Title: Exploring Wyoming Sample Letter for Fee Structures for Bankruptcies Introduction: Bankruptcies can be complex and burdensome processes, requiring careful consideration of various fees and charges. In Wyoming, individuals seeking bankruptcy protection may come across different types of fee structures implemented by legal firms or bankruptcy attorneys. This article aims to provide a detailed description of Wyoming sample letters for fee structures in bankruptcies, outlining their significance and highlighting potential variations. 1. Wyoming Sample Letter for Hourly Fee Structure: The hourly fee structure is a commonly used method in bankruptcy cases, where attorneys charge clients based on the number of hours they spend working on the case. The Wyoming sample letter for this fee structure will outline the attorney's hourly rate, estimated hours required, and provide an estimate of the overall cost based on these factors. It is important to understand that the actual charging depends on the complexity and circumstances of each specific bankruptcy case. 2. Wyoming Sample Letter for Flat Fee Structure: In contrast to the hourly fee structure, the flat fee structure offers a predetermined and fixed amount for legal services throughout the bankruptcy process. The Wyoming sample letter for this fee structure will clearly communicate the total cost of legal representation, regardless of the time spent. This option provides more predictability and may be beneficial for simple bankruptcy cases when the workload can be estimated. 3. Wyoming Sample Letter for Retainer Fee Structure: Retainer fee structures involve clients paying an upfront amount to secure legal services for their bankruptcy case. A Wyoming sample letter for this fee structure will outline the retainer amount, its purpose, and the subsequent billing process. This option is often used when the attorney expects an extensive commitment of time and resources. 4. Wyoming Sample Letter for Contingency Fee Structure: While less common in bankruptcy cases, some attorneys may offer a contingency fee structure where their compensation is contingent upon a successful outcome or financial recovery. A Wyoming sample letter for this fee structure will outline the terms, percentages, and any additional costs that may apply in such cases. Conclusion: Understanding the fee structures in bankruptcy cases is crucial for individuals seeking legal representation in Wyoming. Whether opting for an hourly, flat, retainer, or contingency fee structure, individuals must carefully review and comprehend the terms outlined in sample letters provided by bankruptcy attorneys. It is advisable to consult with multiple legal professionals to compare fee structures, assess their proficiency, and make an informed decision based on the unique circumstances of each bankruptcy case.

Wyoming Sample Letter for Fee Structures for Bankruptcies

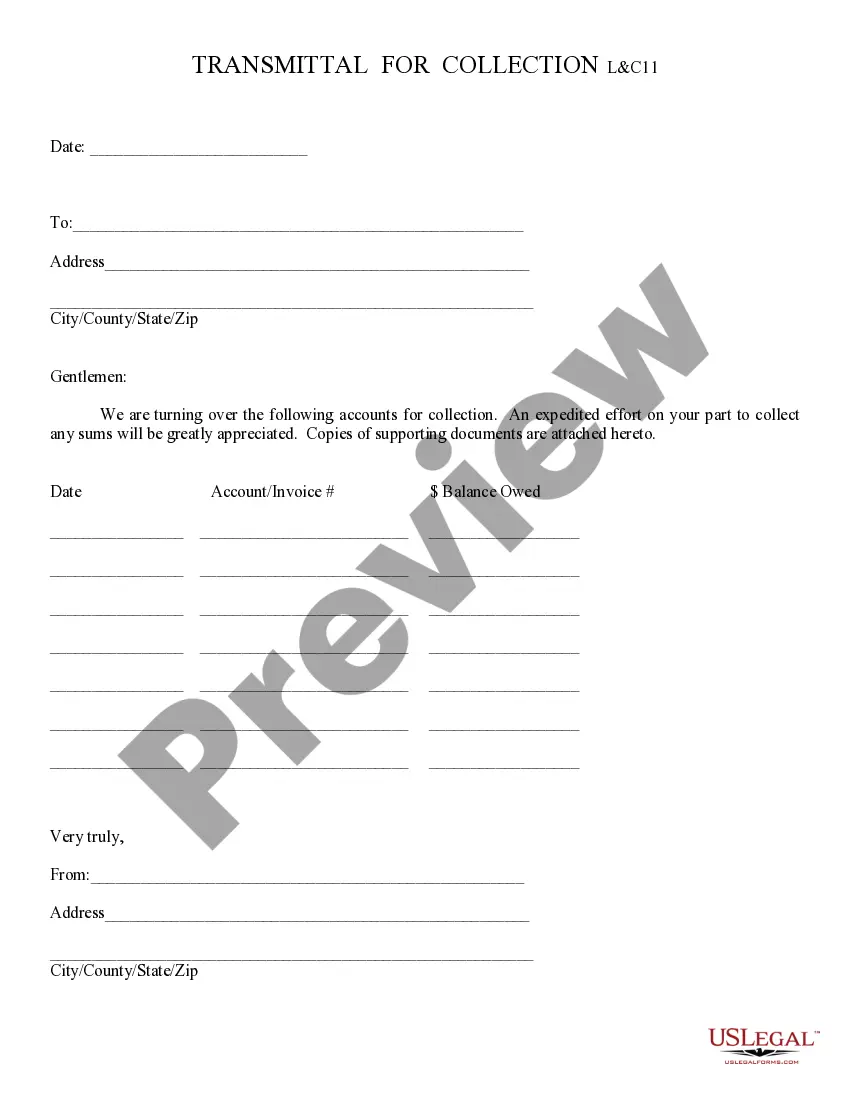

Description

How to fill out Wyoming Sample Letter For Fee Structures For Bankruptcies?

US Legal Forms - one of several most significant libraries of lawful forms in America - offers a wide array of lawful document layouts you may acquire or print. Using the web site, you may get thousands of forms for company and person uses, categorized by types, claims, or key phrases.You can get the most up-to-date variations of forms such as the Wyoming Sample Letter for Fee Structures for Bankruptcies within minutes.

If you already have a membership, log in and acquire Wyoming Sample Letter for Fee Structures for Bankruptcies through the US Legal Forms local library. The Obtain button will appear on every single develop you see. You have access to all in the past saved forms from the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, here are straightforward recommendations to help you started out:

- Be sure you have chosen the proper develop to your city/region. Select the Review button to examine the form`s articles. See the develop description to actually have selected the proper develop.

- In case the develop doesn`t fit your requirements, make use of the Look for area at the top of the display screen to find the one that does.

- When you are pleased with the shape, confirm your decision by simply clicking the Get now button. Then, opt for the rates prepare you favor and give your qualifications to register for an bank account.

- Approach the purchase. Make use of your credit card or PayPal bank account to perform the purchase.

- Find the format and acquire the shape on your own gadget.

- Make changes. Load, modify and print and sign the saved Wyoming Sample Letter for Fee Structures for Bankruptcies.

Each and every web template you included with your bank account does not have an expiration particular date and is your own eternally. So, if you wish to acquire or print an additional duplicate, just proceed to the My Forms segment and then click about the develop you need.

Get access to the Wyoming Sample Letter for Fee Structures for Bankruptcies with US Legal Forms, by far the most substantial local library of lawful document layouts. Use thousands of expert and status-distinct layouts that meet your business or person demands and requirements.

Form popularity

FAQ

Generally, the types of assets that you can keep in a bankruptcy include: personal items and clothing. household furniture, food and equipment in your permanent home. tools necessary to your work. a motor vehicle with a value up to a certain limit, usually an older vehicle qualifies. certain farm property.

Federal law requires that people trying to cram down a loan on personal property other than a car must have purchased the item attached to the loan at least one year before filing under Chapter 13.

A cramdown is a term often used to describe a down round in which existing investors lead a new financing that includes terms that may be severely dilutive to non-participating investors, and that may include other features such as forced conversions, pay-to-play mechanisms, super-priority liquidation preferences, drag ...

A cramdown is the imposition of a bankruptcy reorganization plan by a court despite any objections by certain classes of creditors. A cramdown is often utilized as a part of the Chapter 13 bankruptcy filing and involves the debtor changing the terms of a contract with a creditor with the help of the court.

A cramdown is the imposition of a bankruptcy reorganization plan by a court despite any objections by certain classes of creditors. A cramdown is often utilized as a part of the Chapter 13 bankruptcy filing and involves the debtor changing the terms of a contract with a creditor with the help of the court.

A cramdown in bankruptcy is when the debtor only pays the value of the item they have financed. In reality, it is a court approved way to get out of some of your contractual obligations. The court replaces the value that you are contracted to pay on a certain item with an approved current value of that item.

Chapter 13 cases can be filed for no money down because the attorney fees and court costs can be rolled into a 3-5 year repayment plan. While you're at it, you can also wipe away all of your other unsecured debt (credit cards, medical bills, payday loans, old collections, etc.).

However, there are certain restrictions and limitations on what you can and cannot do after filing for Chapter 7 bankruptcy. Avoid Spending Outside Your Income Levels. ... You Cannot Neglect Your Alimony & Child Support Obligations After Chapter 7. ... You Cannot Ignore Student Loans. ... You Cannot Eliminate Most Tax Debt.