Wyoming Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Letter From Debtor To Credit Card Company Requesting A Lower Interest Rate For A Certain Period Of Time?

Have you been within a place where you require files for sometimes business or personal purposes just about every working day? There are plenty of legal document web templates available online, but getting types you can trust isn`t effortless. US Legal Forms delivers a large number of form web templates, such as the Wyoming Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, which are composed to satisfy federal and state needs.

If you are presently knowledgeable about US Legal Forms site and have a free account, simply log in. Next, you are able to acquire the Wyoming Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time design.

If you do not come with an accounts and want to begin using US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is to the right metropolis/area.

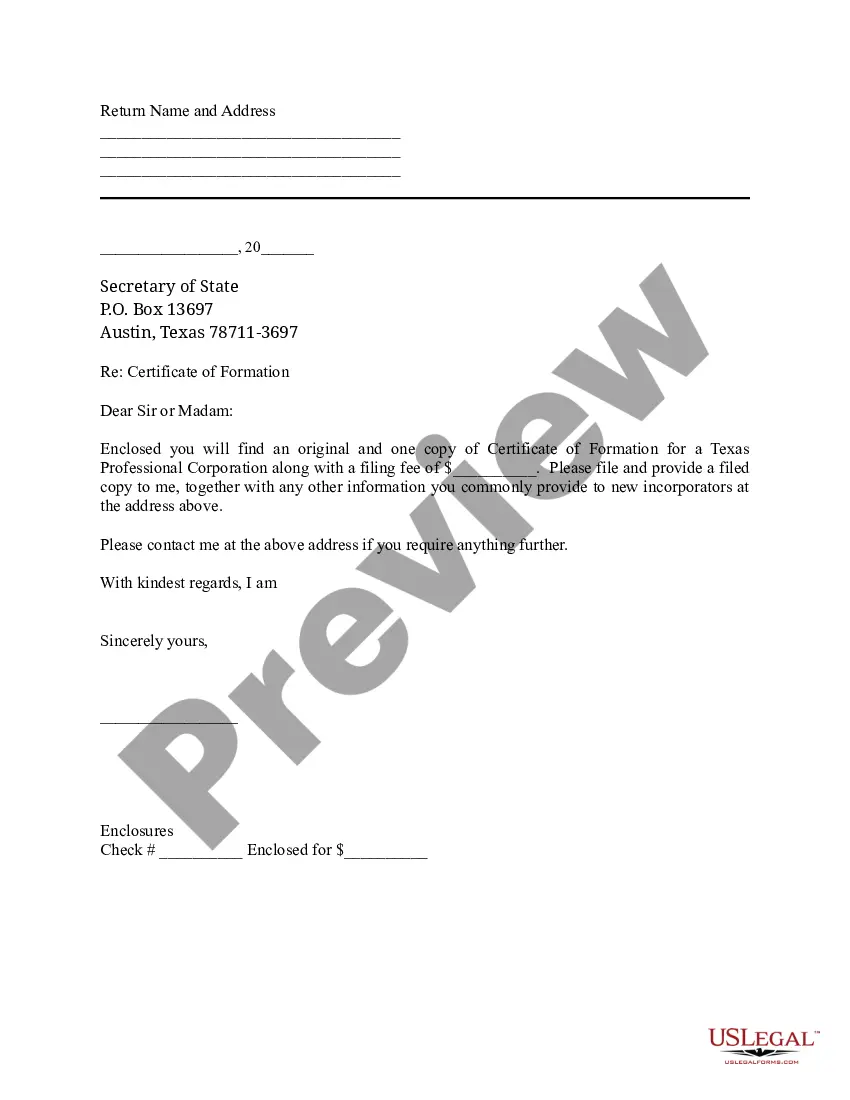

- Utilize the Preview key to review the shape.

- Browse the outline to actually have chosen the appropriate form.

- In the event the form isn`t what you`re seeking, make use of the Search area to obtain the form that meets your needs and needs.

- When you discover the right form, simply click Acquire now.

- Choose the costs plan you want, fill out the required info to produce your money, and pay money for an order using your PayPal or bank card.

- Choose a handy document structure and acquire your duplicate.

Discover every one of the document web templates you may have purchased in the My Forms food list. You can get a additional duplicate of Wyoming Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time any time, if required. Just click the required form to acquire or print the document design.

Use US Legal Forms, one of the most extensive selection of legal forms, to save lots of time as well as avoid mistakes. The support delivers expertly manufactured legal document web templates that you can use for a selection of purposes. Produce a free account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

Call your card provider: Contact your credit card issuer and explain why you would like an interest rate reduction. You could start by pointing out your history with the company and mention your good credit or on-time payment history.

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

You can negotiate a lower interest rate on your credit card by calling your credit card issuerparticularly the issuer of the account you've had the longestand requesting a reduction.

If you're unhappy with your credit card's interest rate, securing a lower one may be as simple as asking your credit card issuer. They may decline your request, but it doesn't hurt to ask. If you've established a history of on-time payments and other responsible behavior with the issuer, your odds may be good.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

I am writing this letter to state that on (Day) i.e. (Date), I got relieved from your (Company/ Organization) but my full and final settlement has not been done. I request you to kindly do the full and final settlement and send me all dues (if any).

Here are 11 ways to pay off high interest credit cards.Try Paying With Cash.Consider a Credit Card Balance Transfer.Pay More Than the Minimum Amount Due.Lower Your Expenses.Increase Your Income.Sell Your Old Stuff.Ask for Lower Interest Rates.Pay Off High Interest Credit Cards First.More items...?03-Dec-2019

State in the letter you are requesting an interest rate reduction for the following reasons and be specific. Include competitor offers with lower rates, your creditor's own new introductory rates, and state your timely payment history and length of time you've had the account.

Writing the Settlement Offer LetterInclude your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

How to Negotiate With Debt CollectorsVerify that it's your debt.Understand your rights.Consider the kind of debt you owe.Consider hardship programs.Offer a lump sum.Mention bankruptcy.Speak calmly and logically.Be mindful of the statute of limitations.More items...