For Car?

If you need to comprehensive, obtain, or print out legitimate record web templates, use US Legal Forms, the most important assortment of legitimate types, that can be found online. Use the site`s simple and practical research to get the papers you will need. Different web templates for enterprise and individual reasons are sorted by groups and says, or key phrases. Use US Legal Forms to get the Wyoming Loan Agreement for Car within a handful of mouse clicks.

If you are currently a US Legal Forms buyer, log in to the accounts and click the Obtain option to obtain the Wyoming Loan Agreement for Car. Also you can entry types you previously downloaded within the My Forms tab of the accounts.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that appropriate area/region.

- Step 2. Make use of the Review solution to check out the form`s information. Never neglect to learn the explanation.

- Step 3. If you are not satisfied with all the kind, make use of the Look for area near the top of the display screen to locate other types of the legitimate kind web template.

- Step 4. When you have identified the form you will need, go through the Purchase now option. Choose the pricing strategy you prefer and add your credentials to register for the accounts.

- Step 5. Procedure the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to accomplish the financial transaction.

- Step 6. Choose the format of the legitimate kind and obtain it in your gadget.

- Step 7. Complete, change and print out or indication the Wyoming Loan Agreement for Car.

Each and every legitimate record web template you acquire is your own permanently. You have acces to each kind you downloaded with your acccount. Click on the My Forms portion and choose a kind to print out or obtain again.

Remain competitive and obtain, and print out the Wyoming Loan Agreement for Car with US Legal Forms. There are many specialist and state-certain types you may use for the enterprise or individual needs.

Form popularity

FAQ

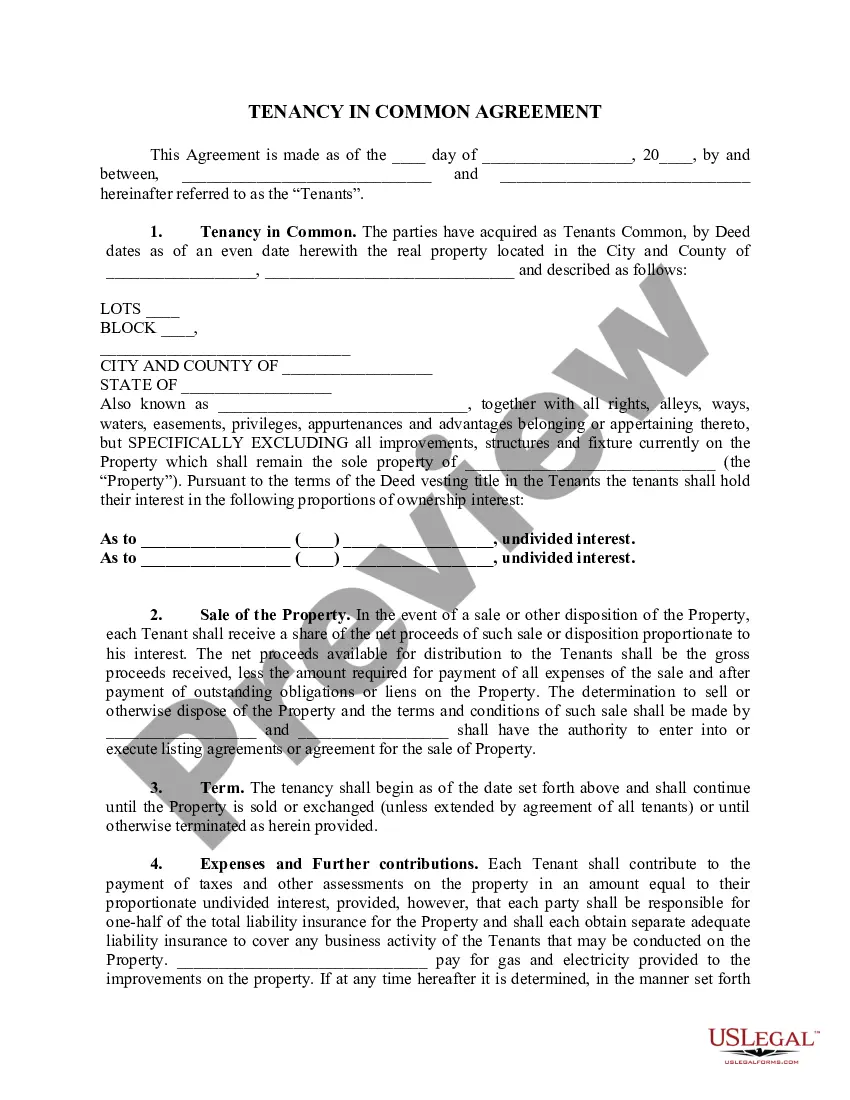

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

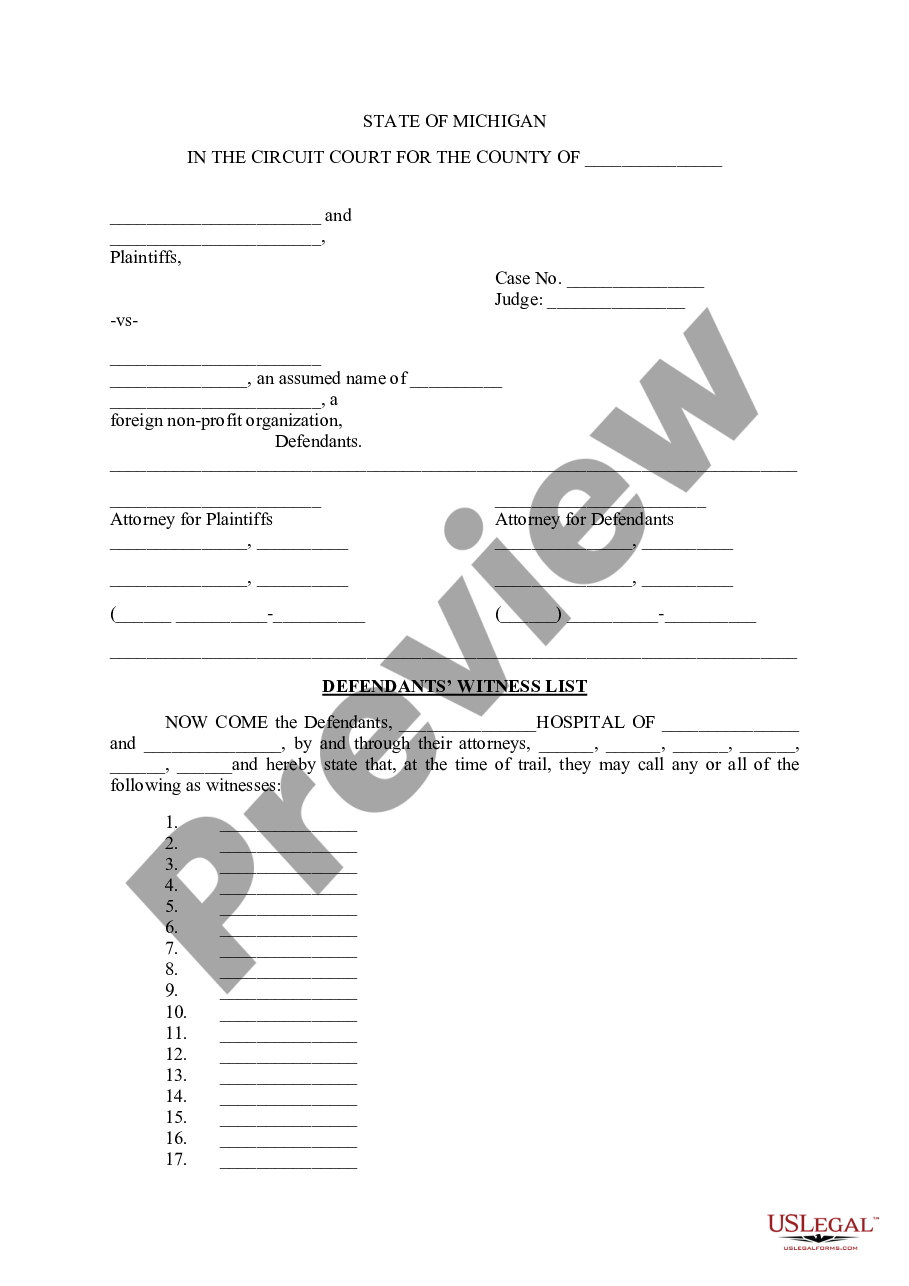

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates.

A simple car promissory note should contain the following information: Both the buyer's and the seller's names and addresses. The manufacturer, model, year, and vehicle identification number of the automobile (VIN) Loan terms, including loan amount, interest rate, and payment schedule.

Secured promissory notes are often used for real estate and auto loans because they provide extra security for the lender.

A bill of sale transfers ownership from seller to buyer. A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car.

No, a promissory note is not a personal guarantee. A promissory message is a commitment an individual makes to repay a loan to their creditors. At the same time, a Personal guarantor takes the burden of a company's debts at the expense of their private properties.