Wyoming General Form of Assignment to Benefit Creditors

Description

How to fill out General Form Of Assignment To Benefit Creditors?

Selecting the appropriate legal document layout can be challenging. It goes without saying that there are numerous templates accessible online, but how do you find the legal form you require? Visit the US Legal Forms website. The platform provides a vast selection of templates, including the Wyoming General Form of Assignment to Benefit Creditors, which can be utilized for both business and personal purposes. All forms have been reviewed by experts and comply with federal and state regulations.

If you are already registered, sign in to your account and click the Download button to obtain the Wyoming General Form of Assignment to Benefit Creditors. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account and retrieve an additional copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow.

Select the document format and download the legal document layout to your device. Complete, modify, print, and sign the acquired Wyoming General Form of Assignment to Benefit Creditors. US Legal Forms is the largest library of legal forms where you can find numerous document templates. Utilize the service to obtain professionally-crafted papers that adhere to state requirements.

- First, ensure you have selected the correct form for your area/state.

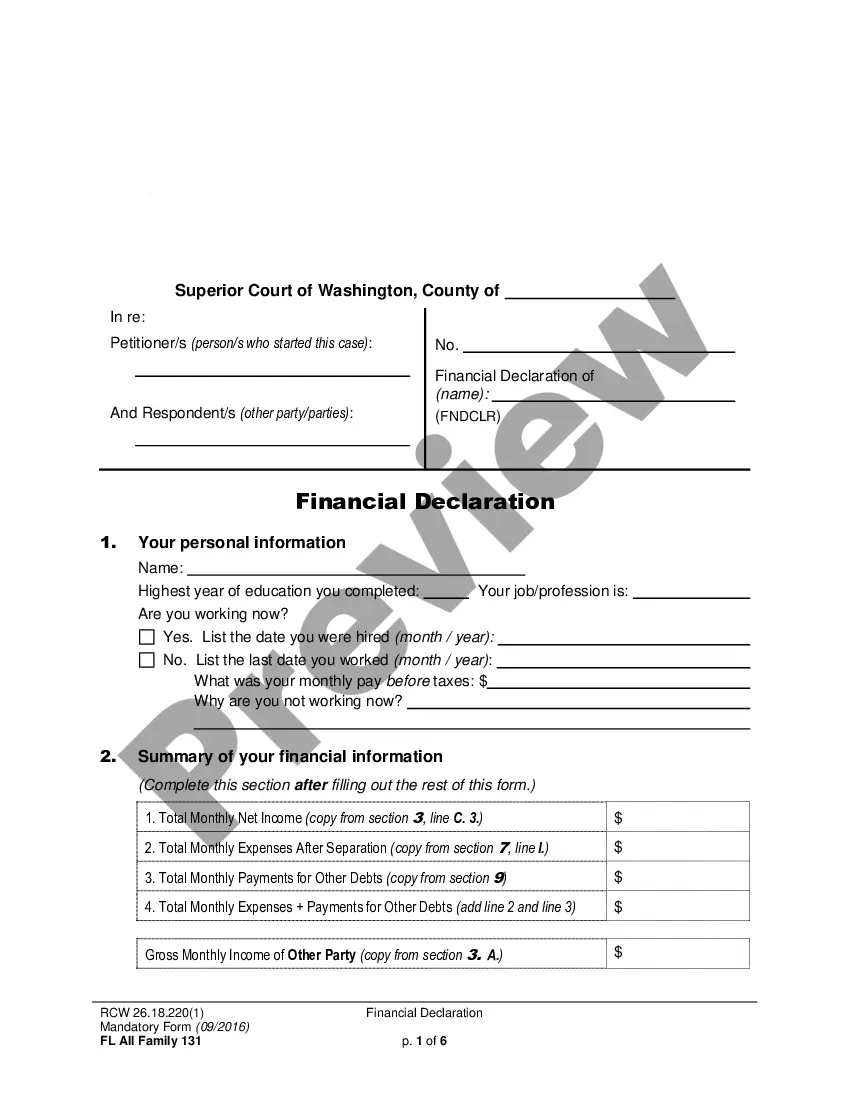

- You may review the form using the Preview feature and examine the form description to verify that this is indeed the correct one for you.

- If the form does not meet your needs, utilize the Search field to find the suitable form.

- Once you are certain that the form is appropriate, click the Get Now button to obtain the form.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

A General Assignment is a document that declares that certain property is held and vested in the name of a trust. Since a trust only works when it holds property, this document is crucial for the funding of a Revocable Trust.

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets.

One of the key benefits of filing for bankruptcy is the imposition of an automatic stay, which halts all efforts to collect a claim against the debtor or the debtor's property (11 U.S.C. § 362). Unlike bankruptcy cases, in an ABC, there is no automatic stay.

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets.

For creditors, an ABC process generally involves the submission to the assignee of a proof of claim by a stated deadline or bar date, similar to bankruptcy. (Click on the link for an example of an ABC proof of claim form.) Employee Priority.

An assignment for the benefit of creditors (ABC) is a business liquidation device available to an insolvent debtor as an alternative to formal bankruptcy proceedings. In many instances, an ABC can be the most advantageous and graceful exit strategy.

It normally takes about 12 months to conclude an ABC. An ABC generally is faster and less costly than a bankruptcy proceeding. Parties can often agree and determine what is going to happen prior to execution of the assignment.

A general assignment is one involving the transfer of all the debtor's property for the benefit of all his or her creditors. A partial assignment is one in which only part of a debtor's property is transferred to benefit all the creditors.