Wyoming Subordination Agreement Subordinating Existing Mortgage to New Mortgage

Description

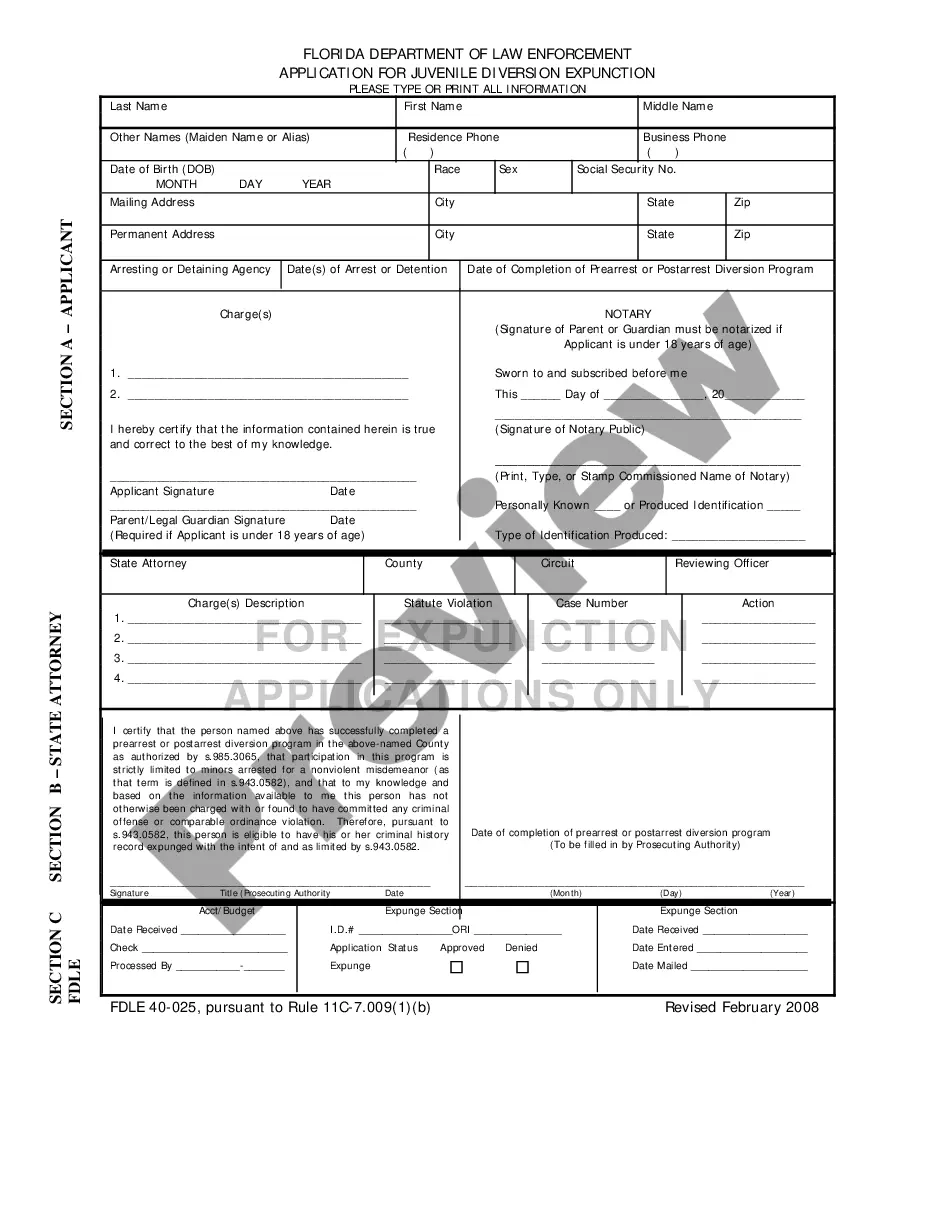

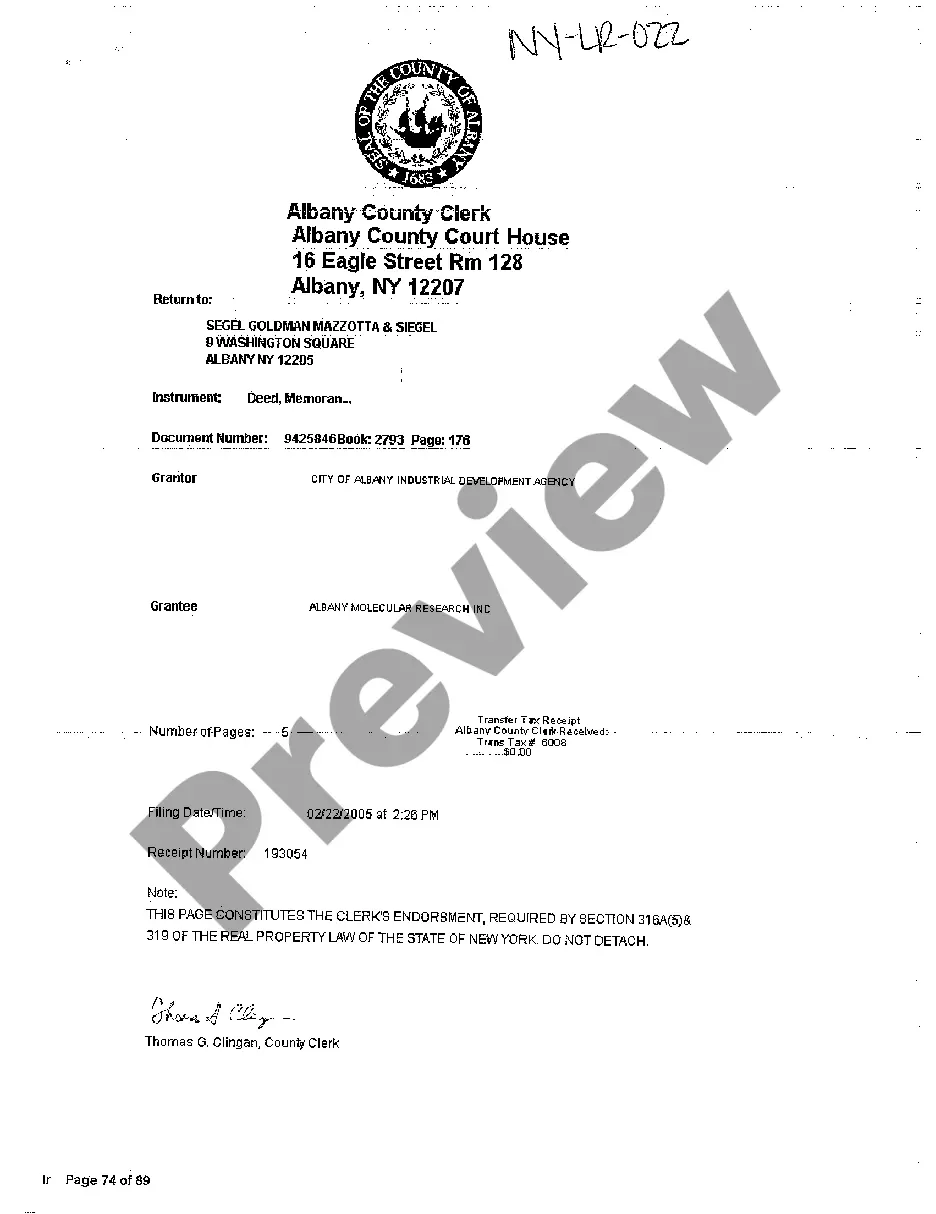

How to fill out Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

Are you currently in the position in which you need to have documents for both business or person reasons nearly every working day? There are plenty of authorized document themes available on the net, but discovering types you can rely is not simple. US Legal Forms provides a large number of kind themes, just like the Wyoming Subordination Agreement Subordinating Existing Mortgage to New Mortgage, that are composed in order to meet state and federal needs.

If you are already acquainted with US Legal Forms web site and also have your account, basically log in. Next, it is possible to acquire the Wyoming Subordination Agreement Subordinating Existing Mortgage to New Mortgage template.

Should you not have an accounts and need to begin to use US Legal Forms, adopt these measures:

- Discover the kind you want and make sure it is for the right metropolis/county.

- Take advantage of the Review button to analyze the shape.

- Look at the information to actually have chosen the correct kind.

- In the event the kind is not what you are searching for, make use of the Look for field to get the kind that meets your needs and needs.

- When you obtain the right kind, just click Acquire now.

- Pick the pricing strategy you desire, fill out the desired details to produce your bank account, and pay for an order making use of your PayPal or charge card.

- Pick a practical paper formatting and acquire your backup.

Get each of the document themes you may have purchased in the My Forms menu. You may get a more backup of Wyoming Subordination Agreement Subordinating Existing Mortgage to New Mortgage anytime, if necessary. Just go through the required kind to acquire or produce the document template.

Use US Legal Forms, by far the most extensive collection of authorized varieties, to save time and steer clear of faults. The services provides expertly made authorized document themes that you can use for a variety of reasons. Generate your account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

Getting A Second Mortgage A second mortgage will become a subordinate loan. If you repay the primary loan within the term of the second mortgage, the second mortgage can take its place as the primary loan.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future. Subordination is the act of yielding priority.

Many people have a subordinate mortgage in the form of a home equity line of credit or home equity loan. A subordinate mortgage is secured by your property but sits in second position, if you have a primary mortgage, for getting paid in the event you default.

Again, if you're refinancing your first mortgage and the property also has a subordinate mortgage, the refinancing lender will usually handle the process of getting the necessary subordination agreement. But you need to ensure that the required subordination agreement is completed before the new loan's closing date.

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.

A subordination real estate mortgage clause gives the loan it's in reference to first lien position. It states that any other loans or liens on the property take a second lien position. Most first mortgage lenders won't fund a loan unless there is a subordination clause giving them first lien position.

Many people have a subordinate mortgage in the form of a home equity line of credit or home equity loan. A subordinate mortgage is secured by your property but sits in second position, if you have a primary mortgage, for getting paid in the event you default.